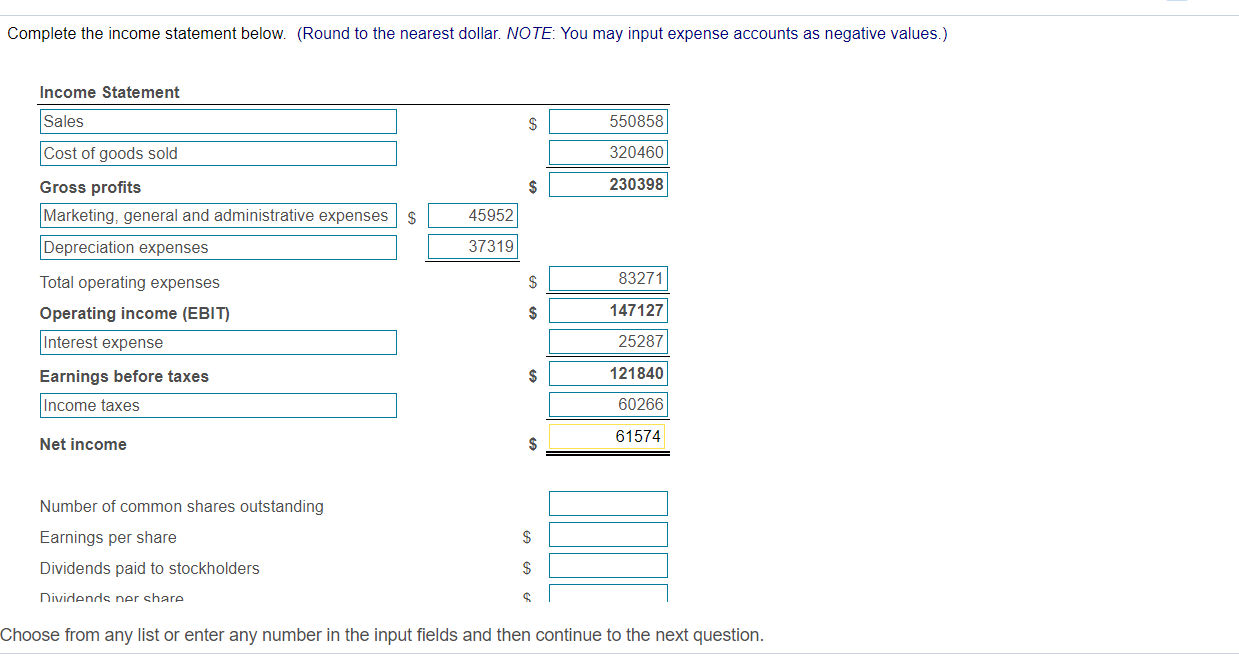

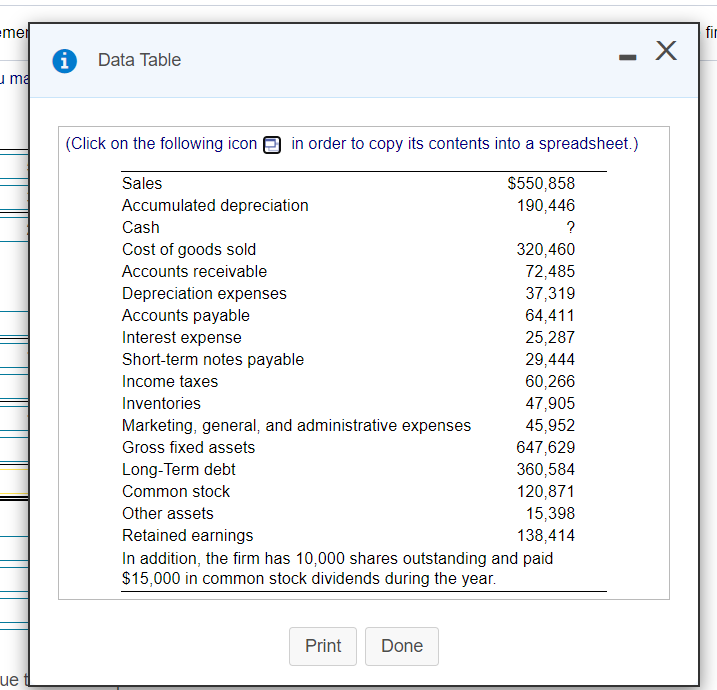

Question: Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense accounts as negative values.) Income Statement S 550858 Sales Cost

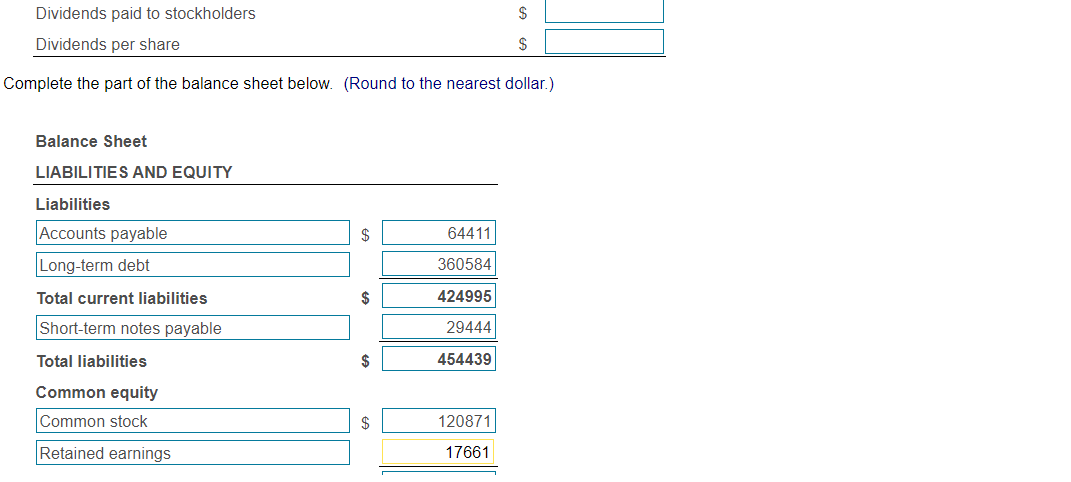

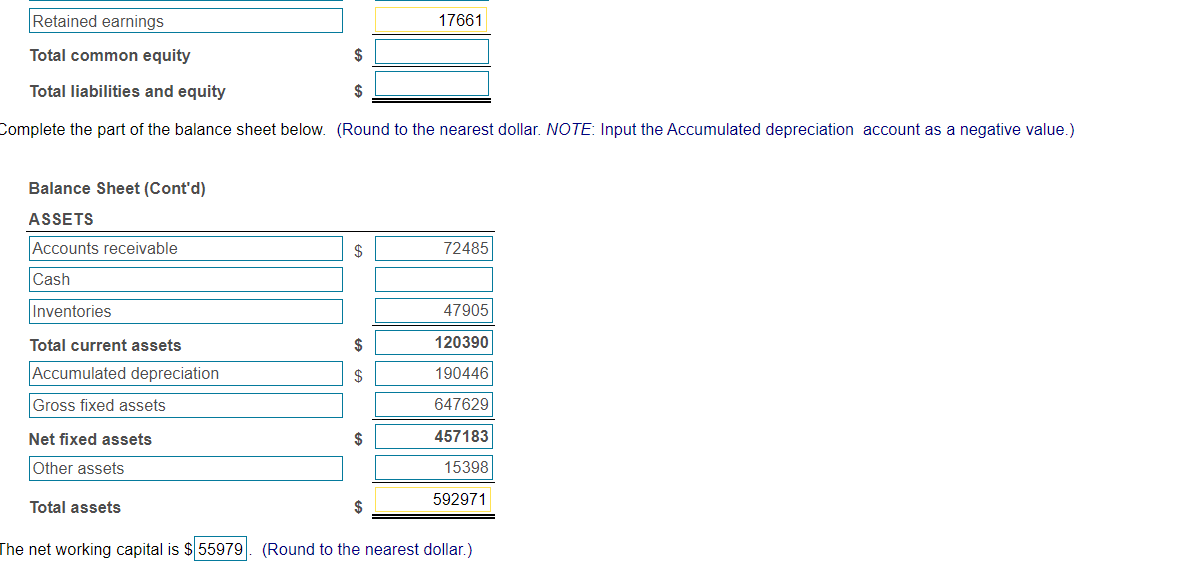

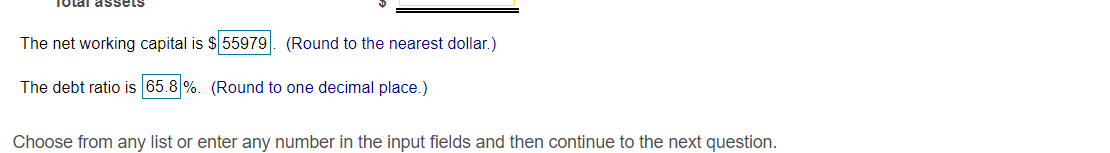

Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense accounts as negative values.) Income Statement S 550858 Sales Cost of goods sold 320460 230398 Gross profits Marketing, general and administrative expenses Depreciation expenses S 45952 37319 $ 83271 $ 147127 Total operating expenses Operating income (EBIT) Interest expense Earnings before taxes 25287 $ 121840 Income taxes 60266 61574 Net income $ Number of common shares outstanding Earnings per share $ Dividends paid to stockholders $ Dividends ner share Choose from any list or enter any number in the input fields and then continue to the next question. $ Dividends paid to stockholders Dividends per share $ Complete the part of the balance sheet below. (Round to the nearest dollar.) Balance Sheet LIABILITIES AND EQUITY Liabilities Accounts payable $ 64411 Long-term debt 360584 Total current liabilities $ 424995 Short-term notes payable 29444 Total liabilities $ 454439 Common equity Common stock $ 120871 Retained earnings 17661 Retained earnings 17661 Total common equity Total liabilities and equity $ Complete the part of the balance sheet below. (Round to the nearest dollar. NOTE: Input the Accumulated depreciation account as a negative value.) Balance Sheet (Cont'd) $ 72485 ASSETS Accounts receivable Cash Inventories 47905 Total current assets $ 120390 Accumulated depreciation $ 190446 Gross fixed assets 647629 $ 457183 Net fixed assets Other assets 15398 592971 Total assets The net working capital is $ 55979. (Round to the nearest dollar.) Total assets The net working capital is $ 55979. (Round to the nearest dollar.) The debt ratio is 65.8%. (Round to one decimal place.) Choose from any list or enter any number in the input fields and then continue to the next question. Emel fir Data Table - i -X uma (Click on the following icon in order to copy its contents into a spreadsheet.) Sales $550,858 Accumulated depreciation 190,446 Cash ? Cost of goods sold 320,460 Accounts receivable 72,485 Depreciation expenses 37,319 Accounts payable 64,411 Interest expense 25,287 Short-term notes payable 29,444 Income taxes 60,266 Inventories 47,905 Marketing, general, and administrative expenses 45,952 Gross fixed assets 647,629 Long-Term debt 360,584 Common stock 120,871 Other assets 15,398 Retained earnings 138,414 In addition, the firm has 10,000 shares outstanding and paid $15,000 in common stock dividends during the year. Print Done ue Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense accounts as negative values.) Income Statement S 550858 Sales Cost of goods sold 320460 230398 Gross profits Marketing, general and administrative expenses Depreciation expenses S 45952 37319 $ 83271 $ 147127 Total operating expenses Operating income (EBIT) Interest expense Earnings before taxes 25287 $ 121840 Income taxes 60266 61574 Net income $ Number of common shares outstanding Earnings per share $ Dividends paid to stockholders $ Dividends ner share Choose from any list or enter any number in the input fields and then continue to the next question. $ Dividends paid to stockholders Dividends per share $ Complete the part of the balance sheet below. (Round to the nearest dollar.) Balance Sheet LIABILITIES AND EQUITY Liabilities Accounts payable $ 64411 Long-term debt 360584 Total current liabilities $ 424995 Short-term notes payable 29444 Total liabilities $ 454439 Common equity Common stock $ 120871 Retained earnings 17661 Retained earnings 17661 Total common equity Total liabilities and equity $ Complete the part of the balance sheet below. (Round to the nearest dollar. NOTE: Input the Accumulated depreciation account as a negative value.) Balance Sheet (Cont'd) $ 72485 ASSETS Accounts receivable Cash Inventories 47905 Total current assets $ 120390 Accumulated depreciation $ 190446 Gross fixed assets 647629 $ 457183 Net fixed assets Other assets 15398 592971 Total assets The net working capital is $ 55979. (Round to the nearest dollar.) Total assets The net working capital is $ 55979. (Round to the nearest dollar.) The debt ratio is 65.8%. (Round to one decimal place.) Choose from any list or enter any number in the input fields and then continue to the next question. Emel fir Data Table - i -X uma (Click on the following icon in order to copy its contents into a spreadsheet.) Sales $550,858 Accumulated depreciation 190,446 Cash ? Cost of goods sold 320,460 Accounts receivable 72,485 Depreciation expenses 37,319 Accounts payable 64,411 Interest expense 25,287 Short-term notes payable 29,444 Income taxes 60,266 Inventories 47,905 Marketing, general, and administrative expenses 45,952 Gross fixed assets 647,629 Long-Term debt 360,584 Common stock 120,871 Other assets 15,398 Retained earnings 138,414 In addition, the firm has 10,000 shares outstanding and paid $15,000 in common stock dividends during the year. Print Done ue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts