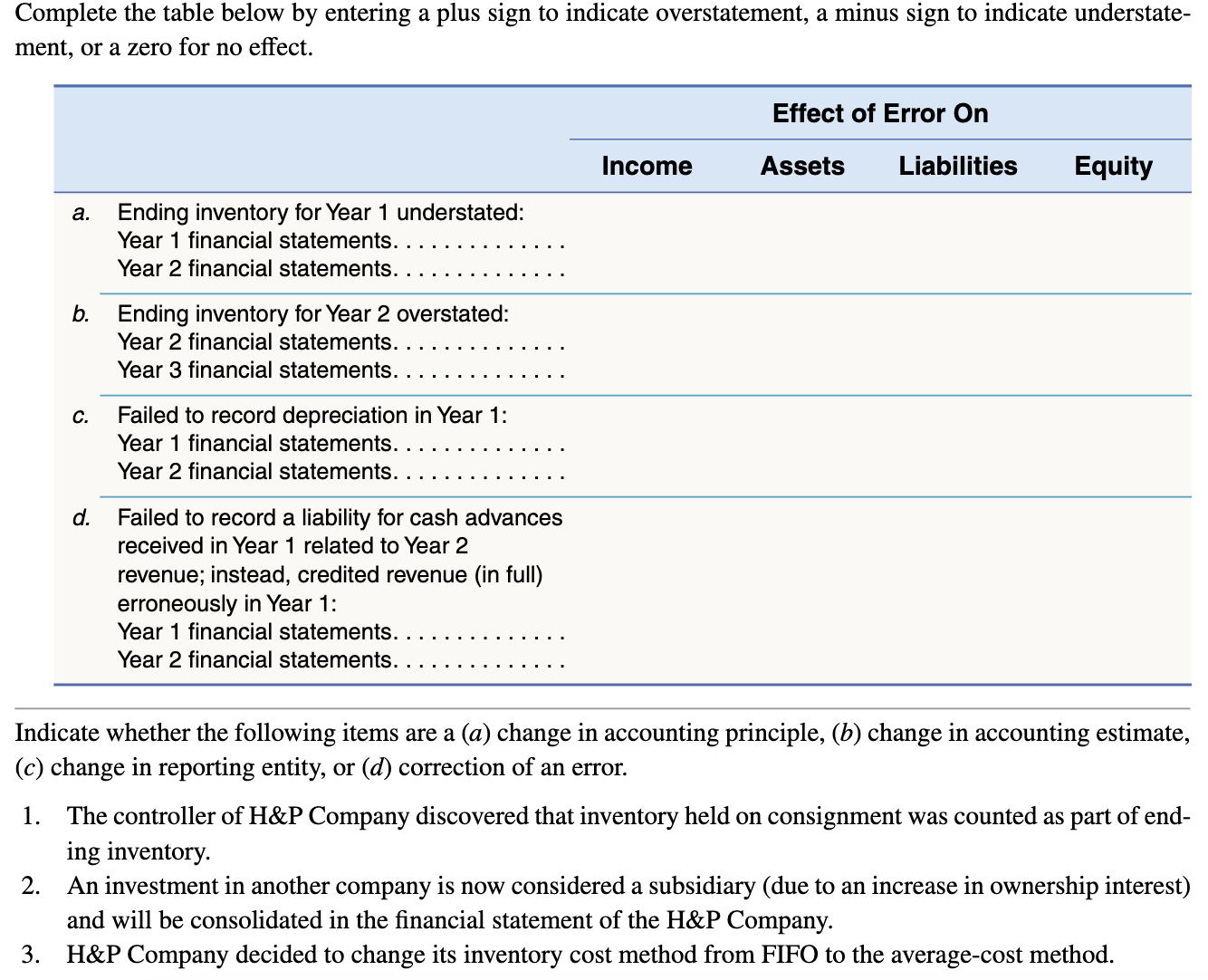

Question: Complete the table below by entering a plus sign to indicate overstatement, a minus sign to indicate understate - ment, or a zero for no

Complete the table below by entering a plus sign to indicate overstatement, a minus sign to indicate understate

ment, or a zero for no effect.

Effect of Error On

Income

Assets

Liabilities

Equity

a Ending inventory for Year understated:

Year financial statements.

Year financial statements.

b Ending inventory for Year overstated:

Year financial statements.

Year financial statements.

c Failed to record depreciation in Year :

Year financial statements.

Year financial statements.

d Failed to record a liability for cash advances

received in Year related to Year

revenue; instead, credited revenue in full

erroneously in Year :

Year financial statements.

Year financial statements.

Indicate whether the following items are a a change in accounting principle, change in accounting estimate,

c change in reporting entity, or correction of an error.

The controller of H&P Company discovered that inventory held on consignment was counted as part of end

ing inventory.

An investment in another company is now considered a subsidiary due to an increase in ownership interest

and will be consolidated in the financial statement of the H&P Company.

H&P Company decided to change its inventory cost method from FIFO to the averagecost method.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock