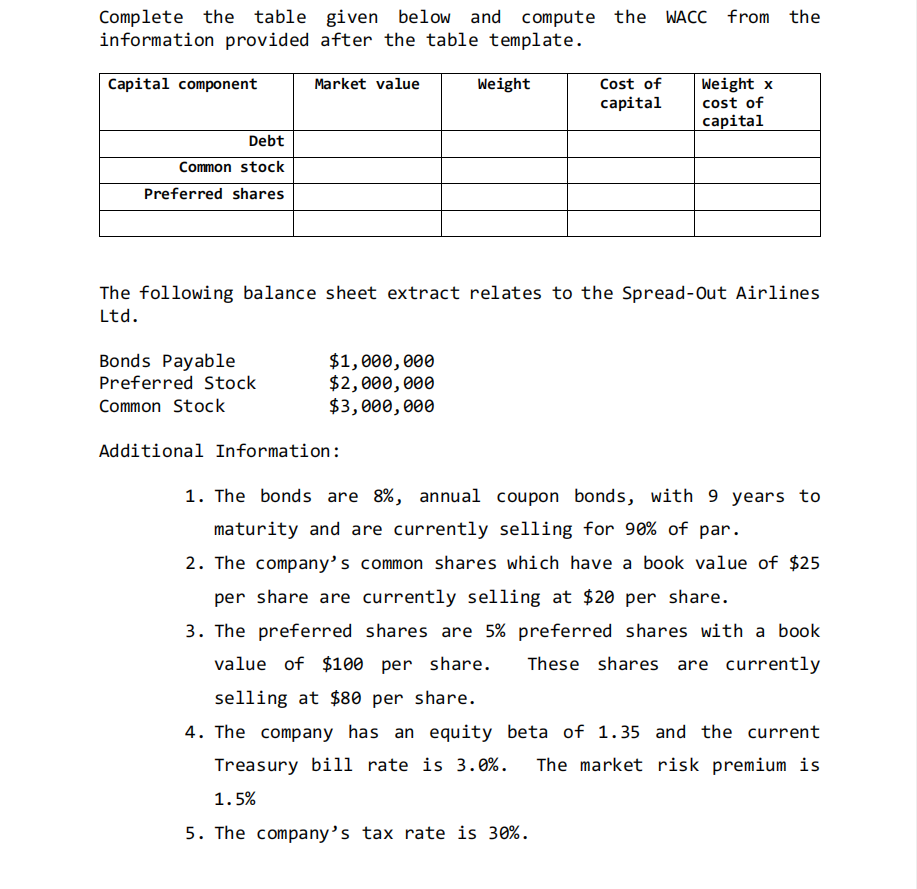

Question: Complete the table given below and compute the WACC from the information provided after the table template. The following balance sheet extract relates to the

Complete the table given below and compute the WACC from the information provided after the table template. The following balance sheet extract relates to the SpreadOut Airlines Ltd Additional Information: The bonds are annual coupon bonds, with years to maturity and are currently selling for of par. The company's common shares which have a book value of $ per share are currently selling at $ per share. The preferred shares are preferred shares with a book value of $ per share. These shares are currently selling at $ per share. The company has an equity beta of and the current Treasury bill rate is The market risk premium is The company's tax rate is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock