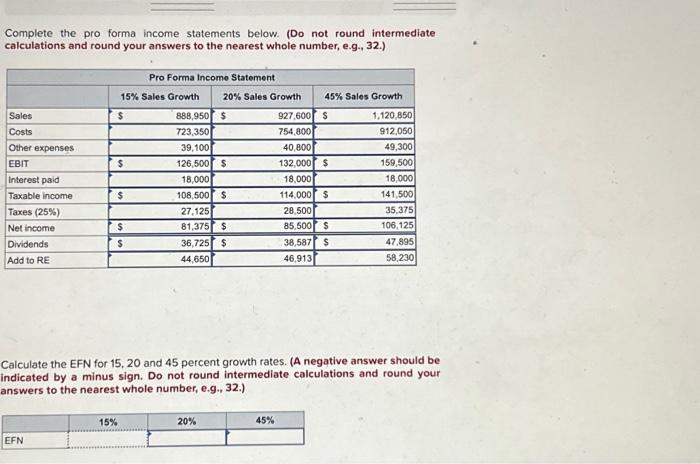

Question: Complete the pro forma income statements below. (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Sales Costs

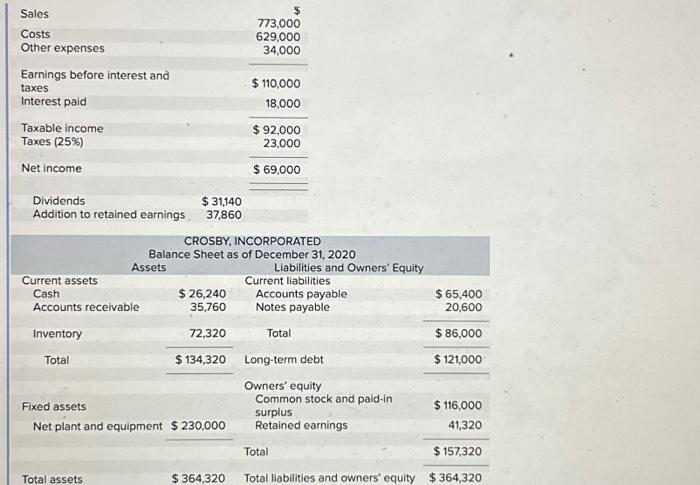

Complete the pro forma income statements below. (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Calculate the EFN for 15,20 and 45 percent growth rates. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) CROSBY, INCORPORATED Balance Sheet as of December 31, 2020 Assets Liabilities and Owners' Equity \begin{tabular}{|c|c|c|c|} \hline \multirow{3}{*}{ Current assets } & \multirow{2}{*}{\multicolumn{3}{|c|}{ Current liabilities }} \\ \hline & & & \\ \hline & $26,240 & Accounts payable & $65,400 \\ \hline Accounts receivable & 35,760 & Notes payable & 20,600 \\ \hline Inventory & 72,320 & Total & $86,000 \\ \hline \multirow[t]{2}{*}{ Total } & $134,320 & Long-term debt & $121,000 \\ \hline & & Owners' equity & \\ \hline Fixed assets & & \begin{tabular}{l} Common stock and paid-in \\ surplus \end{tabular} & $116,000 \\ \hline \multirow[t]{2}{*}{ Net plant and equipment } & $230,000 & Retained earnings & 41,320 \\ \hline & & Total & $157,320 \\ \hline Total assets & $364,320 & Total liabilities and owners' equity & $364,320 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts