Question: Complete the sum properly. Record all 12 entries . Exercise 9-35 Purchase equipment, depreciation, disposal of equipment LO2, 3, 6 Jessica Grewal decided to open

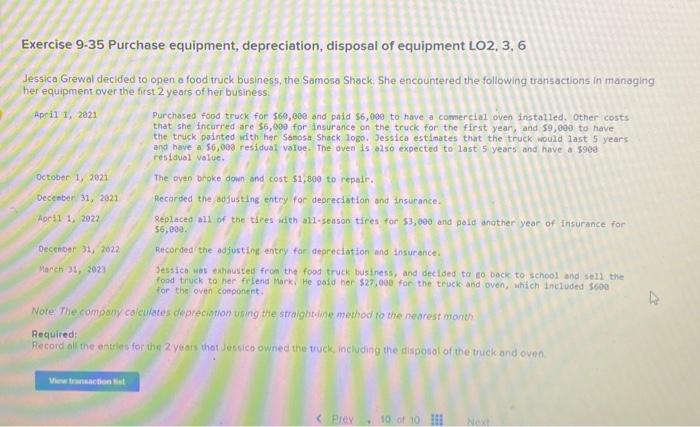

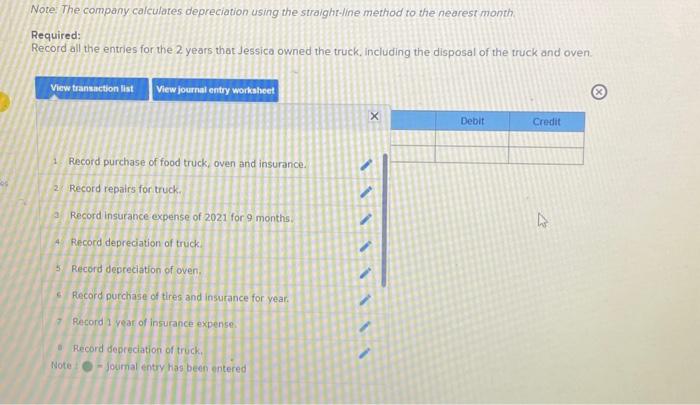

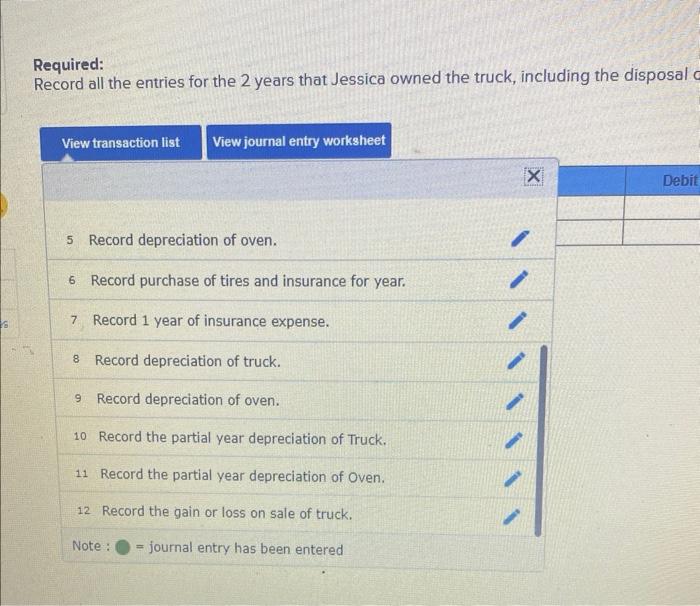

Exercise 9-35 Purchase equipment, depreciation, disposal of equipment LO2, 3, 6 Jessica Grewal decided to open o food truck business, the Samosa Shack. She encountered the following transoctions in manoging her equipment over the first 2 years of her business. Apri1 1, 2021 Purchased food truck for $60,000 and paid $6,000 to have a comsercial oven installed, Other costs that she incurred are $6,009 for insurance on the truck for the first year, and $9,000 to have the truck pointed ifth hetr sanosa shick logo. Jessica estinates that the truck would last 5 years and have a $6,009 residual value, The oven is also expected to last 5 years and have a sgee resldual value. Oetober 1,2021 The oven broke down and cost $1,800 to repair. Decenter 31,2021 Recarded the adfusting entry for deorectation and insurance. 190811 1, 2022 8eplaced all of the tires adth all-zeason tires for $3,000 end pold anather year of Insurince for s6, eag. Qecentoer 31,2022 Recorded the adjusting entry for deprectation and Insurence. March 31, 2023 Jessita was ehnustes fron the food truck business, and decloed to co back to school and sell the food truck to her filend Mork. He pald her \$27,000 for the truck and oven, which included $600 for the oven component. Required: Record oll the entries for the 2 years ther Jeswico owned the truck including the dispotsol of the thuck and oven Note: The company calculates depreciation using the straight-line method to the nearest month. Required: Record all the entries for the 2 years that Jessica owned the truck, including the disposal of the truck and oven 1. Record purchase of food truck, oven and insurance. Record repatis for truck. Record insurance expense of 2021 for 9 months: Ficcord depreciation of truck. Required: Record all the entries for the 2 years that Jessica owned the truck, including the disposal 5 Record depreciation of oven. 6 Record purchase of tires and insurance for year. 7 Record 1 year of insurance expense. 8 Record depreciation of truck. 9 Record depreciation of oven. 10 Record the partial year depreciation of Truck. 11 Record the partial year depreciation of Oven. 12 Record the gain or loss on sale of truck. Note : = journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts