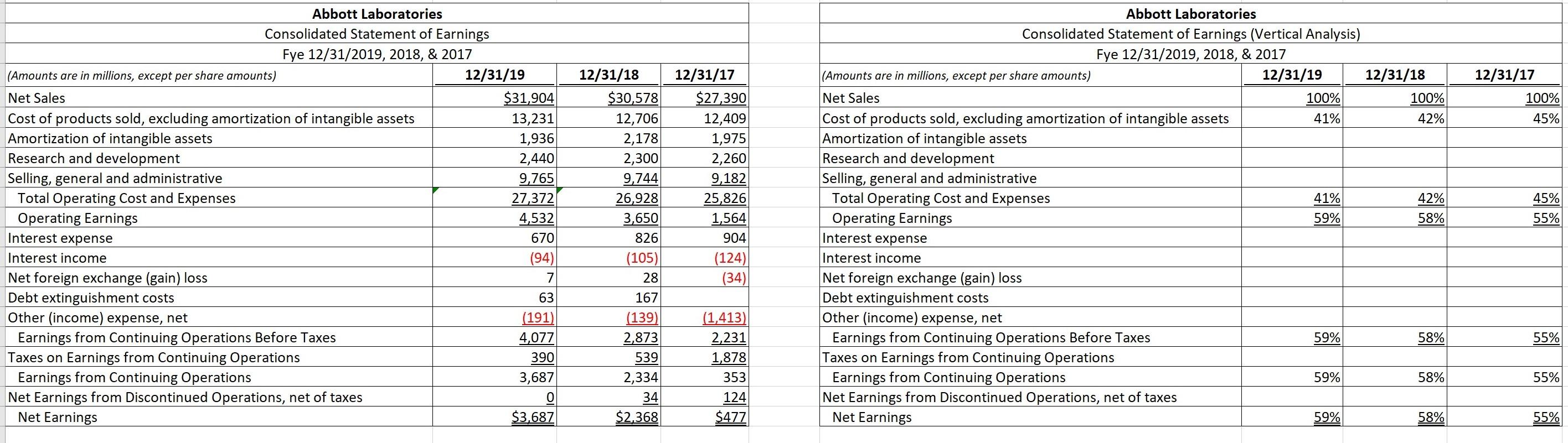

Question: Complete the vertical analysis table 12/31/17 100% 45% Abbott Laboratories Consolidated Statement of Earnings Fye 12/31/2019, 2018, & 2017 (Amounts are in millions, except per

Complete the vertical analysis table

12/31/17 100% 45% Abbott Laboratories Consolidated Statement of Earnings Fye 12/31/2019, 2018, & 2017 (Amounts are in millions, except per share amounts) 12/31/19 Net Sales $31,904 Cost of products sold, excluding amortization of intangible assets 13,231 Amortization of intangible assets 1,936 Research and development 2,440 Selling, general and administrative 9,765 Total Operating cost and Expenses 27,372 Operating Earnings 4,532 Interest expense 670 Interest income (94) Net foreign exchange (gain) loss 7 Debt extinguishment costs 63 Other (income) expense, net (191) Earnings from Continuing Operations Before Taxes 4,077 Taxes on Earnings from Continuing Operations 390 Earnings from Continuing Operations 3,687 Net Earnings from Discontinued Operations, net of taxes 0 Net Earnings $3,687 12/31/18 $30,578 12,706 2,178 2,300 9,744 26,928 3,650 826 (105) 28 167 (139) 2,873 539 2,334 34 $2,368 12/31/17 $27,390 12,409 1,975 2,260 9,182 25,826 1,564 904 (124) (34) Abbott Laboratories Consolidated Statement of Earnings (Vertical Analysis) Fye 12/31/2019, 2018, & 2017 (Amounts are in millions, except per share amounts) 12/31/19 12/31/18 Net Sales 100% 100% Cost of products sold, excluding amortization of intangible assets 41% 42% Amortization of intangible assets Research and development Selling, general and administrative Total Operating cost and Expenses 41% 42% Operating Earnings 59% 58% Interest expense Interest income Net foreign exchange (gain) loss Debt extinguishment costs Other (income) expense, net Earnings from Continuing Operations Before Taxes 59% 58% Taxes on Earnings from Continuing Operations Earnings from Continuing Operations 59% 58% Net Earnings from Discontinued Operations, net of taxes Net Earnings 59% 58% 45% 55% 55% (1,413) 2,231 1,878 353 124 55% $477 55%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts