Question: complete the tax return -form 1040, schedule 1 and Schedule A To my friendly student tax preparer Hello, my name is Cardy, B. I understand

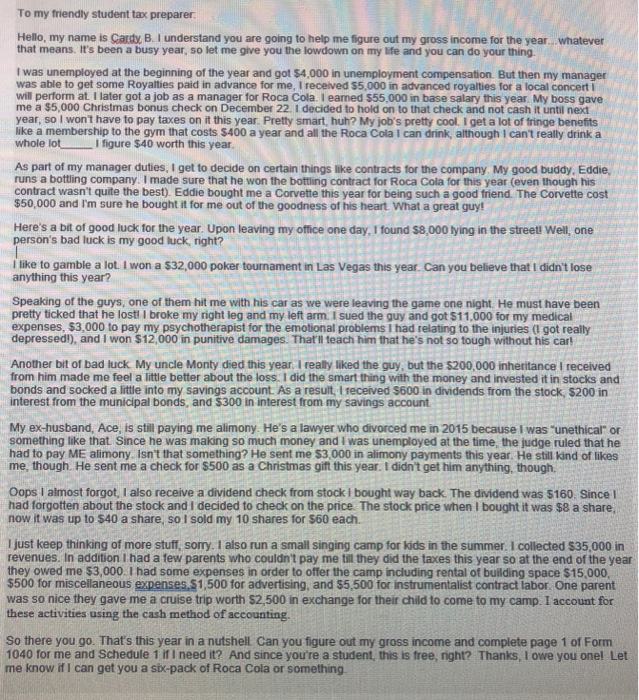

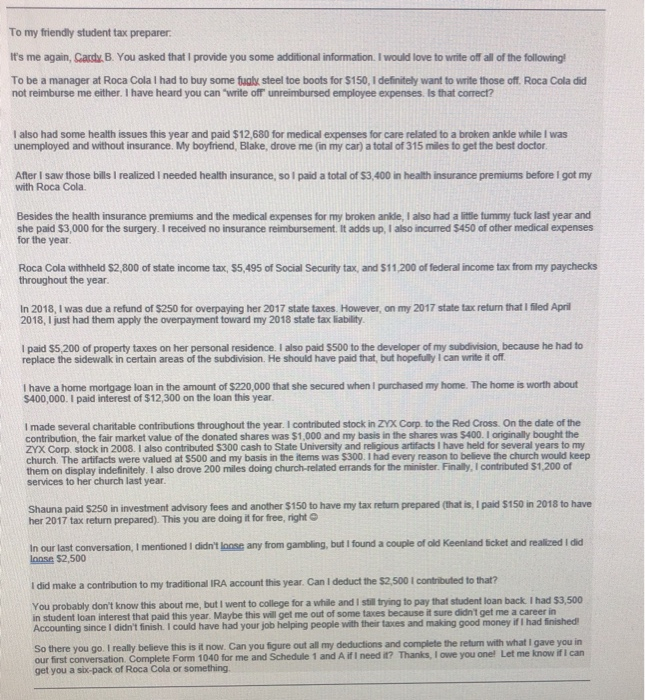

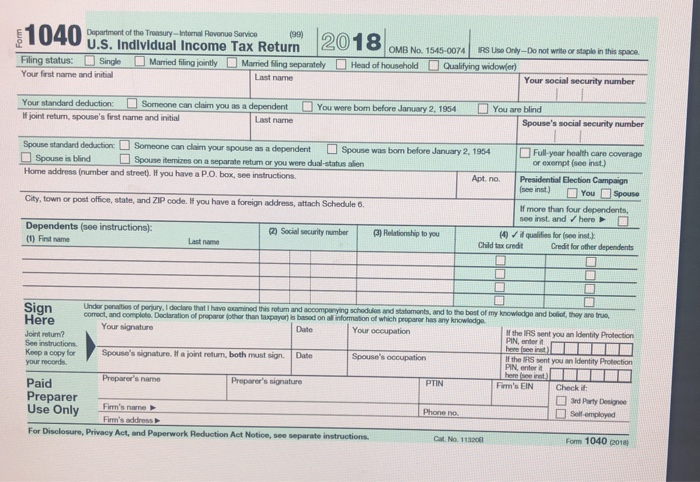

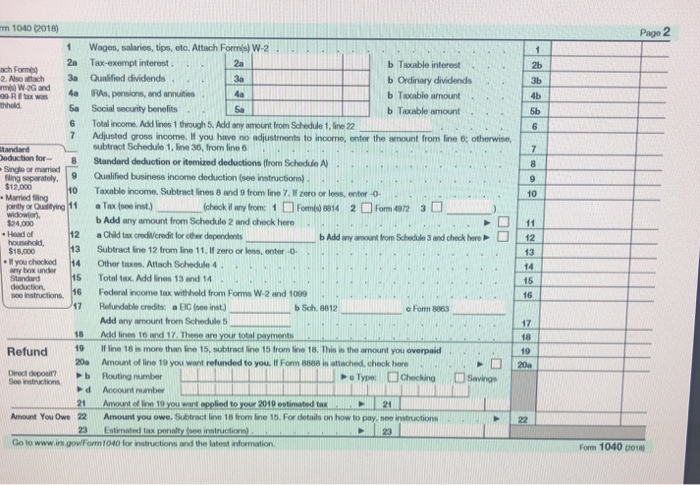

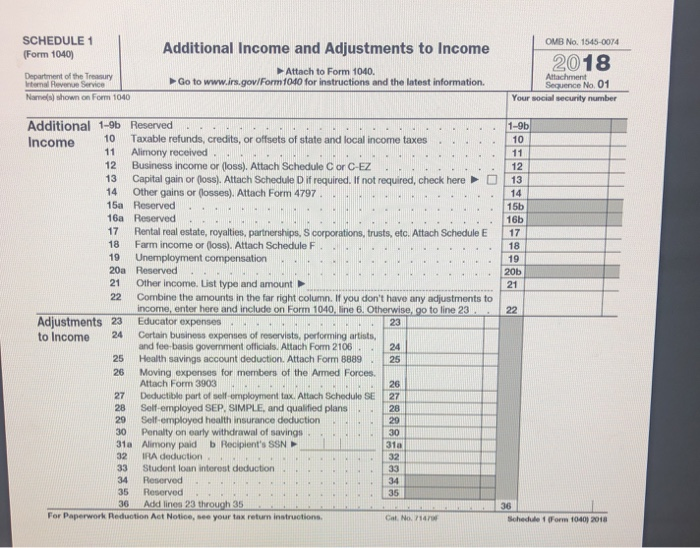

To my friendly student tax preparer Hello, my name is Cardy, B. I understand you are going to help me figure out my gross income for the year. whatever that means. It's been a busy year, so let me give you the lowdown on my life and you can do your thin I was unemployed at the beginning of the year and got $4,000 in unemployment compensation But then my manager was able to get some Royalties paid in advance for me, I received $5,000 in advanced royalties for a local concert I will perform at I later got a job as a manager for Roca Cola. I eamed $55,000 in base salary this year. My boss gave me a $5,000 Christmas bonus check on December 22. I decided to hold on to that check and not cash it until next year, so I won't have to pay taxes on it this year. Pretty smart, huh? My job's pretty cool. I get a lot of fringe benefits like a membership to the gym that costs $400 a year and all the Roca Cola I can drink, although I can't really drink a whole lotI figure $40 worth this year As part of my manager duties, I get to decide on certain things like contracts for the company. My good buddy, Eddie, runs a bottling company. I made sure that he won the bottling contract for Roca Cola for this year (even though his contract wasn't quite the best). Eddie bought me a Corvette this year for being such a good friend. The Corvette cost $50,000 and I'm sure he bought it for me out of the goodness of his heart What a great guy Here's a bit of good luck for the year. Upon leaving my office one day, I found $8,000 lying in the streeti Well one person's bad luck is my good luck, right? I like to gamble a lot. I won a $32,000 poker tournament in Las Vegas this year. Can you believe that I didn't lose anything this year? Speaking of the guys, one of them hit me with his car as we were leaving the game one night. He must have been pretty ticked that he lostl I broke my right leg and my left arm. I sued the guy and got $11,000 for my medical expenses, $3,000 to pay my psychotherapist for the emotional problems I had relating to the injuries (I got really depressed), and I won $12,000 in punitive damages. That'll teach him that he's not so tough without his car Another bit of bad luck. My uncle Monty died this year I really liked the guy, but the $200,000 inheritance I received from him made me feel a little better about the loss. I did the smart thing with the money and invested it in stocks and bonds and socked a little into my savings account. As a result, I received $600 in dividends from the stock, $200 in interest from the municipal bonds, and $300 in interest from my savings account My ex-husband, Ace, is still paying me alimony He's a lawyer who divorced me in 2015 because I was "unethical" or omething like that. Since he was making so much money and I was unemployed at the time, the judge ruled that he had to pay ME alimony. Isn't that something? He sent me $3,000 in alimony payments this year. He still kind of likes me, though. He sent me a check for $500 as a Christmas gift this year. I didn't get him anything, though. Oops I almost forgot, I also receive a dividend check from stock i bought way back. The dividend was $160. Since I had forgotten about the stock and I decided to check on the price. The stock price when I bought it was $8 a share now it was up to 540 a share, so I sold my 10 shares for $60 each. I just keep thinking of more stuff, sorry. I also run a small singing camp for kids in the summer. I collected $35,000 in revenues. In addition I had a few parents who couldn't pay me till they did the taxes this year so at the end of the year they owed me $3,000. I had some expenses in order to offer the camp including rental of building space $15,000 $500 for miscellaneous expenses $1,500 for advertising, and $5,500 for instrumentalist contract labor. One parent was so nice they gave me a cruise trip worth $2,500 in exchange for their child to come to my camp. I account for these activities using the cash method of accounting So there you go. That's this year in a nutshell Can you figure out my gross income and complete page 1 of Form 1040 for me and Schedule 1 ifi need it? And since you're a student, this is free, right? Thanks, I owe you one! Let me know if I can get you a si-pack of Roca Cola or something I I To my friendly student tax preparer It's me again, atB You asked that l provide you some additional information. I would love to write off all of the following! To be a manager at Roca Cola I had to buy some fualy steel toe boots for $150, I definitely want to write those off. Roca Cola did not reimburse me either. I have heard you can "write off unreimbursed employee expenses. Is that correct? I also had some health issues this year and paid $12,680 for medical expenses for care related to a broken ankle while I was unemployed and without insurance. My boyfriend, Blake, drove me (in my car) a total of 315 miles to get the best doctor After I saw those bills I realized I needed health insurance, so I paid a total of $3,400 in health insurance premiums before I got my with Roca Cola Besides the health insurance premiums and the medical expenses for my broken ankle, I also had a little tummy tuck last year and she paid $3,000 for the surgery. I received no insurance reimbursement. It adds up, I also incurred $450 of other medical expenses for the year Roca Cola withheld $2,800 of state income tax, $5,495 of Social Security tax, and $11,200 of federal income tax from my paychecks throughout the year In 2018, I was due a refund of $250 for overpaying her 2017 state taxes. However, on my 2017 state tax return that I filed April 2018, I just had them apply the overpayment toward my 2018 state tax liability I paid $5,200 of property taxes on her personal residence. I also paid $500 to the developer of my subdivision, because he had to replace the sidewalk in certain areas of the subdivision. He should have paid that, but hopefully I can write it off I have a home mortgage loan in the amount of $220,000 that she secured when I purchased my home. The home is worth about $400,000. I paid interest of $12,300 on the loan this year made several charitable contributions throughout the year. I contributed stock in ZYX Corp. to the Red Cross. On the date of the contribution, the fair market value of the donated shares was $1,000 and my basis in the shares was $400. I originally bought the ZYX Corp. stock in 2008. I also contributed $300 cash to State University and religious artifacts I have held for several years to my church. The artifacts were valued at $500 and my basis in the items was $300. I had every reason to believe the church would keep them on display indefinitely I also drove 200 miles doing church-related errands for the minister. Finaly, I contributed $1,200 of services to her church last year Shauna paid $250 in investment advisory fees and another $150 to have my tax return prepared (hat is, paid $150 in 2018 to have her 2017 tax return prepared). This you are doing it for free, right In our last conversation, I mentioned I didn't loose any from gambling, but I found a couple of old Keenland ticket and realized I did lonse $2,500 did make a contribution to my traditional IRA account this year. Can I deduct the $2,500 I contributed to that? You probably don't know this about me, but I went to college for a while and I still trying to pay that student loan back I had $3,500 in student loan interest that paid this year. Maybe this will get me out of some taxes because it sure didn'1 get me a career in Accounting since I didn't finish. I could have had your job helping people with their taxes and making good money if I had finished So there you go. I really believe this is it now. Can you figure out all my deductions and complete the return with what I gave you in our first conversation. Complete Form 1040 for me and Schedule 1 and A if I need it? Thanks, I owe you one! Let me know if I can get you a six-pack of Roca Cola or something Dopartment of the Troasury-Intornal Rlovonue Sorvice (99) OMB No. 1545-0074 Head of household Qualitying widowler) IRS Use Only-Do not write or staplo in this space Filing status: Single Your first name and initial Married filing jointly Married Sling separately Last name Your social security number Your standard deduction: Someone can clairm you as a dependent You were bom before If joint returm, spouse's first name and initial Spouse standard deduction: Someone can claim a dependent Home address (number and street). If you have a P.O. box, see instructions. City, town or post office, state, and ZIP code. lf you have a foreign address, attach Schedule 6. Dependents (see instructions) Last name Spouse's social security number your spouse as a dependent Spouse was bom before January 2, 1954 Full-year health care coverage Spouse itemizes on a separate return or you were dual-status alien or exempt (see inst.) Apt. no. Presidential Election Campaign If more than four dependents, see inst. and/here 2) Social security number 3) Relationship to you 4) Child tax credt (1) First name qualiies for (see inst.): Last name Credit for other dependents and statomonts, and to tho bost of my knowlodge and boliot, thay ane true Here cormact, and comploto. Daclaration of proparor jothor than taxpayor ts based on all information of which Your signature Spouse's signature. If a joint return, both must sign. Date Preparer's name Date Your occupation If the IRS sent you an ldentity Protection PIN, enter iH Joint return? See instructions Keep a copy for your records If the IRS sent you an ldentity Protection PIN, enter it Paid Preparer Preparer's signature Firm's EIN Check if: 3rd Party Designee Self employed Use Only Fim's name For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions Phone no. Firm's address Cat No. 113200 Form 1040 (2018) m 1040 (2018) Page 2 1 2a Wages, salaries, tips, etc. Attach Forms) W-2 Tax-exempt interest 2a b Taxable interest 2b 3b 4b ach Forms) 2. Nso atach 3a Qualified dividends b Ordinary dividends b Taxable amount b Taxable amount 4a RAs. pensions, and anutien Sa RAs, 0 R f tx was thhold Social security benelits 6 Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 7 Adjustod gross income. If you have no adjustments to incone, enter the amount from line 6: otherwise, tandardsubtract Schedule 1, line 36, from line 6 Standard dedusction or itenized deductions trom Schecdldo AV Qualifid business incorme deduction (see instructions) Singlo or married ing sparatoly. 9 $12,000 10 Taxablo nome. Subtract lines 8 rd 9 from Ine 7lfzero or less, enter-O- 10 Married Ting $24,000 $18,000 any box under iniy a Tx (ooe int) . b Add any armount from Schedule 2 and check here 12 aChild tax credii/crodit f for other dependents - Head c b Add wny amount from Schedudle 3 and check here12 13 3 Subtract line 12 from line 11. If zero or less, onter -o "you chockad 114 Other taxes. Attach Schedulo 4 . Standard 15 Total tax. Add ines 13 and 14 15 16 o nainucitions. 16 Fedoral income tax witheld from Forms W-2 and 1099.. from Schedude sSch.8812 eFom 8863 Add any amount from Schedule 5 17 18 19 18 Add lines 10 and 17. Thene are your total payments Refund 19 Iine 18 is more than line 15, subtract line 15 from Iine 18. This is the amount you overpaid 20a Amount of line 19 you want refunded to you. If Form 8888 in attached, cheok hore Droct deposit? See instnuctions b Routing number Account number e Type: Checking)Sevings d 21 Amount of line 19 you want applied to your 2010 estimated tax P2 Amount You Owe 22 Amount you owe. Subtract line 18 from ine 15. For details on how to pay, see instructions 122 Go to www.irs gowlForm1040 for instructions and the lateat information Form 1040C01 SCHEDULE 1 Form 1040) OMB No. 1545-0074 Additional Income and Adjustments to Income 2018 Department of the Treasury ternal Reveue Service Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Attachment Sequence No. 01 Namels) shown on Form 1040 Your social security number Additional 1-9b Reserved Income 10 Taxable refunds, credits, or offsets of state and local income taxes 10 1-9b 11 Alimony received 12 Business income or (loss). Attach Schedule C or C-EZ . 13 Capital gain or (oss). Attach Schedule D if required. If not required, check here13 14 Other gains or (osses). Attach Form 4797.- 15a Reserved 16a Reserved 12 14 15b 16b 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17 18 Farm income or (loss). Attach Schedule F 19 Unemployment compensation 20a Reserved 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to 18 . 19 20b income, enter here and include on Form 1040, line 6. Otherwise,go to line 23 Adjustments 23 Educator expenses to Income 24 Cortain business expenses of reservists, performing artists, and fee-basis govenment officials. Altach Form 2106 25 Health savings account deduction. Attach Form 8889- 25 26 Moving expenses for mermbers of the Armed Forces. Attach Form 3903 27 Deductible part of self employment tax. Attach Schedulo SE 27 28 Self-employed SEP, SIMPLE, and qualified plans28 20 Self-employed health insurance deduction 30 Penalty on early withdrawal of savings 31a Alimony paid b Recipient's SSN 32 IRA deduction 33 Student loan interest deduction 34 Reserved.. 35 Reserved 36 Add lines 23 through 35 31a 36 For Paperwork Reduotion Aet Notioe, see your tax returm instructions. at. No. 714 Schelde (Form 1040) 2018 To my friendly student tax preparer Hello, my name is Cardy, B. I understand you are going to help me figure out my gross income for the year. whatever that means. It's been a busy year, so let me give you the lowdown on my life and you can do your thin I was unemployed at the beginning of the year and got $4,000 in unemployment compensation But then my manager was able to get some Royalties paid in advance for me, I received $5,000 in advanced royalties for a local concert I will perform at I later got a job as a manager for Roca Cola. I eamed $55,000 in base salary this year. My boss gave me a $5,000 Christmas bonus check on December 22. I decided to hold on to that check and not cash it until next year, so I won't have to pay taxes on it this year. Pretty smart, huh? My job's pretty cool. I get a lot of fringe benefits like a membership to the gym that costs $400 a year and all the Roca Cola I can drink, although I can't really drink a whole lotI figure $40 worth this year As part of my manager duties, I get to decide on certain things like contracts for the company. My good buddy, Eddie, runs a bottling company. I made sure that he won the bottling contract for Roca Cola for this year (even though his contract wasn't quite the best). Eddie bought me a Corvette this year for being such a good friend. The Corvette cost $50,000 and I'm sure he bought it for me out of the goodness of his heart What a great guy Here's a bit of good luck for the year. Upon leaving my office one day, I found $8,000 lying in the streeti Well one person's bad luck is my good luck, right? I like to gamble a lot. I won a $32,000 poker tournament in Las Vegas this year. Can you believe that I didn't lose anything this year? Speaking of the guys, one of them hit me with his car as we were leaving the game one night. He must have been pretty ticked that he lostl I broke my right leg and my left arm. I sued the guy and got $11,000 for my medical expenses, $3,000 to pay my psychotherapist for the emotional problems I had relating to the injuries (I got really depressed), and I won $12,000 in punitive damages. That'll teach him that he's not so tough without his car Another bit of bad luck. My uncle Monty died this year I really liked the guy, but the $200,000 inheritance I received from him made me feel a little better about the loss. I did the smart thing with the money and invested it in stocks and bonds and socked a little into my savings account. As a result, I received $600 in dividends from the stock, $200 in interest from the municipal bonds, and $300 in interest from my savings account My ex-husband, Ace, is still paying me alimony He's a lawyer who divorced me in 2015 because I was "unethical" or omething like that. Since he was making so much money and I was unemployed at the time, the judge ruled that he had to pay ME alimony. Isn't that something? He sent me $3,000 in alimony payments this year. He still kind of likes me, though. He sent me a check for $500 as a Christmas gift this year. I didn't get him anything, though. Oops I almost forgot, I also receive a dividend check from stock i bought way back. The dividend was $160. Since I had forgotten about the stock and I decided to check on the price. The stock price when I bought it was $8 a share now it was up to 540 a share, so I sold my 10 shares for $60 each. I just keep thinking of more stuff, sorry. I also run a small singing camp for kids in the summer. I collected $35,000 in revenues. In addition I had a few parents who couldn't pay me till they did the taxes this year so at the end of the year they owed me $3,000. I had some expenses in order to offer the camp including rental of building space $15,000 $500 for miscellaneous expenses $1,500 for advertising, and $5,500 for instrumentalist contract labor. One parent was so nice they gave me a cruise trip worth $2,500 in exchange for their child to come to my camp. I account for these activities using the cash method of accounting So there you go. That's this year in a nutshell Can you figure out my gross income and complete page 1 of Form 1040 for me and Schedule 1 ifi need it? And since you're a student, this is free, right? Thanks, I owe you one! Let me know if I can get you a si-pack of Roca Cola or something I I To my friendly student tax preparer It's me again, atB You asked that l provide you some additional information. I would love to write off all of the following! To be a manager at Roca Cola I had to buy some fualy steel toe boots for $150, I definitely want to write those off. Roca Cola did not reimburse me either. I have heard you can "write off unreimbursed employee expenses. Is that correct? I also had some health issues this year and paid $12,680 for medical expenses for care related to a broken ankle while I was unemployed and without insurance. My boyfriend, Blake, drove me (in my car) a total of 315 miles to get the best doctor After I saw those bills I realized I needed health insurance, so I paid a total of $3,400 in health insurance premiums before I got my with Roca Cola Besides the health insurance premiums and the medical expenses for my broken ankle, I also had a little tummy tuck last year and she paid $3,000 for the surgery. I received no insurance reimbursement. It adds up, I also incurred $450 of other medical expenses for the year Roca Cola withheld $2,800 of state income tax, $5,495 of Social Security tax, and $11,200 of federal income tax from my paychecks throughout the year In 2018, I was due a refund of $250 for overpaying her 2017 state taxes. However, on my 2017 state tax return that I filed April 2018, I just had them apply the overpayment toward my 2018 state tax liability I paid $5,200 of property taxes on her personal residence. I also paid $500 to the developer of my subdivision, because he had to replace the sidewalk in certain areas of the subdivision. He should have paid that, but hopefully I can write it off I have a home mortgage loan in the amount of $220,000 that she secured when I purchased my home. The home is worth about $400,000. I paid interest of $12,300 on the loan this year made several charitable contributions throughout the year. I contributed stock in ZYX Corp. to the Red Cross. On the date of the contribution, the fair market value of the donated shares was $1,000 and my basis in the shares was $400. I originally bought the ZYX Corp. stock in 2008. I also contributed $300 cash to State University and religious artifacts I have held for several years to my church. The artifacts were valued at $500 and my basis in the items was $300. I had every reason to believe the church would keep them on display indefinitely I also drove 200 miles doing church-related errands for the minister. Finaly, I contributed $1,200 of services to her church last year Shauna paid $250 in investment advisory fees and another $150 to have my tax return prepared (hat is, paid $150 in 2018 to have her 2017 tax return prepared). This you are doing it for free, right In our last conversation, I mentioned I didn't loose any from gambling, but I found a couple of old Keenland ticket and realized I did lonse $2,500 did make a contribution to my traditional IRA account this year. Can I deduct the $2,500 I contributed to that? You probably don't know this about me, but I went to college for a while and I still trying to pay that student loan back I had $3,500 in student loan interest that paid this year. Maybe this will get me out of some taxes because it sure didn'1 get me a career in Accounting since I didn't finish. I could have had your job helping people with their taxes and making good money if I had finished So there you go. I really believe this is it now. Can you figure out all my deductions and complete the return with what I gave you in our first conversation. Complete Form 1040 for me and Schedule 1 and A if I need it? Thanks, I owe you one! Let me know if I can get you a six-pack of Roca Cola or something Dopartment of the Troasury-Intornal Rlovonue Sorvice (99) OMB No. 1545-0074 Head of household Qualitying widowler) IRS Use Only-Do not write or staplo in this space Filing status: Single Your first name and initial Married filing jointly Married Sling separately Last name Your social security number Your standard deduction: Someone can clairm you as a dependent You were bom before If joint returm, spouse's first name and initial Spouse standard deduction: Someone can claim a dependent Home address (number and street). If you have a P.O. box, see instructions. City, town or post office, state, and ZIP code. lf you have a foreign address, attach Schedule 6. Dependents (see instructions) Last name Spouse's social security number your spouse as a dependent Spouse was bom before January 2, 1954 Full-year health care coverage Spouse itemizes on a separate return or you were dual-status alien or exempt (see inst.) Apt. no. Presidential Election Campaign If more than four dependents, see inst. and/here 2) Social security number 3) Relationship to you 4) Child tax credt (1) First name qualiies for (see inst.): Last name Credit for other dependents and statomonts, and to tho bost of my knowlodge and boliot, thay ane true Here cormact, and comploto. Daclaration of proparor jothor than taxpayor ts based on all information of which Your signature Spouse's signature. If a joint return, both must sign. Date Preparer's name Date Your occupation If the IRS sent you an ldentity Protection PIN, enter iH Joint return? See instructions Keep a copy for your records If the IRS sent you an ldentity Protection PIN, enter it Paid Preparer Preparer's signature Firm's EIN Check if: 3rd Party Designee Self employed Use Only Fim's name For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions Phone no. Firm's address Cat No. 113200 Form 1040 (2018) m 1040 (2018) Page 2 1 2a Wages, salaries, tips, etc. Attach Forms) W-2 Tax-exempt interest 2a b Taxable interest 2b 3b 4b ach Forms) 2. Nso atach 3a Qualified dividends b Ordinary dividends b Taxable amount b Taxable amount 4a RAs. pensions, and anutien Sa RAs, 0 R f tx was thhold Social security benelits 6 Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 7 Adjustod gross income. If you have no adjustments to incone, enter the amount from line 6: otherwise, tandardsubtract Schedule 1, line 36, from line 6 Standard dedusction or itenized deductions trom Schecdldo AV Qualifid business incorme deduction (see instructions) Singlo or married ing sparatoly. 9 $12,000 10 Taxablo nome. Subtract lines 8 rd 9 from Ine 7lfzero or less, enter-O- 10 Married Ting $24,000 $18,000 any box under iniy a Tx (ooe int) . b Add any armount from Schedule 2 and check here 12 aChild tax credii/crodit f for other dependents - Head c b Add wny amount from Schedudle 3 and check here12 13 3 Subtract line 12 from line 11. If zero or less, onter -o "you chockad 114 Other taxes. Attach Schedulo 4 . Standard 15 Total tax. Add ines 13 and 14 15 16 o nainucitions. 16 Fedoral income tax witheld from Forms W-2 and 1099.. from Schedude sSch.8812 eFom 8863 Add any amount from Schedule 5 17 18 19 18 Add lines 10 and 17. Thene are your total payments Refund 19 Iine 18 is more than line 15, subtract line 15 from Iine 18. This is the amount you overpaid 20a Amount of line 19 you want refunded to you. If Form 8888 in attached, cheok hore Droct deposit? See instnuctions b Routing number Account number e Type: Checking)Sevings d 21 Amount of line 19 you want applied to your 2010 estimated tax P2 Amount You Owe 22 Amount you owe. Subtract line 18 from ine 15. For details on how to pay, see instructions 122 Go to www.irs gowlForm1040 for instructions and the lateat information Form 1040C01 SCHEDULE 1 Form 1040) OMB No. 1545-0074 Additional Income and Adjustments to Income 2018 Department of the Treasury ternal Reveue Service Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Attachment Sequence No. 01 Namels) shown on Form 1040 Your social security number Additional 1-9b Reserved Income 10 Taxable refunds, credits, or offsets of state and local income taxes 10 1-9b 11 Alimony received 12 Business income or (loss). Attach Schedule C or C-EZ . 13 Capital gain or (oss). Attach Schedule D if required. If not required, check here13 14 Other gains or (osses). Attach Form 4797.- 15a Reserved 16a Reserved 12 14 15b 16b 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 17 18 Farm income or (loss). Attach Schedule F 19 Unemployment compensation 20a Reserved 21 Other income. List type and amount 22 Combine the amounts in the far right column. If you don't have any adjustments to 18 . 19 20b income, enter here and include on Form 1040, line 6. Otherwise,go to line 23 Adjustments 23 Educator expenses to Income 24 Cortain business expenses of reservists, performing artists, and fee-basis govenment officials. Altach Form 2106 25 Health savings account deduction. Attach Form 8889- 25 26 Moving expenses for mermbers of the Armed Forces. Attach Form 3903 27 Deductible part of self employment tax. Attach Schedulo SE 27 28 Self-employed SEP, SIMPLE, and qualified plans28 20 Self-employed health insurance deduction 30 Penalty on early withdrawal of savings 31a Alimony paid b Recipient's SSN 32 IRA deduction 33 Student loan interest deduction 34 Reserved.. 35 Reserved 36 Add lines 23 through 35 31a 36 For Paperwork Reduotion Aet Notioe, see your tax returm instructions. at. No. 714 Schelde (Form 1040) 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts