Question: Complete the SCHEDULE E (Form 1040) for the following information: Taxpayer Information Name: John Washington Address: 3450 Green St. Miami, FL 54321 DOB: 5/5/1960 Filing

Complete the SCHEDULE E (Form 1040) for the following information:

Taxpayer Information

Name: John Washington

Address: 3450 Green St.

Miami, FL 54321

DOB: 5/5/1960

Filing Status: Married

SSN: 434-20-2020

Occupation: Engineer

Name: Debra Washington

Address: 3450 Green St.

Miami, FL 54321

DOB: 7/7/1962

Filing Status: Married

SSN: 411-21-4568

Occupation: Teacher

INCOME INFORMATION:

Wages and Compensation

The following information is taken from John Washingtons 2017 Form W-2 Wage and Tax Statement:

| Box 1 Wages, tips, and other compensation | 80,000 |

| Box 2 Federal Withholding | 12,500 |

| Box 17 State Income Tax Withholding | 2,000 |

The following information is taken from Debra Washingtons 2017 Form W-2 Wage and Tax Statement:

| Box 1 Wages, tips, and other compensation | 42,000 |

| Box 2 Federal Withholding | 3,500 |

| Box 17 State Income Tax Withholding | 750 |

Interest and Dividends

John had interest income from a savings account from Everest Bank of $500.00

Debra had dividend income of $550 from Blue Co. stock.

Capital Gains

John had the following stock transactions in 2017:

He sold 1,000 shares of Apex Co. for $ 12,000 on June 7, 2017, which he purchased on April 1, 2017 for 25,000

Rental Real Estate

The couple owns a rent house which he purchased on July 1, 2014. The income and expenses of the rental real estate unit are as follows:

Rental income $12,000

Property taxes $1,500

Depreciation $1,000

Repairs and Maintenance $750

Insurance $2,000

Other Transactions in 2017

1. Debra had educator expenses in 2017 of $450.00

2. John had gambling winnings of $1,000.

3. John was the beneficiary of his mothers life insurance policy.

His mother died in 2017 and he received $50,000 under this policy.

4. Debra paid $700 in student loan interest.

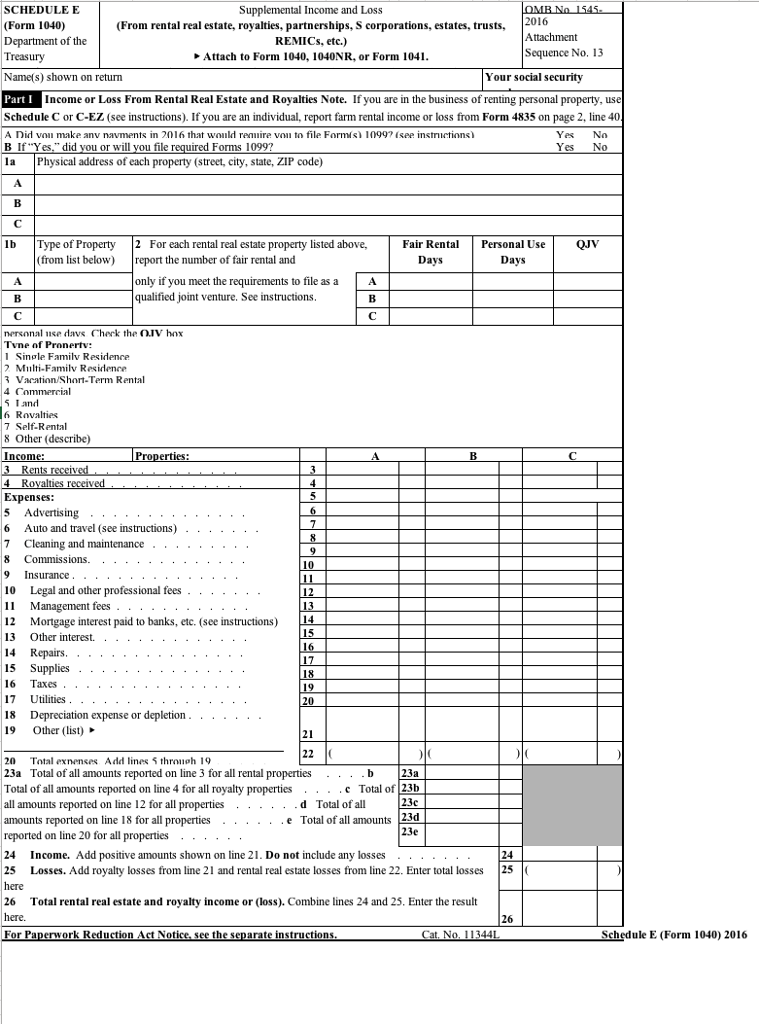

SCHEDULE E (Form 1040) Department of the Treasury Supplemental Income and Loss (From rental real estate, royalties, partnerships, S corporations, estates, trusts, REMICs. etc.) Attach to Form 1040, 1040NR, or Form 104 Attachment Sequence No. 13 Name(s) shown on return Your social securitv Part I Income or Loss From Rental Real Estate and Royalties Note. If you are in the business of renting personal property, use Schedule C or C-EZ (see instructions). If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40 A Did von make anv navments in 2016 that would reanire von to file Formis) 1099 (see instructions B If Yes," did you or will you file required Forms 1099? la Physical address of each property (street, city, state, ZIP code) Ys No Yes No lb Type of Property 2 For each rental real estate property listed above, Fair Renta Personal Use QJV (from list below) report the number of fair rental and Days Days only if you meet the requirements to file as a A qualified joint venture. See instructions. nersonal use davs Cherk the OIV hox Tvne of Pronertv: l Single Familv Residence 7 Multi-Familv Residence Vacation/Short-Term Rental 4 Commercial Iand 6 Rovalties 7 Self Rental 8 Other (describe) Income Properties Expenses: 5 Advertising 6 Auto and travel (see instructions) - 8 Commissions. .. - 10 Legal and other professional fees. . - 1 Management fees 12 Mortgage interest paid to banks, etc. (see instructions) 13 Other interest. .. . _. 15 Supplies . 17 Utilities . . 18 Depreciation expense or depletion. 19 Other (list 20 . 20 Total exnenses Add lines throneh 19 23aTotal of all amounts reported on line 3 for all rental properties .b 23a Total of all amounts reported on line 4 for all royalty properties all amounts reported on line 12 for all properties .. ...d Total of all amounts reported on line 18 for all properties . reported on line 20 for all properties . . . 24 Income. Add positive amounts shown on line 21. Do not include any losses 25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses 25 . Total of 23h 23c . . e Total of all amounts 23d 23e 26 Total rental real estate and royalty income or loss). Combine lines 24 and 25. Enter the result 26Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts