Question: Complete the table below based on Redhawk Inc. ' s debt and equity. Redhawk Inc. paid a dividend of $ 1 per share today on

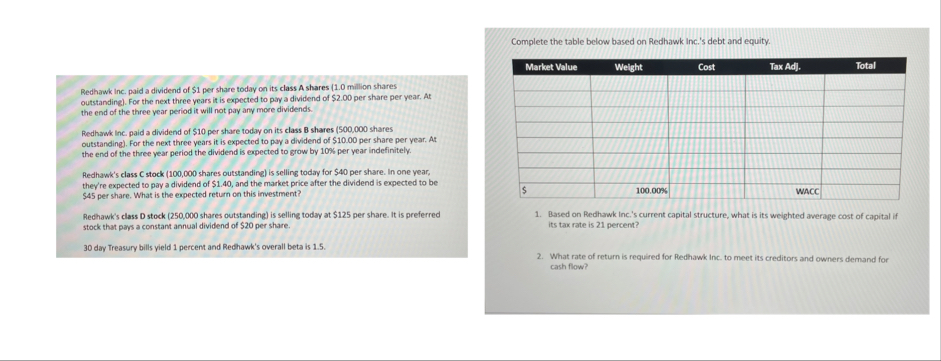

Complete the table below based on Redhawk Inc.s debt and equity.

Redhawk Inc. paid a dividend of $ per share today on its class A shares million shares outstanding For the next three years it is expected to pay a dividend of $ per share per year. At the end of the three year period it will not pay any more dividends.

Redhawk Inc. paid a dividend of $ per share today on its class B shares shares outstanding For the next three years it is expected to pay a dividend of $ per share per year. At the end of the three year period the dividend is expected to grow by per year indefinitely.

Redhawk's class C stock shares outstanding is selling today for $ per share. In one year, theyre expected to pay a dividend of $ and the market price after the dividend is expected to be $ per share. What is the expected return on this investment?

Rechawk's class D stock shares outstanding is selling today at $ per share. It is preferred stock that pays a constant annual dividend of $ per share.

day Treasury bills yield percent and Rechawk's overall beta is

tableMarket Value,Welght,Cost,Tax Adj.,Total$WACC,

Based on Redhawk Inc.s current capital structure, what is its weighted average cost of capital if its tax rate is percent?

What rate of return is required for Redhawk Inc. to meet its creditors and owners demand for cash flow?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock