Question: Complete the tables and answer the question 2. C Corporation currently has no debt in its capital structure. The firm is considering restructuring that would

Complete the tables and answer the question

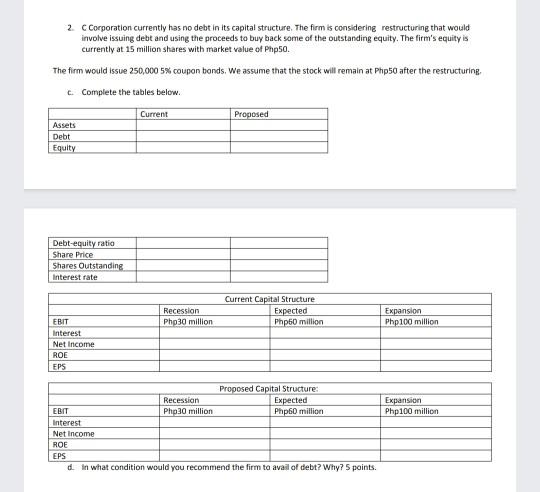

2. C Corporation currently has no debt in its capital structure. The firm is considering restructuring that would involve issuing debt and using the proceeds to buy back some of the outstanding equity. The firm's equity is currently at 15 million shares with market value of Php50. The firm would issue 250,000 5% coupon bonds. We assume that the stock will remain at Php50 after the restructuring Complete the tables below. Current Proposed Assets Debt Equity Debt-equity ratio Share Price Shares Outstanding Interest rate Recession Php 30 million Current Capital Structure Expected Php60 million Expansion Php100 million EBIT Interest Net Income ROE EPS Recession Php 30 million Proposed Capital Structure: Expected Php60 million Expansion Php100 million EBIT Interest Net Income ROE EPS din what condition would you recommend the firm to avail of debt? Why? 5 points. 2. C Corporation currently has no debt in its capital structure. The firm is considering restructuring that would involve issuing debt and using the proceeds to buy back some of the outstanding equity. The firm's equity is currently at 15 million shares with market value of Php50. The firm would issue 250,000 5% coupon bonds. We assume that the stock will remain at Php50 after the restructuring Complete the tables below. Current Proposed Assets Debt Equity Debt-equity ratio Share Price Shares Outstanding Interest rate Recession Php 30 million Current Capital Structure Expected Php60 million Expansion Php100 million EBIT Interest Net Income ROE EPS Recession Php 30 million Proposed Capital Structure: Expected Php60 million Expansion Php100 million EBIT Interest Net Income ROE EPS din what condition would you recommend the firm to avail of debt? Why? 5 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts