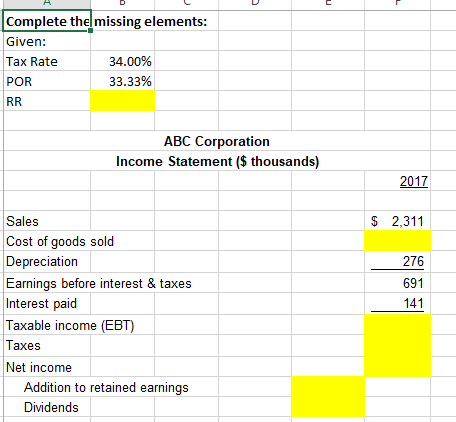

Question: Complete the missing elements: Given: Tax Rate 34.00% POR 33.33% RR ABC Corporation Income Statement ($ thousands) 2017 $ 2,311 276 691 141 Sales Cost

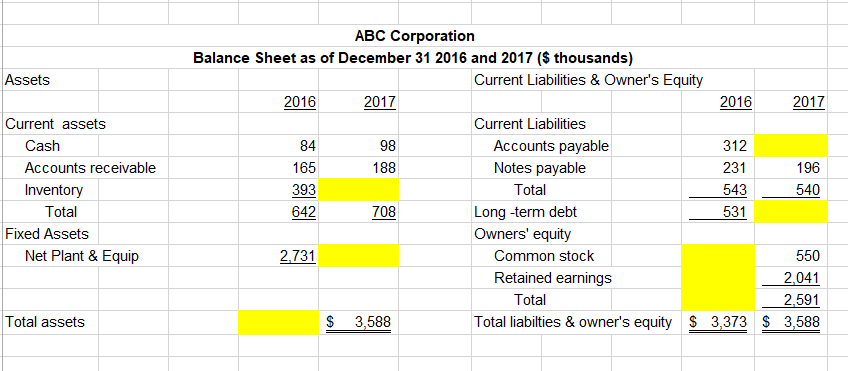

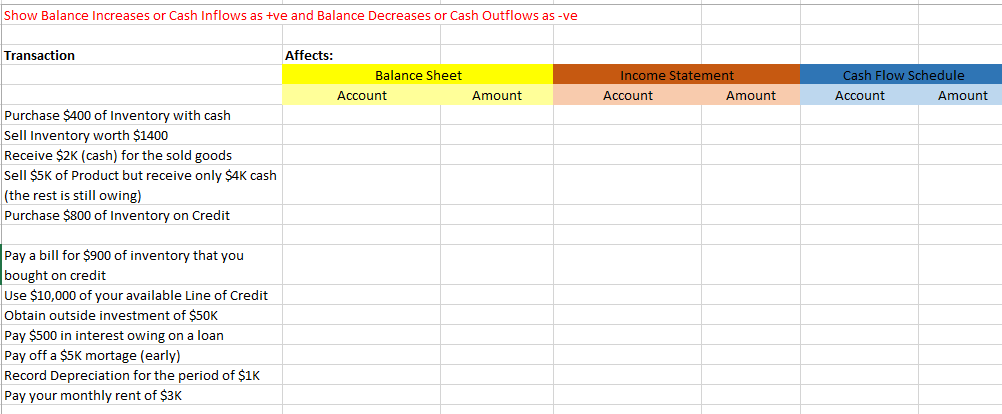

Complete the missing elements: Given: Tax Rate 34.00% POR 33.33% RR ABC Corporation Income Statement ($ thousands) 2017 $ 2,311 276 691 141 Sales Cost of goods sold Depreciation Earnings before interest & taxes Interest paid Taxable income (EBT) Taxes Net income Addition to retained earnings Dividends Assets Current assets Cash Accounts receivable Inventory Total Fixed Assets Net Plant & Equip ABC Corporation Balance Sheet as of December 31 2016 and 2017 ($ thousands) Current Liabilities & Owner's Equity 2016 2017 2016 2017 Current Liabilities 84 98 Accounts payable 312 165 188 Notes payable 231 196 393 Total 543 540 642 Long-term debt 531 Owners' equity 2,731 Common stock 550 Retained earnings 2.041 Total 2.591 $ 3,588 Total liabilties & owner's equity $ 3,373 $ 3,588 708 Total assets Show Balance Increases or Cash Inflows as +ve and Balance Decreases or Cash Outflows as-ve Transaction Affects: Balance Sheet Account Income Statement Account Amount Cash Flow Schedule Account Amount Amount Purchase $400 of Inventory with cash Sell Inventory worth $1400 Receive $2K (cash) for the sold goods Sell $5K of Product but receive only $4K cash (the rest is still owing) Purchase $800 of Inventory on Credit Pay a bill for $900 of inventory that you bought on credit Use $10,000 of your available Line of Credit Obtain outside investment of $50K Pay $500 in interest owing on a loan Pay off a $5K mortage (early) Record Depreciation for the period of $1K Pay your monthly rent of $3K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts