Question: Complete the given worksheet. ( If a transaction results in a decrease in Assets, Liabilities or Owner's Equity, place a negative sign ( or parentheses

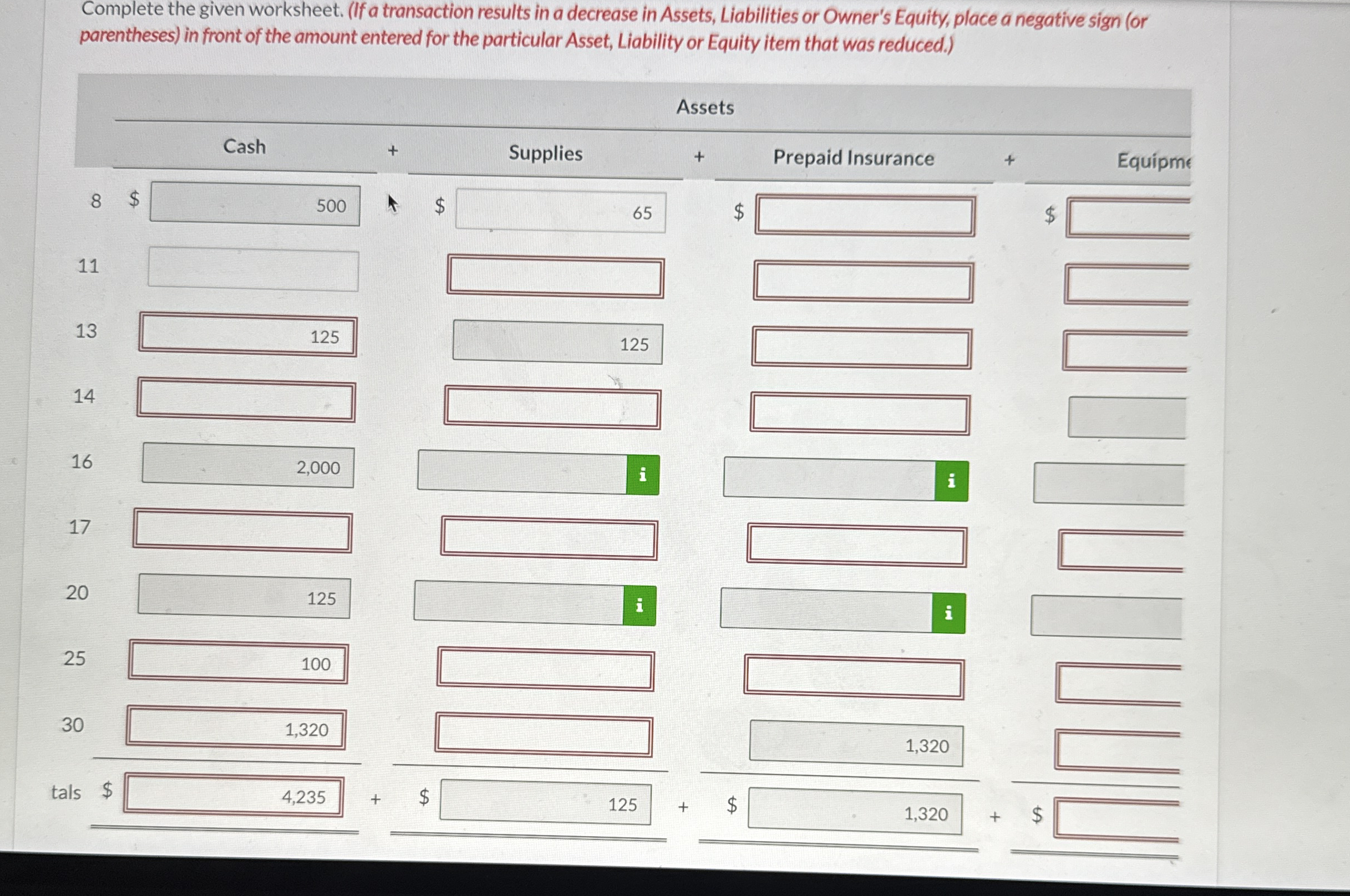

Complete the given worksheet. If a transaction results in a decrease in Assets, Liabilities or Owner's Equity, place a negative sign or parentheses in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.

Question

Complete the given worksheet. If a transaction results in a decrease in Assets, Liabilities or Owner's Equity, place a negative sign or parentheses in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.

$

$

$

$

$

$

n worksheet. If a transaction results in a decrease in Assets, Liabilities or Owner's Equity, place a negative sign or t of the amount entered for the particular Asset, Liability or Equity item that was reduced.

After researching the different forms of business organization. Natalie Koebel decides to operate "Cookie Creations" as a proprietorship. She then starts the process of operating the business. In November the following activities take place.

Nov. Natalie cashes her US Savings Bonds and receives $ which she deposits in her personal bank account.

She opens a bank account under the name "Cookie Creations" and transfers $ from her personal account to the new account.

Natalie pays $ for advertising.

She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $ cash. Hint: Use the Supplies account.

Natalie starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent topoftheline food processor and mixer that originally cost her $ Natalie decides to start using it only in her new business. She estimates that the food processor is currently worth $ She invests the food processor in the business.

Natalie realizes that her initial cash investment is not enough. Her grandmother lends her $ cash, for which Natalie signs a note payable in the name of the business. Natalie deposits the money in the business bank account. Hint: The note will be repaid in months. As a result, the note payable should be reported in the accounts and the balance sheet as the last liability.

She buys more baking equipment for $ cash.

She teaches her first class and collects $ cash.

Natalie withdraws $ from the business for personal expenditures.

Natalie pays $ for a oneyear insurance policy that will expire on December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock