Question: Complete the Year 2 income statement data for Cold Goose, then answer the questions that follow. Be sure to round each dollar value to the

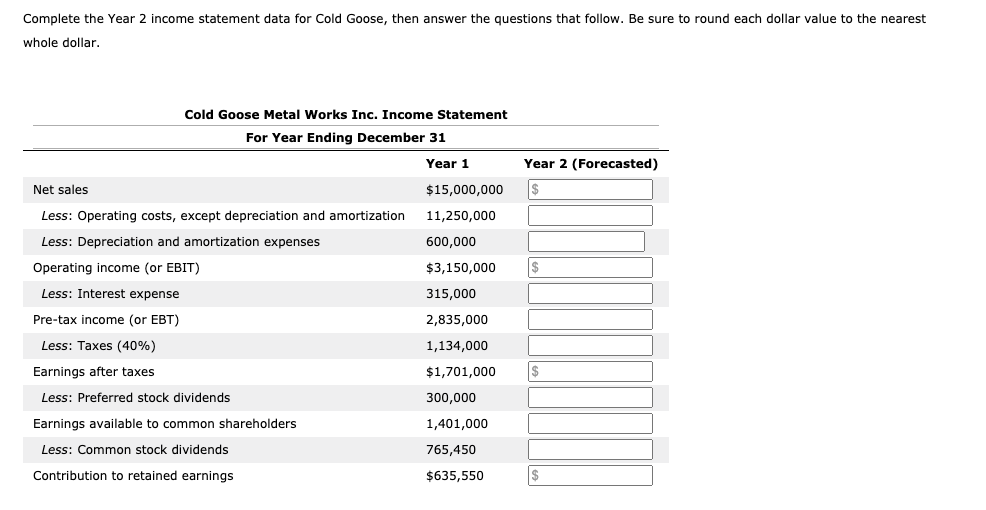

Complete the Year 2 income statement data for Cold Goose, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Cold Goose Metal Works Inc. Income Statement For Year Ending December 31 Year 1 Year 2 (Forecasted) Net sales $15,000,000 $ Less: Operating costs, except depreciation and amortization Less: Depreciation and amortization expenses Operating income (or EBIT) 11,250,000 600,000 $3,150,000 $ Less: Interest expense Pre-tax income (or EBT) Less: Taxes (40%) 315,000 2,835,000 1,134,000 Earnings after taxes $1,701,000 $ 300,000 Less: Preferred stock dividends Earnings available to common shareholders Less: Common stock dividends 1,401,000 765,450 Contribution to retained earnings $635,550 $ Complete the Year 2 income statement data for Cold Goose, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Cold Goose Metal Works Inc. Income Statement For Year Ending December 31 Year 1 Year 2 (Forecasted) Net sales $15,000,000 $ Less: Operating costs, except depreciation and amortization Less: Depreciation and amortization expenses Operating income (or EBIT) 11,250,000 600,000 $3,150,000 $ Less: Interest expense Pre-tax income (or EBT) Less: Taxes (40%) 315,000 2,835,000 1,134,000 Earnings after taxes $1,701,000 $ 300,000 Less: Preferred stock dividends Earnings available to common shareholders Less: Common stock dividends 1,401,000 765,450 Contribution to retained earnings $635,550 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts