Question: Complete the payroll register for this pay period and update the Employee Earnings Record form for each employee with the corresponding information. The Step -

Complete the payroll register for this pay period and update the Employee Earnings Record form for each employee with the corresponding information. The Step of Form W is unchecked. The amount per period should be included in the record. As an example, if an employee elected to contribute $ to his or her FSA, the period payroll deduction would be $ or $ All insurance and k deductions are pretax for federal and state.

Benefitrelated payroll deductions will take effect on the first pay period of March.

tableEmployeeChild Care Assistance under FlexTime $ annuallyEducational

Assistance

FSA annualife Insurance at of annual salary valueLongTerm Care Insurance $ per periodGym Membership $ per monthMillenYes,,Yes,$ NoNoYesTowleNoNo$ Yes,,,NoYesLongYes,,Yes,$ Yes,,,NoYesShangrawYes,,No$ NoNoNoLewisNoNo$ NoYes,NoSchwartzNoNo$ Yes,,,NoYesPrevostiYes,,No$NoNoYesStudentNoNo$ Yes,,,NoYesComplete this question by entering your answers in the table below.Payroll Register Payroll Register Thomas Millen,Avery Towle,Charlie Long,tableMaryShangrawKristen Lewis,tableJoelSchwartzToni Prevosti,tableStudentSuccess

Complete the payroll register form for the pay period ending February th for each employee with the corresponding information.

Note: Round your answers for "Hourly Rate" or "Period Wage" to decimal places. Round all other intermediate computations and final answers to decimal places

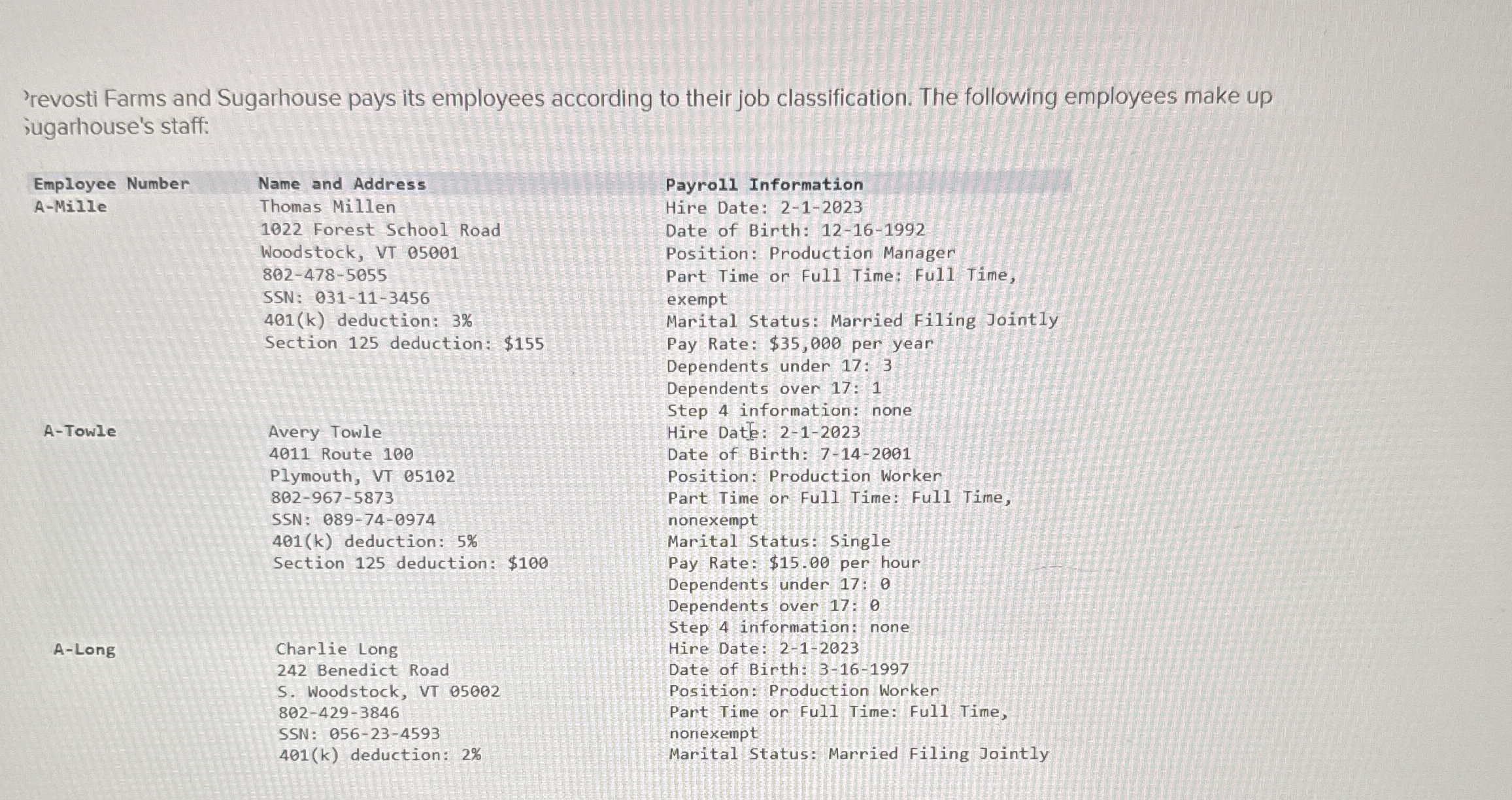

'revosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up ;ugarhouse's staff:

Payroll Information

Hire Date:

Date of Birth:

Position: Production Manager

Part Time or Full Time: Full Time,

exempt

Marital Status: Married Filing Jointly

Pay Rate: $ per year

Dependents under :

Dependents over :

Step information: none

Hire Dat e:

Date of Birth:

Position: Production Worker

Part Time or Full Time: Full Time,

nonexempt

Marital Status: Single

Pay Rate: $ per hour

Dependents under :

Dependents over :

Step information: none

Hire Date:

Date of Birth:

Position: Production Worker

Part Time or Full Time: Full Time,

nonexempt

Marital Status: Married Filing Jointly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock