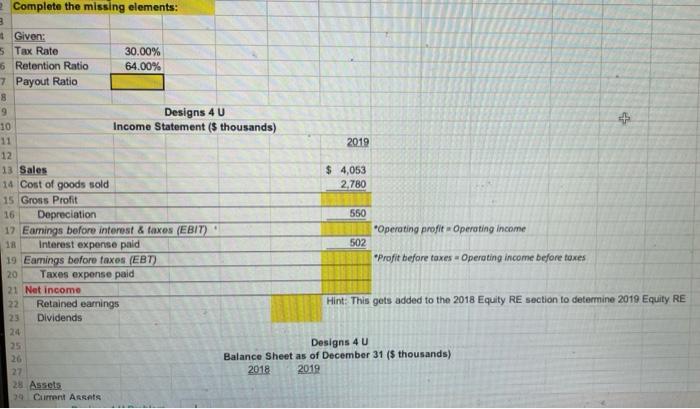

Question: Complete the missing elements: 3 Given: 5 Tax Rate 30.00% 6 Retention Ratio 64.00% 7 Payout Ratio 8 9 Designs 4U 10 Income Statement (5

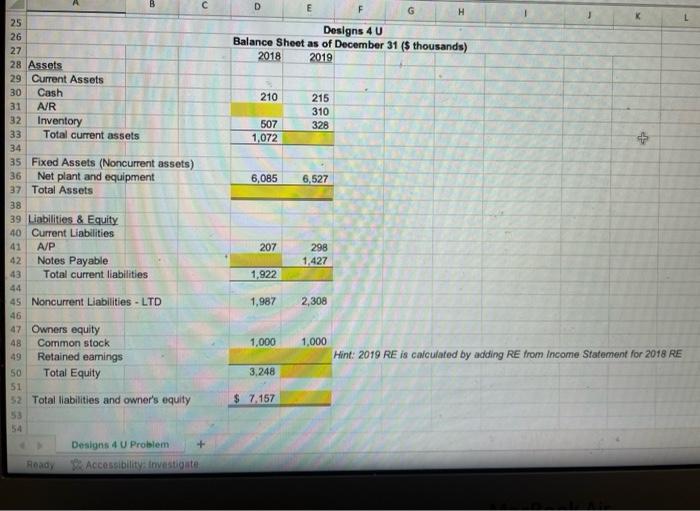

Complete the missing elements: 3 Given: 5 Tax Rate 30.00% 6 Retention Ratio 64.00% 7 Payout Ratio 8 9 Designs 4U 10 Income Statement (5 thousands) + 2019 $ 4,053 2,780 550 "Operating profit Operating income 502 *Profit before taxes Operating income before toxes 12 13 Sales 14 Cost of goods sold 15 Gross Profit 16 Depreciation 17 Earings before interest & taxes (EBIT) Interest expense paid 19 Earnings before taxes (EBT) 20 Taxes expense paid 21 Net income 22 Retained earnings 23 Dividends 24 25 26 27 28 Assets 79 Current Assets Hint: This gets added to the 2018 Equity RE section to determine 2019 Equity RE Designs 4 U Balance Sheet as of December 31 (s thousands) 2018 2019 D F G H Designs 40 Balance Sheet as of December 31 ($ thousands) 2018 2019 210 215 310 328 507 1,072 T F 6,085 6,527 25 26 27 28 Assets 29 Current Assets 30 Cash 31 AR 32 Inventory 33 Total current assets 34 35 Fixed Assets (Noncurrent assets) 36 Net plant and equipment 37 Total Assets 38 39 Liabilities & Equity 40 Current Liabilities 41 A/P 42 Notes Payable 43 Total current liabilities 44 45 Noncurrent Liabilities - LTD 46 47 Owners equity 48 Common stock 49 Retained earnings 50 Total Equity 51 32 Total liabilities and owner's equity 53 54 Designs 4 U Problem Accessibility Investigate 207 298 1,427 1,922 1,987 2,308 1,000 1,000 Hint: 2019 RE is calculated by adding RE from Income Statement for 2018 RE 3.248 $ 7.157 Read

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts