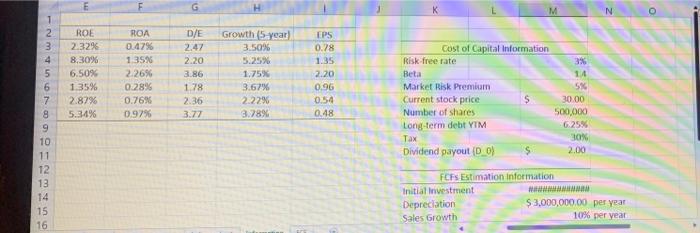

Question: Complete the spreadsheet K M N 0 ow ROE 2.32% 8,30% 6.50% 1.35% 2.87% 5.34% ROA 0.47% 1356 2.26% 0.28% 0.76% 0.97% D/E 2.47 2.20

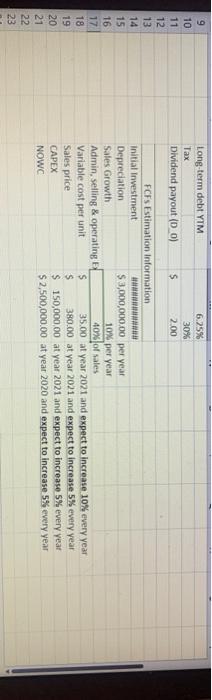

K M N 0 ow ROE 2.32% 8,30% 6.50% 1.35% 2.87% 5.34% ROA 0.47% 1356 2.26% 0.28% 0.76% 0.97% D/E 2.47 2.20 3.86 1.78 2.36 3.77 Growth (5 year 3.50% 5.25% 1.75% 3.62% 2.2296 3.78% EPS 0.78 1.35 2.20 0.96 0.54 0.48 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Cost of Capital Information Risk free rate Beta Market Risk Premium Current stock price Number of shares Long-term debt YTM Tax Dividend payout (D_01 $ 3% 14 5% 30.00 500,000 6.25% 30% 2.00 FCFS Estimation Information Initial investment Depreciation $3,000,000.00 per year Sales Growth 10% per year Long-term debt YTM Tax Dividend payout ( 0) 6.25% 30% 2.00 $ Nm 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 FCFS Estimation Information Initial Investment Depreciation $3,000,000,00 per year Sales Growth 10% per year Admin, selling & operating 40% of sales Variable cost per unit s 35.00 at year 2021 and expect to increase 10% every year Sales price S 380.00 at year 2021 and expect to increase 5% every year CAPEX $ 150,000.00 at year 2021 and expect to increase 5% every year NOWC $2,500,000.00 at year 2020 and expect to increase 5% every year W NNO K M N 0 ow ROE 2.32% 8,30% 6.50% 1.35% 2.87% 5.34% ROA 0.47% 1356 2.26% 0.28% 0.76% 0.97% D/E 2.47 2.20 3.86 1.78 2.36 3.77 Growth (5 year 3.50% 5.25% 1.75% 3.62% 2.2296 3.78% EPS 0.78 1.35 2.20 0.96 0.54 0.48 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Cost of Capital Information Risk free rate Beta Market Risk Premium Current stock price Number of shares Long-term debt YTM Tax Dividend payout (D_01 $ 3% 14 5% 30.00 500,000 6.25% 30% 2.00 FCFS Estimation Information Initial investment Depreciation $3,000,000.00 per year Sales Growth 10% per year Long-term debt YTM Tax Dividend payout ( 0) 6.25% 30% 2.00 $ Nm 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 FCFS Estimation Information Initial Investment Depreciation $3,000,000,00 per year Sales Growth 10% per year Admin, selling & operating 40% of sales Variable cost per unit s 35.00 at year 2021 and expect to increase 10% every year Sales price S 380.00 at year 2021 and expect to increase 5% every year CAPEX $ 150,000.00 at year 2021 and expect to increase 5% every year NOWC $2,500,000.00 at year 2020 and expect to increase 5% every year W NNO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts