Question: Complete the following using the statements as a guide. No potential common shares were outstanding during any of the periods shown above. Use the EPS

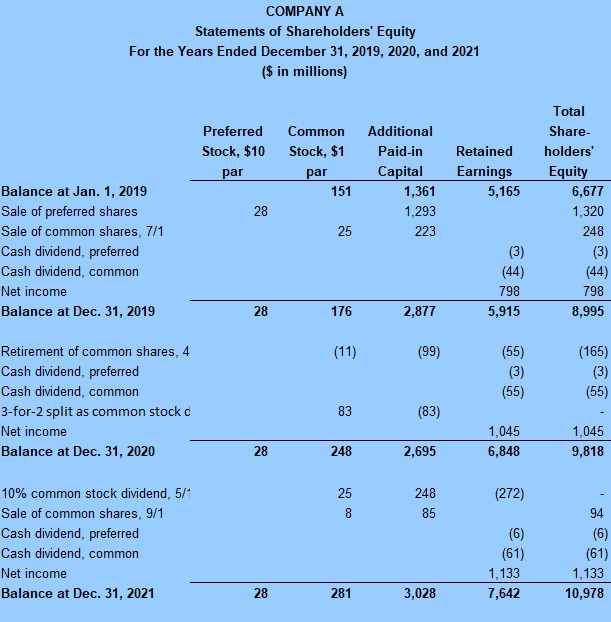

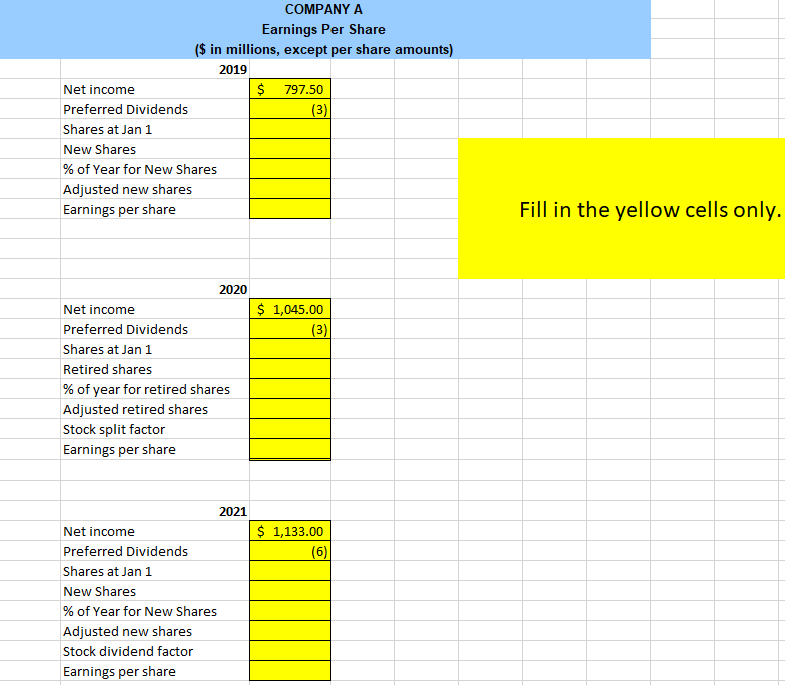

Complete the following using the statements as a guide. No potential common shares were outstanding during any of the periods shown above. Use the EPS tab for your work and only fill out the yellow cells.

- Compute earnings per share (EPS) as they would have appeared on the income statements for:

- December 31, 2019

- December 31, 2020

- December 31, 2021

COMPANY A Statements of Shareholders' Equity For the Years Ended December 31, 2019, 2020, and 2021 ($ in millions) Preferred Stock, $10 par Common Stock, $1 par 151 Additional Paid-in Capital 1,361 1,293 223 Retained Earnings 5,165 28 Total Share- holders' Equity 6,677 1,320 248 (3) (44) 798 8,995 Balance at Jan. 1, 2019 Sale of preferred shares Sale of common shares, 7/1 Cash dividend, preferred Cash dividend, common Net income Balance at Dec. 31, 2019 25 (3) (44) 798 5,915 28 176 2,877 (11) (99) (55) (3) (55) (165) (3) (55) Retirement of common shares, 4 Cash dividend, preferred Cash dividend, common 3-for-2 split as common stock d Net income Balance at Dec. 31, 2020 83 (83) 1,045 6,848 1,045 9,818 28 248 2,695 25 (272) 248 85 8 10% common stock dividend, 5/1 Sale of common shares, 9/1 Cash dividend, preferred Cash dividend, common Net income Balance at Dec. 31, 2021 (6) (61) 1,133 7,642 94 (6) (61) 1,133 10,978 28 281 3,028 COMPANY A Earnings Per Share ($ in millions, except per share amounts) 2019 Net income $ 797.50 Preferred Dividends (3) Shares at Jan 1 New Shares % of Year for New Shares Adjusted new shares Earnings per share Fill in the yellow cells only. $ 1,045.00 (3) 2020 Net income Preferred Dividends Shares at Jan 1 Retired shares % of year for retired shares Adjusted retired shares Stock split factor Earnings per share 2021 $ 1,133.00 (6) Net income Preferred Dividends Shares at Jan 1 New Shares % of Year for New Shares Adjusted new shares Stock dividend factor Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts