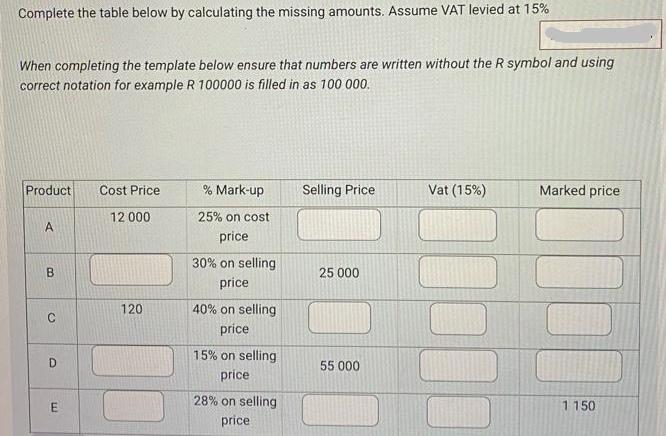

Question: Complete the table below by calculating the missing amounts. Assume VAT levied at 15% When completing the template below ensure that numbers are written

Complete the table below by calculating the missing amounts. Assume VAT levied at 15% When completing the template below ensure that numbers are written without the R symbol and using correct notation for example R 100000 is filled in as 100 000. Product A B C D E Cost Price 12 000 120 % Mark-up 25% on cost price 30% on selling price 40% on selling price 15% on selling price 28% on selling price Selling Price 25 000 55 000 Vat (15%) Marked price 1150

Step by Step Solution

There are 3 Steps involved in it

SOLUTION To calculate the missing amounts well use the given information and apply the appropriate c... View full answer

Get step-by-step solutions from verified subject matter experts