Question: Complete the questions for the enclosed case, Cat & Joe Case. Required Questions:1. List and briefly describe the advantages and disadvantages inherent to the food

Complete the questions for the enclosed case, Cat & Joe Case. Required Questions:1. List and briefly describe the advantages and disadvantages inherent to the food truck business model as compared to traditional restaurants.2a. On a typical day in Kamloops, how many “Ripped Pig” sandwiches must be sold in order to break even?2b. Comment on Cat and Joe’s breakeven point (calculated in Part a). Should this number be relevant to the entrepreneurs?2c. If Cat and Joe wish to make a $100,000 profit for the year (after tax), how many pulled pork sandwiches must the Pig Rig sell each day? Assume all days are in Kamloops at regular prices.3. Prepare a contribution-format income statement for one day’s business at the Pig Rig based on optimistic, realistic, and pessimistic projections for a regular, non-event day in Kamloops.4. Prepare a contribution-format income statement for the Bullarama event based on an optimistic projection (no onsite competitors), a conservative projection (one onsite competitor), and a pessimistic projection (two onsite competitors).5. What are the nonfinancial advantages and disadvantages of attending Bullarama?6. Assume Cat and Joe were told that they should expect one onsite competitor. Would you recommend they stay in Kamloops for the day or go to Bullarama? Justify your answer with both financial and nonfinancial data.

Case Study 1 is about the Co-Owners of a BBQ truck, Cathy Obertowitch and Joe

Thompson, and their decision about attending “Bullarama” as food providers. Cat and Joe’s

truck, the Pig Rig, is located in Kamloops, British Columbia, Canada. At the time of the case

study, the Pig Rig has been in operation for several months and has been outperforming

projections in sale and customer growth.

Currently, Cat and Joe serve between 75-125 people a day, selling its signature dish the

“Ripped Pig” combo for $12 each with 40% of revenue going to variable costs and a corporate

income taxes for small businesses of 20%. Fixed costs for the pig rig includes gas, maintenance,

business licenses, and depreciation amounts to a yearly cost of $10,000. The Pig Rig operates

180 days out of the year. They use a simple trend forecasting method when attending events.

They assume 35% of all attendees will want food, and there will be equal distribution among all

vendors of that 35 %.

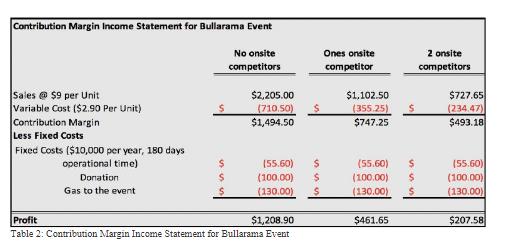

“Bullarama” is a charity rodeo event, with 700 people attending according to ticket sales.

Cat and Joe remove bottlenecks by only serving the sandwiches that allow for a lower cost to

customers and a shorter lead time from order to delivery. Attending the event would add an extra

$100 in fuel costs for the truck, $100 in a donation, and $30 to take another vehicle to their fix

costs. Cat and Joe wonder if they should stay in Kamloops, or attend the event.

Advantages and disadvantages of food truck business compared to traditional restaurants.

Owning a food truck comes with many advantages over a traditional restaurant. Food

trucks have a lower investment and operational cost due to buying or renting a truck over real

estate. The equipment is smaller, and cheaper to operate requiring less startup capital. Labor

costs are lower when operating a food truck over a conventional store due to a smaller workforce

needed, and most times owners are the workforce and do not draw a paycheck. Food trucks have

the luxury of having the flexibility of moving from location to location where their customers are

and attending events to create a revenue stream not available to standing stores. By following the

customer they do not have the spend money on marketing.

The advantages of owning a food truck can quickly turn into a disadvantage if not

properly managed. With smaller and cheaper equipment there is also limited cooking space

causing a bottleneck for orders. There is also limited cold storage causing limited variety and

amount of food carried. The mobility and flexibility advantage become canceled because of the

potential for the truck to break down causing a loss of revenue until the truck is fixed. Sales are

weather dependent, which causes a shorter selling season. The savings on marketing could be

wasted if current customers do not know the current location of the truck, as well as increased

competition from other trucks not respecting the sales boundary.

Cost-Volume-Profit Analysis baseline of Kamloops operations

The break-even point on a typical day in Kamloops can be found using the information stated

below.

○ Total Fixed cost per year = $10,000

○ Operational time - 180 days

○ Price = $12

○ Variable costs= 40% of revenue

The fixed costs on a typical day are found by taking the total fixed cost per year and dividing it

over the total yearly operational time of 180 days. This dollar amount per day is then divided by

revenue generated per sale which is the unit price subtracted by variable cost.

○ Break even for a typical day = $10,000/180 days = $55.60/day

○ $55.60 / (Price per unit $12- Variable cost per unit $4.80)= 7.716 units/day

The break-even for a typical day using the level plan that the ripped pig needs to sell is 7.7,

rounded to 8 “ripped pig” sandwiches. The break-even number is very important and relevant to

entrepreneurs because the bottom line is it helps them know the minimum sales volume to avoid

a loss. It is also important when planning a target profit level when comparing situations. Whe

setting profit levels, knowing the break-even point allows an entrepreneur to set the optimum

price and manage and schedule inventory requirements. For example, if the Pig Rig wanted to

make $100,000 profit for the year (after tax) they would need to know how many pulled pork

sandwiches they would need to sell each day.

○ Fixed cost per day = $55.6

○ Corporate Income Tax = 20%

○ Contribution Margin (CM) per unit = 12 - (12 ⋅ 40%)= $7.20 / unit

○ Desired Yearly Income (Before Tax)= $100,000 / (1-20%) = $125,000

○ Desired Monthly Income (Before Tax)= $125,000 / 180 days = $694.44/day

○ Daily Sale of Units required = (55.6 + 694.44) / 7.20 = 104.17 units/ day

By using the same calculations in the break even model with the addition of finding the pre tax

income amount it was found the Pig Rig needed to sell 105 “ripped pig” sandwiches a day.

Contribution-format income statements

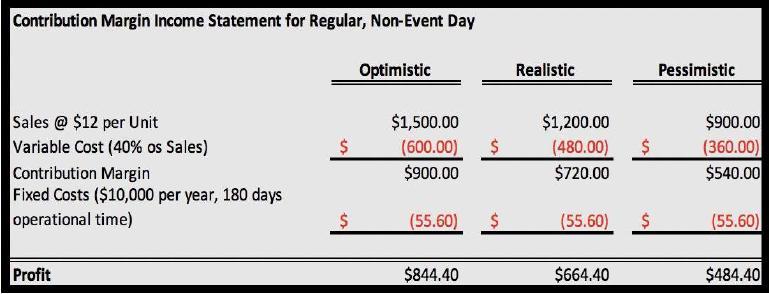

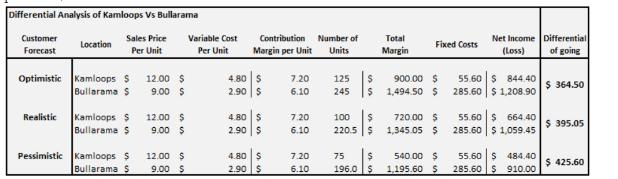

Contribution income statement for a regular day in Kamloops, Table 1, compares the income

and revenue from optimistic (125 customers), realistic (100 customers), and pessimistic( 75

customers) projections. The sales per day are found by multiplying the number of customers

projected by the costs per unit ($12) as a starting point. Using the data and solutions found

earlier, the total profit per day for each projection is found.

Contribution Margin Income Statement for Regular, Non-Event Day Optimistic Realistic Pessimistic Sales @ $12 per Unit Variable Cost (40% os Sales) Contribution Margin Fixed Costs ($10,000 per year, 180 days operational time) $900.00 (360.00) $540.00 $1,500.00 $1,200.00 $ (600.00) 2$ (480.00) $720.00 $900.00 2$ (55.60) (55.60) $ (55.60) Profit $844.40 $664.40 $484.40

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

1 Advantage Lower cost cause buying or renting a truck would be much cheaper than buying or renting ... View full answer

Get step-by-step solutions from verified subject matter experts