Question: Complete the homework below. Please submit the assignment online (an Excel file is probably the easiest). a. 1. Excel Problem 1 (this is the hardest

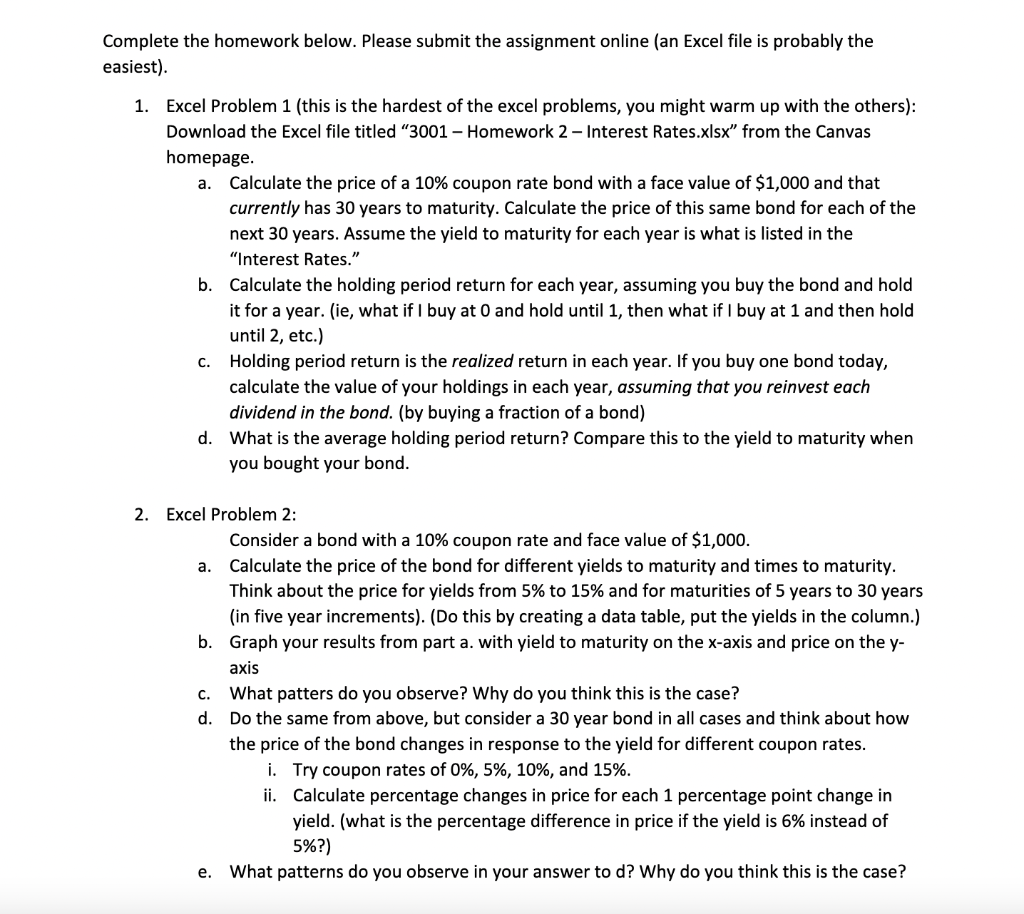

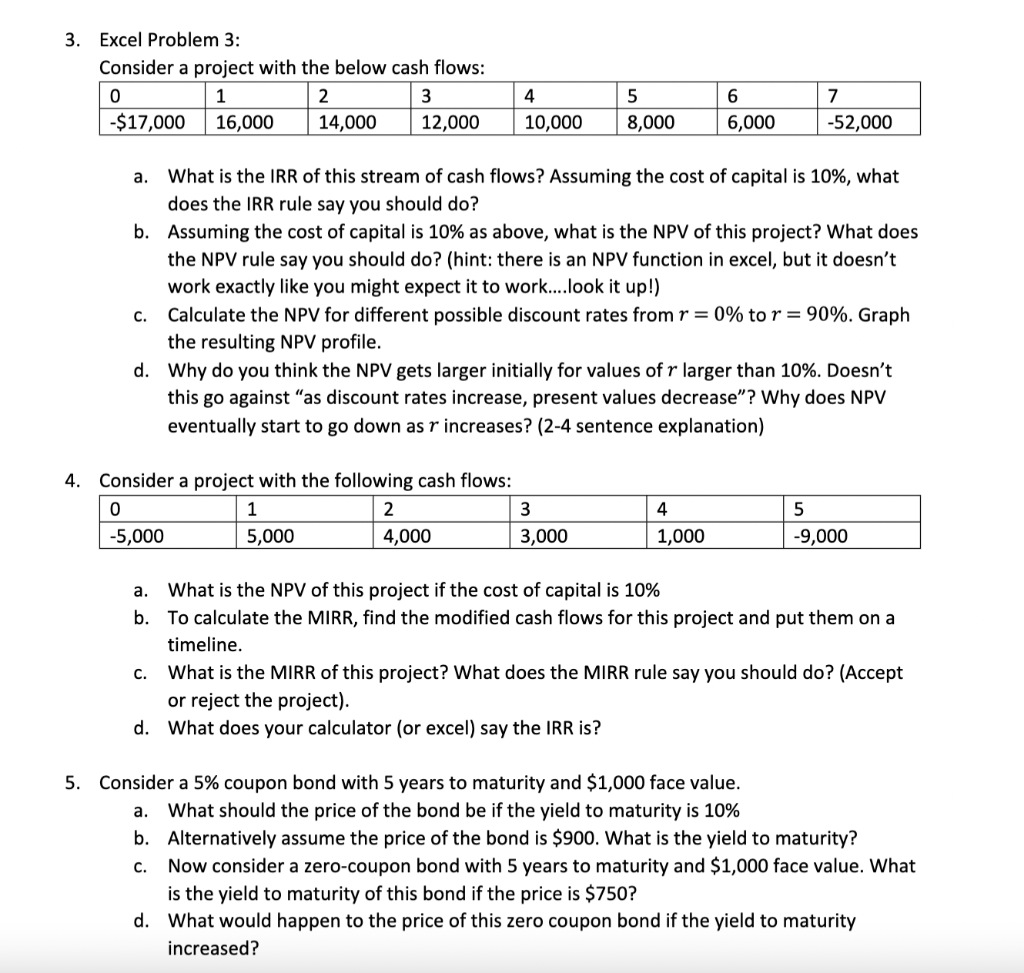

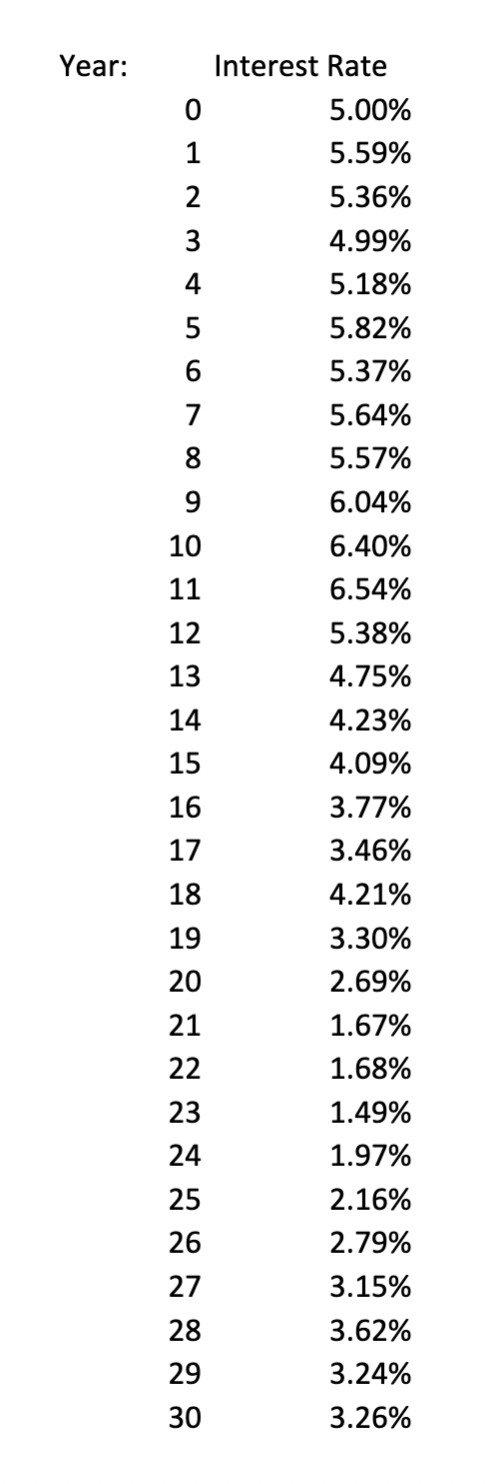

Complete the homework below. Please submit the assignment online (an Excel file is probably the easiest). a. 1. Excel Problem 1 (this is the hardest of the excel problems, you might warm up with the others): Download the Excel file titled "3001 - Homework 2 - Interest Rates.xlsx" from the Canvas homepage. Calculate the price of a 10% coupon rate bond with a face value of $1,000 and that currently has 30 years to maturity. Calculate the price of this same bond for each of the next 30 years. Assume the yield to maturity for each year is what is listed in the "Interest Rates." b. Calculate the holding period return for each year, assuming you buy the bond and hold it for a year. (ie, what if I buy at 0 and hold until 1, then what if I buy at 1 and then hold until 2, etc.) c. Holding period return is the realized return in each year. If you buy one bond today, calculate the value of your holdings in each year, assuming that you reinvest each dividend in the bond. (by buying a fraction of a bond) d. What is the average holding period return? Compare this to the yield to maturity when you bought your bond. a. 2. Excel Problem 2: Consider a bond with a 10% coupon rate and face value of $1,000. Calculate the price of the bond for different yields to maturity and times to maturity. Think about the price for yields from 5% to 15% and for maturities of 5 years to 30 years (in five year increments). (Do this by creating a data table, put the yields in the column.) b. Graph your results from part a. with yield to maturity on the x-axis and price on the y- axis c. What patters do you observe? Why do you think this is the case? d. Do the same from above, but consider a 30 year bond in all cases and think about how the price of the bond changes in response to the yield for different coupon rates. i. Try coupon rates of 0%, 5%, 10%, and 15%. ii. Calculate percentage changes in price for each 1 percentage point change in yield. (what is the percentage difference in price if the yield is 6% instead of 5%?) e. What patterns do you observe in your answer to d? Why do you think this is the case? 3. Excel Problem 3: Consider a project with the below cash flows: 0 1 2 3 -$17,000 16,000 14,000 12,000 4 10,000 5 8,000 6 6,000 7 -52,000 a. What is the IRR of this stream of cash flows? Assuming the cost of capital is 10%, what does the IRR rule say you should do? b. Assuming the cost of capital is 10% as above, what is the NPV of this project? What does the NPV rule say you should do? (hint: there is an NPV function in excel, but it doesn't work exactly like you might expect it to work....look it up!) C. Calculate the NPV for different possible discount rates from r=0% to r = 90%. Graph the resulting NPV profile. d. Why do you think the NPV gets larger initially for values of r larger than 10%. Doesn't this go against as discount rates increase, present values decrease"? Why does NPV eventually start to go down as r increases? (2-4 sentence explanation) 4. Consider a project with the following cash flows: 0 1 2 3 -5,000 5,000 4,000 3,000 4 1,000 5 -9,000 a. What is the NPV of this project if the cost of capital is 10% b. To calculate the MIRR, find the modified cash flows for this project and put them on a timeline. What is the MIRR of this project? What does the MIRR rule say you should do? (Accept or reject the project). d. What does your calculator (or excel) say the IRR is? c. 5. Consider a 5% coupon bond with 5 years to maturity and $1,000 face value. a. What should the price of the bond be if the yield to maturity is 10% b. Alternatively assume the price of the bond is $900. What is the yield to maturity? Now consider a zero-coupon bond with 5 years to maturity and $1,000 face value. What is the yield to maturity of this bond if the price is $750? d. What would happen to the price of this zero coupon bond if the yield to maturity increased? c. Year: Interest Rate 0 5.00% 1 5.59% 2 5.36% 4.99% 4 5.18% 5 5.82% 6 5.37% 7 5.64% 8 5.57% 9 6.04% 10 6.40% 11 6.54% 12 5.38% 13 4.75% 14 4.23% 15 4.09% 16 3.77% 17 3.46% 18 4.21% 19 3.30% 20 2.69% 21 1.67% 22 1.68% 23 1.49% 24 1.97% 25 2.16% 26 2.79% 27 3.15% 28 3.62% 29 3.24% 30 3.26% Complete the homework below. Please submit the assignment online (an Excel file is probably the easiest). a. 1. Excel Problem 1 (this is the hardest of the excel problems, you might warm up with the others): Download the Excel file titled "3001 - Homework 2 - Interest Rates.xlsx" from the Canvas homepage. Calculate the price of a 10% coupon rate bond with a face value of $1,000 and that currently has 30 years to maturity. Calculate the price of this same bond for each of the next 30 years. Assume the yield to maturity for each year is what is listed in the "Interest Rates." b. Calculate the holding period return for each year, assuming you buy the bond and hold it for a year. (ie, what if I buy at 0 and hold until 1, then what if I buy at 1 and then hold until 2, etc.) c. Holding period return is the realized return in each year. If you buy one bond today, calculate the value of your holdings in each year, assuming that you reinvest each dividend in the bond. (by buying a fraction of a bond) d. What is the average holding period return? Compare this to the yield to maturity when you bought your bond. a. 2. Excel Problem 2: Consider a bond with a 10% coupon rate and face value of $1,000. Calculate the price of the bond for different yields to maturity and times to maturity. Think about the price for yields from 5% to 15% and for maturities of 5 years to 30 years (in five year increments). (Do this by creating a data table, put the yields in the column.) b. Graph your results from part a. with yield to maturity on the x-axis and price on the y- axis c. What patters do you observe? Why do you think this is the case? d. Do the same from above, but consider a 30 year bond in all cases and think about how the price of the bond changes in response to the yield for different coupon rates. i. Try coupon rates of 0%, 5%, 10%, and 15%. ii. Calculate percentage changes in price for each 1 percentage point change in yield. (what is the percentage difference in price if the yield is 6% instead of 5%?) e. What patterns do you observe in your answer to d? Why do you think this is the case? 3. Excel Problem 3: Consider a project with the below cash flows: 0 1 2 3 -$17,000 16,000 14,000 12,000 4 10,000 5 8,000 6 6,000 7 -52,000 a. What is the IRR of this stream of cash flows? Assuming the cost of capital is 10%, what does the IRR rule say you should do? b. Assuming the cost of capital is 10% as above, what is the NPV of this project? What does the NPV rule say you should do? (hint: there is an NPV function in excel, but it doesn't work exactly like you might expect it to work....look it up!) C. Calculate the NPV for different possible discount rates from r=0% to r = 90%. Graph the resulting NPV profile. d. Why do you think the NPV gets larger initially for values of r larger than 10%. Doesn't this go against as discount rates increase, present values decrease"? Why does NPV eventually start to go down as r increases? (2-4 sentence explanation) 4. Consider a project with the following cash flows: 0 1 2 3 -5,000 5,000 4,000 3,000 4 1,000 5 -9,000 a. What is the NPV of this project if the cost of capital is 10% b. To calculate the MIRR, find the modified cash flows for this project and put them on a timeline. What is the MIRR of this project? What does the MIRR rule say you should do? (Accept or reject the project). d. What does your calculator (or excel) say the IRR is? c. 5. Consider a 5% coupon bond with 5 years to maturity and $1,000 face value. a. What should the price of the bond be if the yield to maturity is 10% b. Alternatively assume the price of the bond is $900. What is the yield to maturity? Now consider a zero-coupon bond with 5 years to maturity and $1,000 face value. What is the yield to maturity of this bond if the price is $750? d. What would happen to the price of this zero coupon bond if the yield to maturity increased? c. Year: Interest Rate 0 5.00% 1 5.59% 2 5.36% 4.99% 4 5.18% 5 5.82% 6 5.37% 7 5.64% 8 5.57% 9 6.04% 10 6.40% 11 6.54% 12 5.38% 13 4.75% 14 4.23% 15 4.09% 16 3.77% 17 3.46% 18 4.21% 19 3.30% 20 2.69% 21 1.67% 22 1.68% 23 1.49% 24 1.97% 25 2.16% 26 2.79% 27 3.15% 28 3.62% 29 3.24% 30 3.26%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts