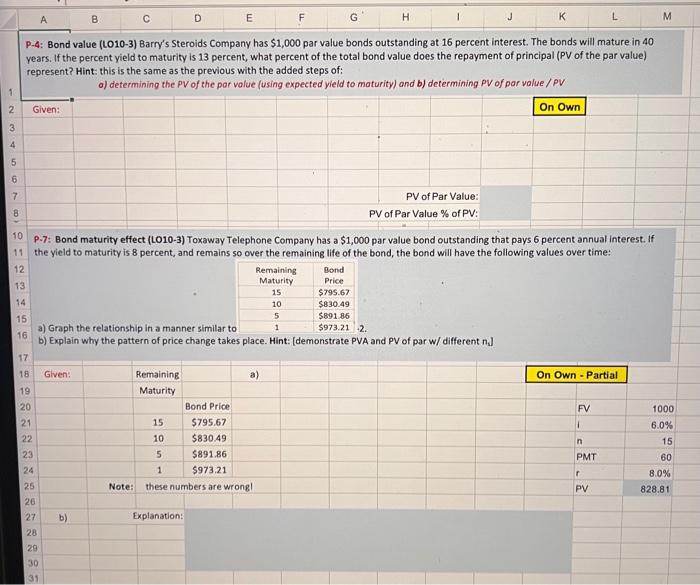

Question: complete the problem using excel formula P-4: Bond value (LO10-3) Barry's Steroids Company has $1,000 par value bonds outstanding at 16 percent interest. The bonds

P-4: Bond value (LO10-3) Barry's Steroids Company has $1,000 par value bonds outstanding at 16 percent interest. The bonds will mature in 40 years. If the percent yield to maturity is 13 percent, what percent of the total bond value does the repayment of principal (PV of the par value) represent? Hint: this is the same as the previous with the added steps of: o) determining the PV of the par value (using expected yield to maturity) and b ) determining PV of par value / PV P-7: Bond maturity effect (LO10-3) Toxaway Telephone Company has a $1,000 par value bond outstanding that pays 6 percent annual interest. If the yield to maturity is 8 percent, and remains so over the remaining life of the bond, the bond will have the following values over time: a) Graph the relationship in a manner similar to b) Explain why the pattern of price change takes place. Hint: [demonstrate PVA and PV of par w/ different ns ] P-4: Bond value (LO10-3) Barry's Steroids Company has $1,000 par value bonds outstanding at 16 percent interest. The bonds will mature in 40 years. If the percent yield to maturity is 13 percent, what percent of the total bond value does the repayment of principal (PV of the par value) represent? Hint: this is the same as the previous with the added steps of: o) determining the PV of the par value (using expected yield to maturity) and b ) determining PV of par value / PV P-7: Bond maturity effect (LO10-3) Toxaway Telephone Company has a $1,000 par value bond outstanding that pays 6 percent annual interest. If the yield to maturity is 8 percent, and remains so over the remaining life of the bond, the bond will have the following values over time: a) Graph the relationship in a manner similar to b) Explain why the pattern of price change takes place. Hint: [demonstrate PVA and PV of par w/ different ns ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts