Question: Complete the three questions below. All work must be included and presented in a manner that is easy to follow to be able to receive

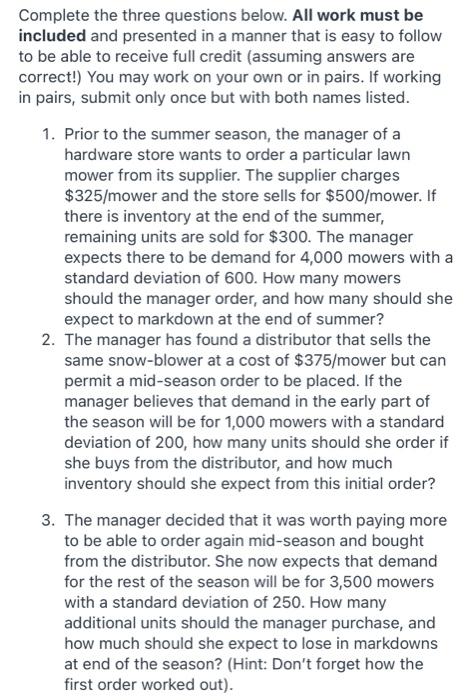

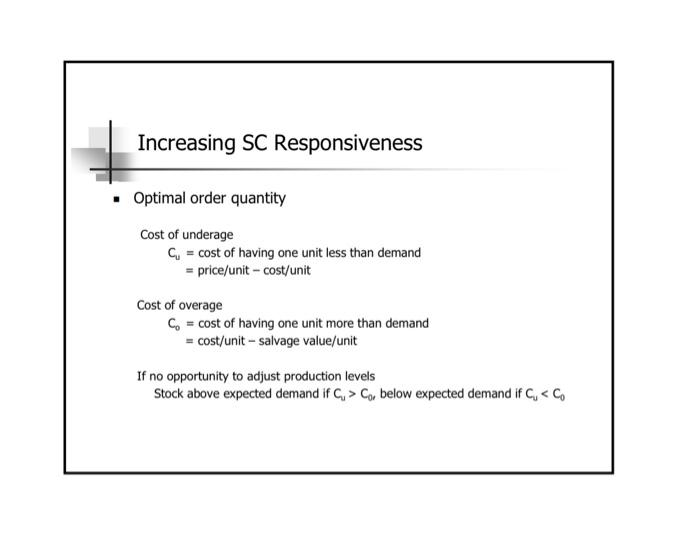

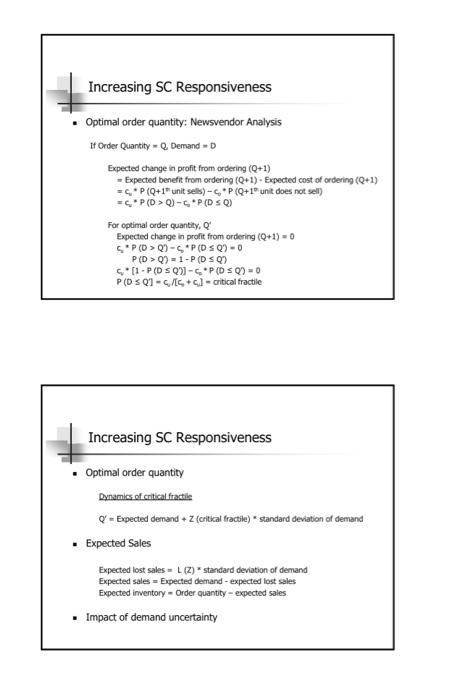

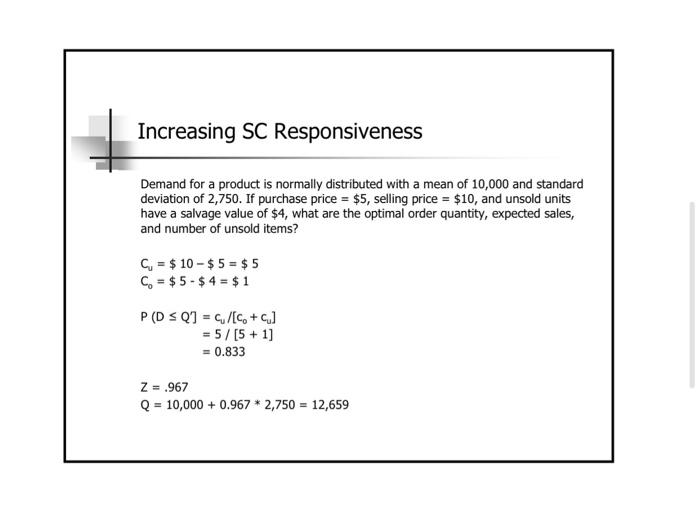

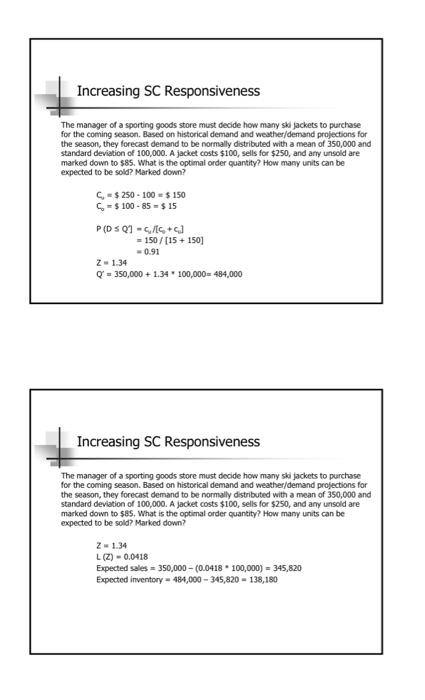

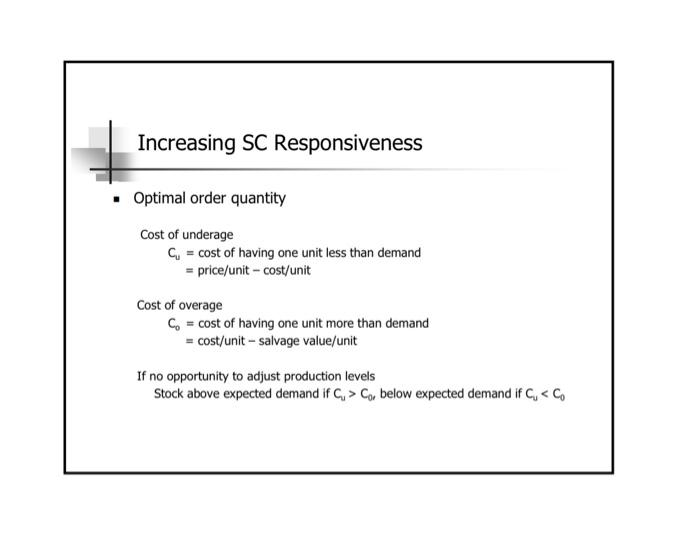

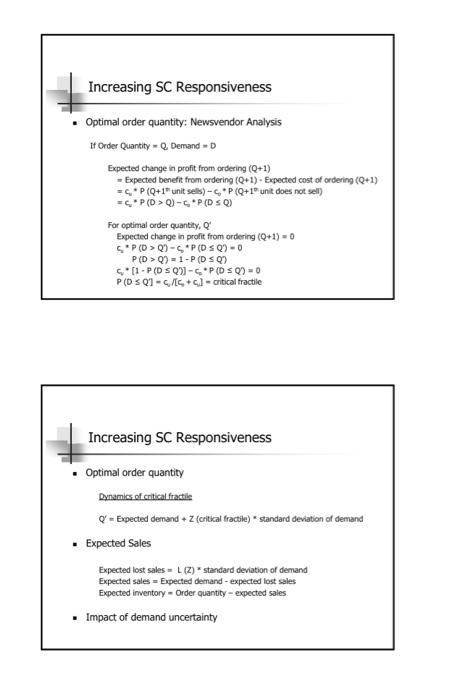

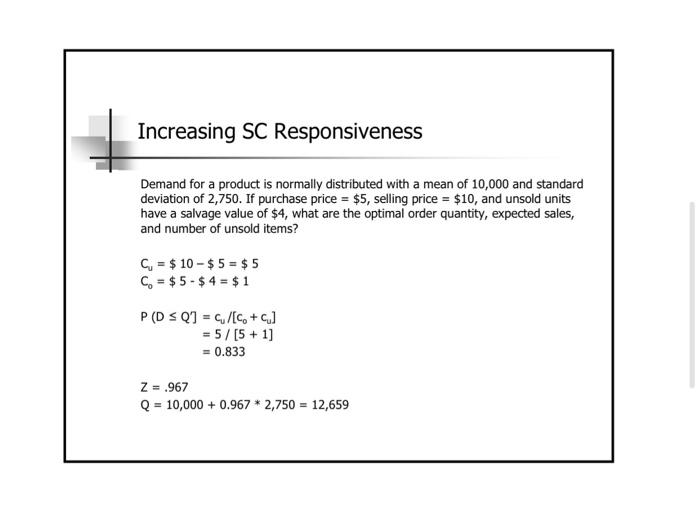

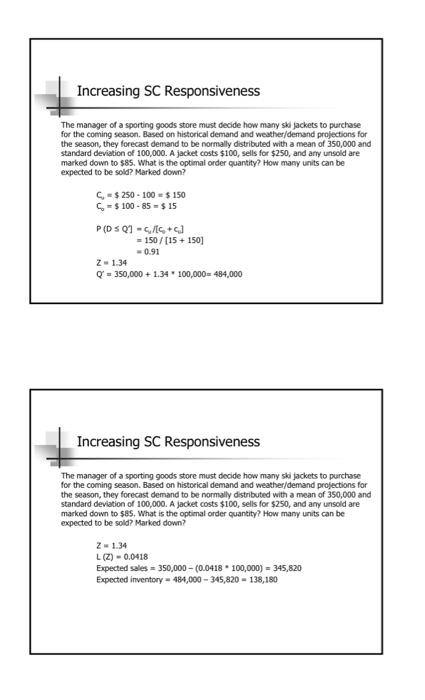

Complete the three questions below. All work must be included and presented in a manner that is easy to follow to be able to receive full credit (assuming answers are correct! You may work on your own or in pairs. If working in pairs, submit only once but with both names listed. 1. Prior to the summer season, the manager of a hardware store wants to order a particular lawn mower from its supplier. The supplier charges $325/mower and the store sells for $500/mower. If there is inventory at the end of the summer, remaining units are sold for $300. The manager expects there to be demand for 4,000 mowers with a standard deviation of 600. How many mowers should the manager order, and how many should she expect to markdown at the end of summer? 2. The manager has found a distributor that sells the same snow-blower at a cost of $375/mower but can permit a mid-season order to be placed. If the manager believes that demand in the early part of the season will be for 1,000 mowers with a standard deviation of 200, how many units should she order if she buys from the distributor, and how much inventory should she expect from this initial order? 3. The manager decided that it was worth paying more to be able to order again mid-season and bought from the distributor. She now expects that demand for the rest of the season will be for 3,500 mowers with a standard deviation of 250. How many additional units should the manager purchase, and how much should she expect to lose in markdowns at end of the season? (Hint: Don't forget how the first order worked out). Increasing SC Responsiveness . Optimal order quantity Cost of underage C = cost of having one unit less than demand = price/unit - cost/unit Cost of overage C = cost of having one unit more than demand = cost/unit - salvage value/unit If no opportunity to adjust production levels Stock above expected demand if C, > Co, below expected demand if C, Q-CP (DSO) For optimal order quantity, Q Expected change in profit from ordering (Q+1) = 0 SPD > Q2-CPD SQ) - 0 P(D > 0) = 1-PD SQ7 (1-PDS Q-CP (DS) = 0 PDSQ-5/+] - critical fractile Increasing SC Responsiveness Optimal order quantity Dynanks of critical fractie QExpected demand + Z (critical fractile) - standard deviation of demand . Expected Sales Expected lost sales - L(Z) standard deviation of demand Expected sales Expected demand - expected lost sales Expected inventory - Order quantity expected sales Impact of demand uncertainty Increasing SC Responsiveness Demand for a product is normally distributed with a mean of 10,000 and standard deviation of 2,750. If purchase price = $5, selling price = $10, and unsold units have a salvage value of $4, what are the optimal order quantity, expected sales, and number of unsold items? C = $ 10 - $ 5 = $5 C = $5 - $ 4 = $1 PD SQ] = C/EC, + cu] =5/[5 + 1] = 0.833 Z = .967 Q = 10,000+ 0.967 * 2,750 = 12,659 Increasing SC Responsiveness The manager of a sporting goods store must decide how many ski jackets to purchase for the coming season. Based on historical demand and weather/demand projections for the season, they forecast demand to be normally distributed with a mean of 350,000 and standard deviation of 100,000. A jacket costs $100, sells for $250, and any unsold are marked down to $85. What is the optimal order quantity? How many units can be expected to be sold? Marked down? C. $ 250 - 100 $ 150 - $100 - 85 - $ 15 PD S01 -/] = 150 / (15 + 150] 0.91 2- 1.34 Q = 350,000+ 1.34 100,000 484,000 Increasing SC Responsiveness The manager of a sporting goods store must decide how many skijackets to purchase for the coming season. Based on historical demand and weather/demand projections for the season, they forecast demand to be normally distributed with a mean of 350,000 and standard deviation of 100,000. A jacket costs $100, sells for $250, and any unsold are marked down to $85. What is the optimal order quantity? How many units can be expected to be sold? Marked down? 21.34 L(Z) - 0.0418 Expected sales = 350,000 - (0.0418 - 100,000) = 345,820 Expected inventory - 484,000 - 345,820 - 138,180