Question: Complete the problem using the example on page 183. This is a decision tree analysis to choose between two options. You do not have to

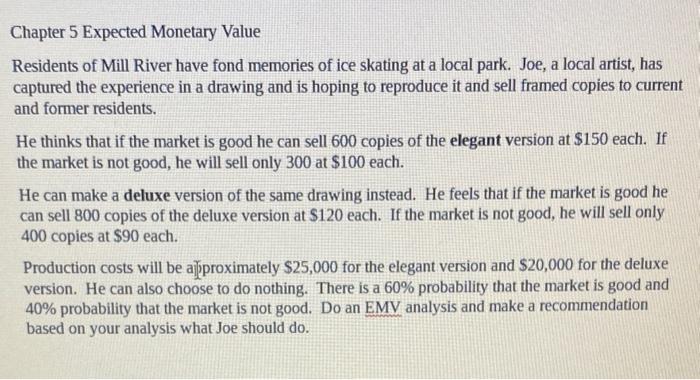

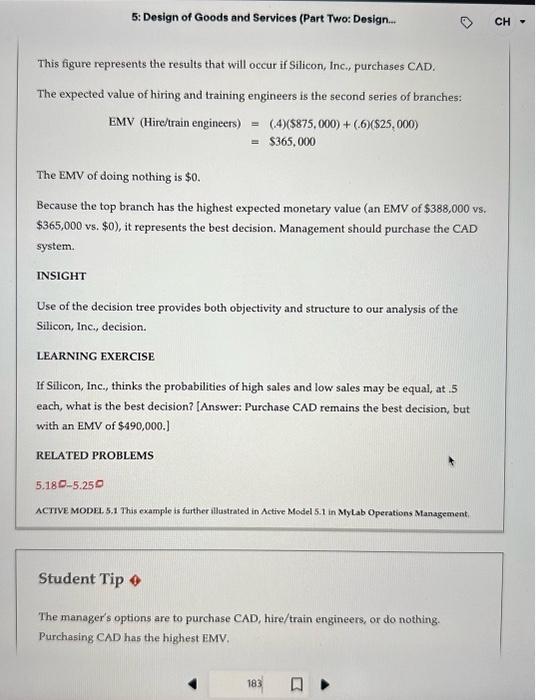

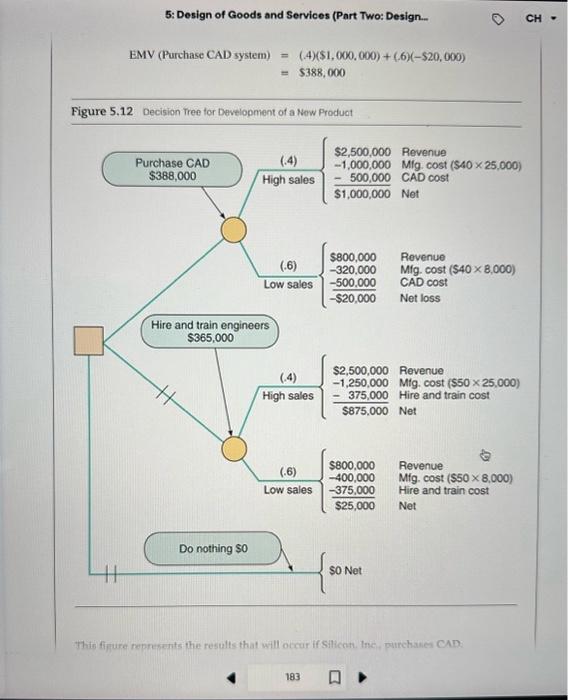

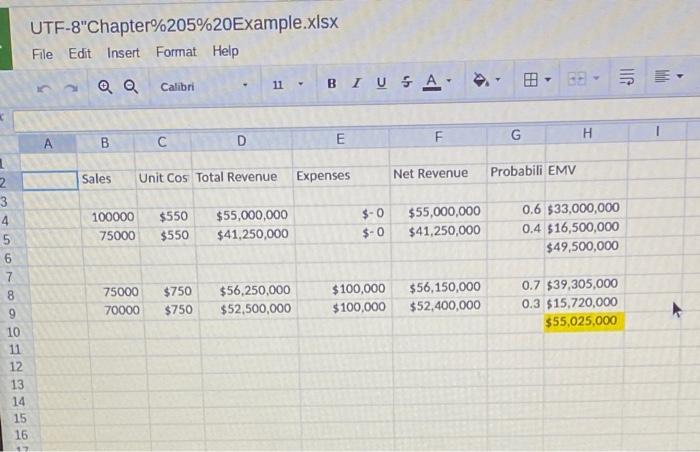

Chapter 5 Expected Monetary Value Residents of Mill River have fond memories of ice skating at a local park. Joe, a local artist, has captured the experience in a drawing and is hoping to reproduce it and sell framed copies to current and former residents. He thinks that if the market is good he can sell 600 copies of the elegant version at $150 each. If the market is not good, he will sell only 300 at $100 each. He can make a deluxe version of the same drawing instead. He feels that if the market is good he can sell 800 copies of the deluxe version at $120 each. If the market is not good, he will sell only 400 copies at $90 each. Production costs will be a]jproximately $25,000 for the elegant version and $20,000 for the deluxe version. He can also choose to do nothing. There is a 60% probability that the market is good and 40% probability that the market is not good. Do an EMV analysis and make a recommendation based on your analysis what Joe should do. This figure represents the results that will occur if Silicon, Inc,, purchases CAD. The expected value of hiring and training engineers is the second series of branches: EMV(Hire/trainengineers)=(.4)($875,000)+(.6)($25,000)=$365,000 The EMV of doing nothing is $0. Because the top branch has the highest expected monetary value (an EMV of $388,000 vs. $365,000 vs. $0 ), it represents the best decision. Management should purchase the CAD system. INSIGHT Use of the decision tree provides both objectivity and structure to our analysis of the Silicon, Inc., decision. LEARNING EXERCISE If Silicon, Inc., thinks the probabilities of high sales and low sales may be equal, at. 5 each, what is the best decision? [Answer: Purchase CAD remains the best decision, but with an EMV of $490,000. RELATED PROBLEMS 5.1805.250 ACTIVE MODEL. 5.1 This example is further illastrated in Active Model 5.1 in MyLab Operations Management. Student Tip 0 The manager's options are to purchase CAD, hire/train engineers, or do nothing: Purchasing CAD has the highest BMV. EMV(PurchaseCADsystem)=(.4)($1,000,000)+(.6)($20,000)=$388,000 This fifure represents the results that will occur if Siliceth. Ine. purchases CAD. Complete the problem using the example on page 183. Example 3, Figure 5.13 or (5.12 13th ed). This is a decision tree analysis to choose between two options. You do not have to draw the tree as illustrated in the text, but be sure to include all of your formulas. Here is an excel format that you can use. Be sure to indicate which option is best. Show all you work. Chapter 5 Example.xisx EMV Homework Assignment.docx UTF-8"Chapter\%205\%20Example.xIsX File Edit Insert Format Help \begin{tabular}{l|l|l|l|l|l|l} A & B & C & D & E & F & G \end{tabular} Sales Unit cos Total Revenue Expenses Net Revenue Probabili EMV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts