Question: complete the problems using Excel formula P.10: Underwriting spread (LO15.2) The Wrigley Corporation needs to raise $44 milion. The investment banking firm of Tinkers, Evers,

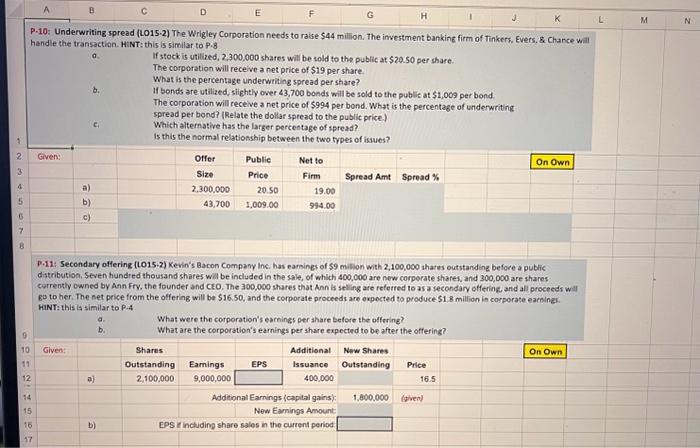

P.10: Underwriting spread (LO15.2) The Wrigley Corporation needs to raise $44 milion. The investment banking firm of Tinkers, Evers, 8 Chance will handle the transaction. HiNT: this is similar to P.8 a. If stock is utilined, 2,300,000 shares will be sold to the public at $20.50 per share. The corporation will receive a net price of $19 per share. b. What is the percentage underwriting spread per share? If bonts are utilized, slightly over 43,700 bonds will be sold to the public at $1,009 per bond. The corporation will receive a net price of $994 per bond. What is the percentage of underwriting spread per bond? (Relate the dollar specad to the public price) Whichalternative has the larger percentage of spread? is this the normal relationship between the two types of issues? P.11: Secondary offering (1015-2) Kevin's Bacon Company Inc. has earnines of \$9 millon with 2, 100,000 shares outstanding before a public distribution, Seven hundred thousand shates wal be included in the sale, of which 400,000 are new corperate shares, and 300,000 are shares. currently owned by Aan Fry, the founder and CEO. The 300,000 shares that Ann is selling are referred to as a secondary offering and all proceeds wil go to her. The set price from the offering will be $16.50, and the corporate proceeds are expected to produce $1.8 million in corporate earning. HiNT: this is similar to p-4 a. What were the corporation's earnings per share before the offering? b. What are the corporation's earnings per share expected to be after the offering

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts