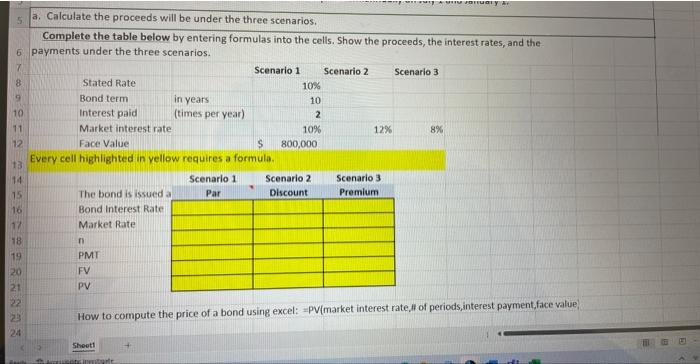

Question: Complete the table below by entering formulas into the cells. Show the proceeds, the interest rates, and the payments under the three scenarios. Every cell

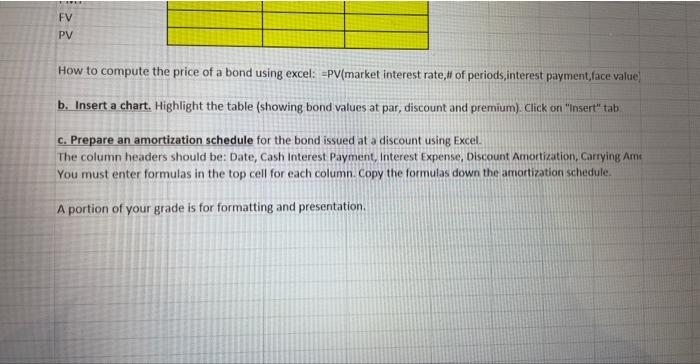

Complete the table below by entering formulas into the cells. Show the proceeds, the interest rates, and the payments under the three scenarios. Every cell highlighted in yellow requires a formula. How to compute the price of a bond using excel: = PV(market interest rate. of periods, interest payment, face value, How to compute the price of a bond using excel: =PV(market interest rate, Hf of periods, interest payment,face value) b. Insert a chart. Highlight the table (showing bond values at par, discount and premium). Click on "Insert" tab c. Prepare an amortization schedule for the bond issued at a discount using Excel. The column headers should be: Date, Cash Interest Payment, Interest Expense, Discount Amortization, Carrying Ams You must enter formulas in the top cell for each column. Copy the formulas down the amortization schedule. A portion of your grade is for formatting and presentation. Complete the table below by entering formulas into the cells. Show the proceeds, the interest rates, and the payments under the three scenarios. Every cell highlighted in yellow requires a formula. How to compute the price of a bond using excel: = PV(market interest rate. of periods, interest payment, face value, How to compute the price of a bond using excel: =PV(market interest rate, Hf of periods, interest payment,face value) b. Insert a chart. Highlight the table (showing bond values at par, discount and premium). Click on "Insert" tab c. Prepare an amortization schedule for the bond issued at a discount using Excel. The column headers should be: Date, Cash Interest Payment, Interest Expense, Discount Amortization, Carrying Ams You must enter formulas in the top cell for each column. Copy the formulas down the amortization schedule. A portion of your grade is for formatting and presentation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts