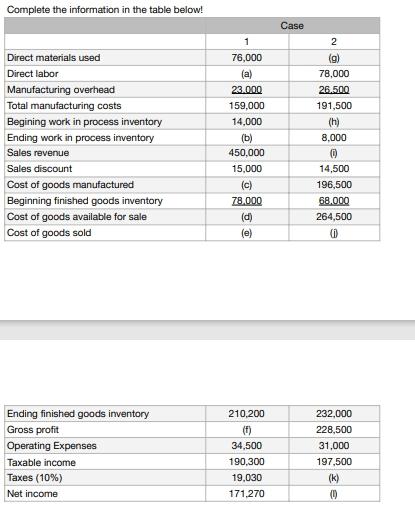

Question: Complete the information in the table below! Case 1 2 (9) 78,000 26.500 191,500 (h) 8,000 Direct materials used Direct labor Manufacturing overhead Total manufacturing

Complete the information in the table below! Case 1 2 (9) 78,000 26.500 191,500 (h) 8,000 Direct materials used Direct labor Manufacturing overhead Total manufacturing costs Begining work in process inventory Ending work in process inventory Sales revenue Sales discount Cost of goods manufactured Beginning finished goods inventory Cost of goods available for sale Cost of goods sold 76,000 (a) 22.000 159.000 14.000 (b) 450,000 15,000 (c) 78.000 (d) (e) 14,500 196,500 68.000 264,500 0 Ending finished goods inventory Gross profit Operating Expenses Taxable income Taxes (10%) Net income 210,200 (1) 34,500 190.300 19.030 171,270 232,000 228,500 31,000 197.500 (k) 0 Complete the information in the table below! Case 1 2 (9) 78,000 26.500 191,500 (h) 8,000 Direct materials used Direct labor Manufacturing overhead Total manufacturing costs Begining work in process inventory Ending work in process inventory Sales revenue Sales discount Cost of goods manufactured Beginning finished goods inventory Cost of goods available for sale Cost of goods sold 76,000 (a) 22.000 159.000 14.000 (b) 450,000 15,000 (c) 78.000 (d) (e) 14,500 196,500 68.000 264,500 0 Ending finished goods inventory Gross profit Operating Expenses Taxable income Taxes (10%) Net income 210,200 (1) 34,500 190.300 19.030 171,270 232,000 228,500 31,000 197.500 (k) 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts