Question: Complete the following worksheet by inserting the appropriate values to evaluate the contract and answer the related questions. Note: To clarify possible sources of confusion

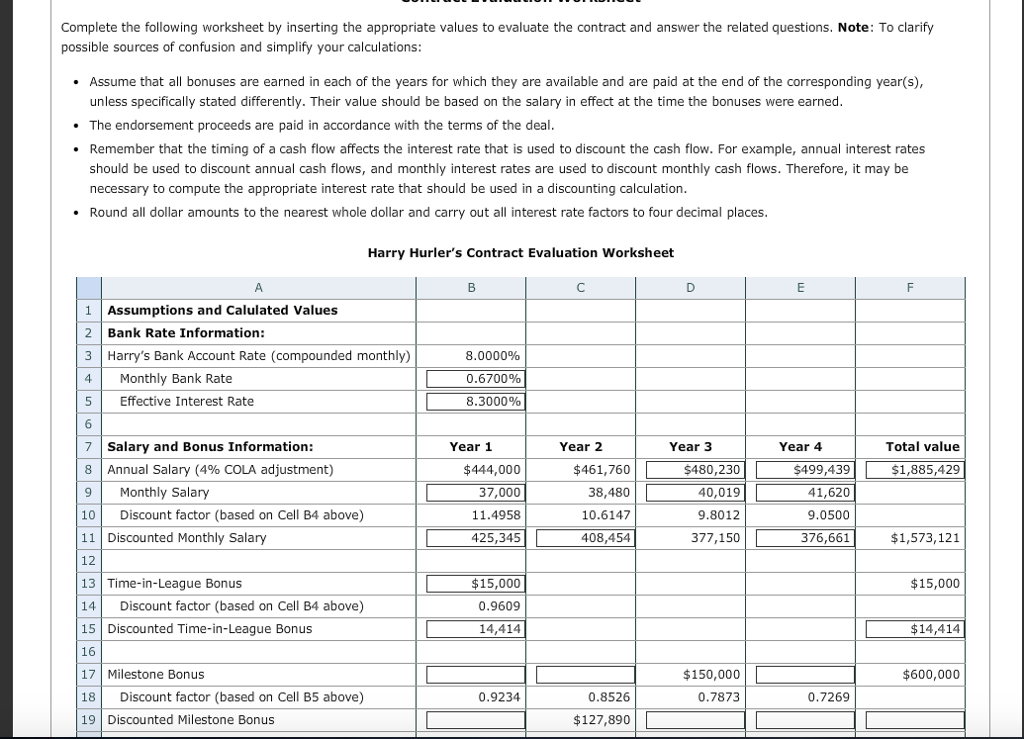

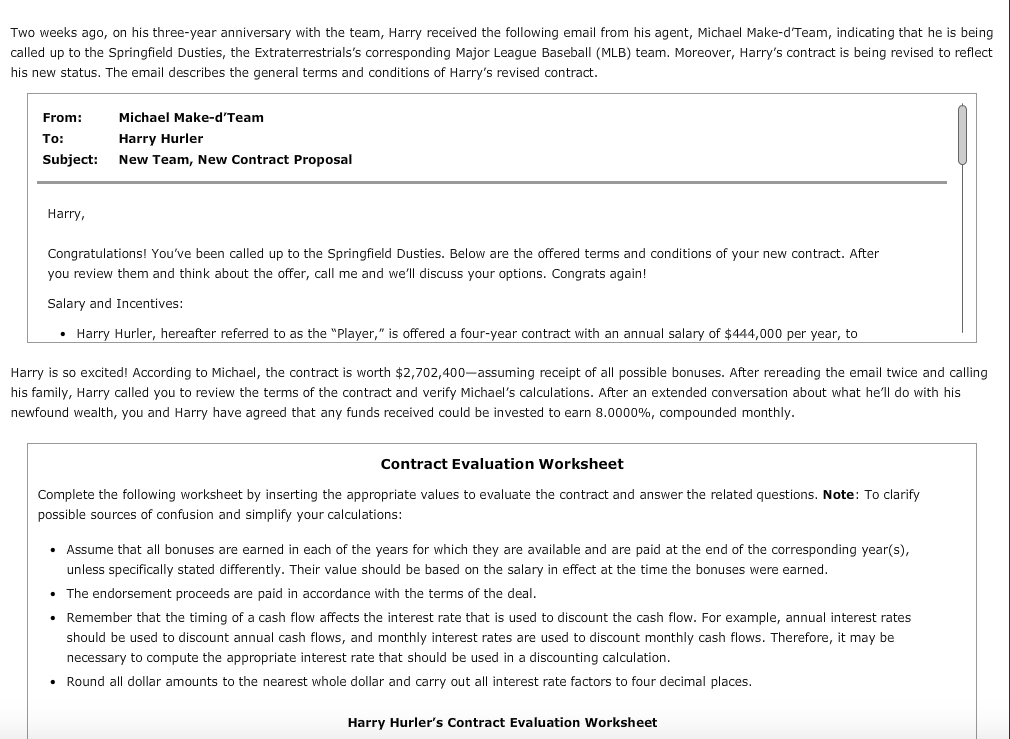

Complete the following worksheet by inserting the appropriate values to evaluate the contract and answer the related questions. Note: To clarify possible sources of confusion and simplify your calculations: Assume that all bonuses are earned in each of the years for which they are available and are paid at the end of the corresponding year(s), unless specifically stated differently. Their value should be based on the salary in effect at the time the bonuses were earned. The endorsement proceeds are paid in accordance with the terms of the deal. Remember that the timing of a cash flow affects the interest rate that is used to discount the cash flow. For example, annual interest rates should be used to discount annual cash flows, and monthly interest rates are used to discount monthly cash flows. Therefore, it may be necessary to compute the appropriate interest rate that should be used in a discounting calculation. Round all dollar amounts to the nearest whole dollar and carry out all interest rate factors to four decimal places. Harry Hurler's Contract Evaluation Worksheet A 1 Assumptions and Calulated Values 2 Bank Rate Information: Harry's Bank Account Rate (compounded monthly) Monthly Bank Rate Effective Interest Rate 3 8.0000% 0.6700% 8.3000% Total value $1,885,429 Salary and Bonus Information: 8 Annual Salary (4% COLA adjustment) Monthly Salary Discount factor (based on Cell B4 above) 11 Discounted Monthly Salary Year 1 $444,000 37,000 11.4958 425,345 Year 2 $461,760 38,480 10.6147 408,454 L L Year 3 $480,230 40,019 9.8012 377,150 Year 4 $499,439 41,620 9.0500 376,661 $1,573,121 $ 15,000 13 Time-in-League Bonus 14 Discount factor (based on Cell B4 above) 15 Discounted Time-in-League Bonus $15,000 0.9609 14,414 $ 14,414 $600,000 17 Milestone Bonus Discount factor (based on Cell B5 above) 19 Discounted Milestone Bonus $150,000 0.7873 0.9234 0.7269 0.8526 $127,890 Complete the following worksheet by inserting the appropriate values to evaluate the contract and answer the related questions. Note: To clarify possible sources of confusion and simplify your calculations: Assume that all bonuses are earned in each of the years for which they are available and are paid at the end of the corresponding year(s), unless specifically stated differently. Their value should be based on the salary in effect at the time the bonuses were earned. The endorsement proceeds are paid in accordance with the terms of the deal. Remember that the timing of a cash flow affects the interest rate that is used to discount the cash flow. For example, annual interest rates should be used to discount annual cash flows, and monthly interest rates are used to discount monthly cash flows. Therefore, it may be necessary to compute the appropriate interest rate that should be used in a discounting calculation. Round all dollar amounts to the nearest whole dollar and carry out all interest rate factors to four decimal places. Harry Hurler's Contract Evaluation Worksheet A 1 Assumptions and Calulated Values 2 Bank Rate Information: Harry's Bank Account Rate (compounded monthly) Monthly Bank Rate Effective Interest Rate 3 8.0000% 0.6700% 8.3000% Total value $1,885,429 Salary and Bonus Information: 8 Annual Salary (4% COLA adjustment) Monthly Salary Discount factor (based on Cell B4 above) 11 Discounted Monthly Salary Year 1 $444,000 37,000 11.4958 425,345 Year 2 $461,760 38,480 10.6147 408,454 L L Year 3 $480,230 40,019 9.8012 377,150 Year 4 $499,439 41,620 9.0500 376,661 $1,573,121 $ 15,000 13 Time-in-League Bonus 14 Discount factor (based on Cell B4 above) 15 Discounted Time-in-League Bonus $15,000 0.9609 14,414 $ 14,414 $600,000 17 Milestone Bonus Discount factor (based on Cell B5 above) 19 Discounted Milestone Bonus $150,000 0.7873 0.9234 0.7269 0.8526 $127,890

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts