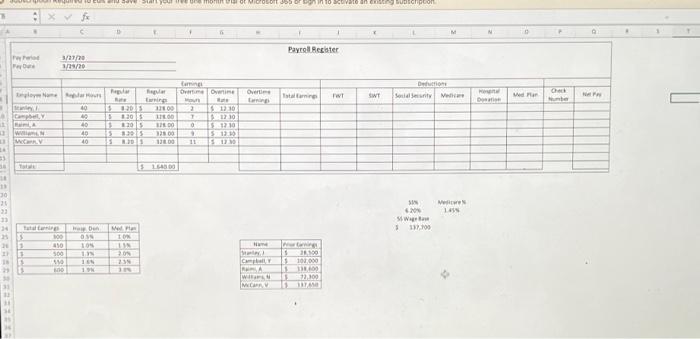

Question: complete through excel or google sheets L A 13 24 33 14 18 13 30 21 23 25 24 aw podrane W 21 w Fey

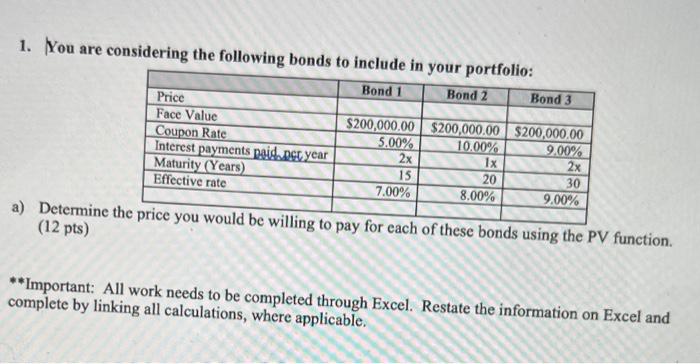

L A 13 24 33 14 18 13 30 21 23 25 24 aw podrane W 21 w Fey Dare gloy Name Stanley Campbel, Y RAMIL Williams N McCann V Totale Tatal Canings 1 x fx C 3/27/20 3/19/20 40 40 40 40 40 3 100 410 500 OW TO 10 EYR Elly save stan your tree de month trist D Coming Regular Bate Overtime Overtime woun Rate 2 $ 820 5 324.00 $ 12.30 5 8.30 $ 118.00 7 12.30 8:20 S 0 15 12 30 328.00 328.00 15 8.30 5 $ 12.30 EX 138.00 11 13 8.30 S 6:00 Den 0.3% 10% 1.38 NOT 198 $1 Med Plan 10% 138 2.0% 2.38 Regular $1640 00 6 Overtime Name Stanley) Campbell Y LA Wil McCa sign in to activate an existing subscription f L Payroll Register Tatal Earnings FWT Maramings $1 $1 $3 1 28,500 100,000 334,600 12,300 137AM SWT M Defton Medic Me 4.20% Las W 137,700 Social Security $ NIS N 0 Med Plan Donation Au Check Number NE P 1. You are considering the following bonds to include in your portfolio: Bond 1 Bond 2 Bond 3 Price $200,000.00 Face Value Coupon Rate $200,000.00 5.00% $200,000.00 10.00% 9.00% Interest payments paid, per year 2x 1x 2x Maturity (Years) 15 20 30 Effective rate 7.00% 8.00% 9.00% a) Determine the price you would be willing to pay for each of these bonds using the PV function. (12 pts) **Important: All work needs to be completed through Excel. Restate the information on Excel and complete by linking all calculations, where applicable. L A 13 24 33 14 18 13 30 21 23 25 24 aw podrane W 21 w Fey Dare gloy Name Stanley Campbel, Y RAMIL Williams N McCann V Totale Tatal Canings 1 x fx C 3/27/20 3/19/20 40 40 40 40 40 3 100 410 500 OW TO 10 EYR Elly save stan your tree de month trist D Coming Regular Bate Overtime Overtime woun Rate 2 $ 820 5 324.00 $ 12.30 5 8.30 $ 118.00 7 12.30 8:20 S 0 15 12 30 328.00 328.00 15 8.30 5 $ 12.30 EX 138.00 11 13 8.30 S 6:00 Den 0.3% 10% 1.38 NOT 198 $1 Med Plan 10% 138 2.0% 2.38 Regular $1640 00 6 Overtime Name Stanley) Campbell Y LA Wil McCa sign in to activate an existing subscription f L Payroll Register Tatal Earnings FWT Maramings $1 $1 $3 1 28,500 100,000 334,600 12,300 137AM SWT M Defton Medic Me 4.20% Las W 137,700 Social Security $ NIS N 0 Med Plan Donation Au Check Number NE P 1. You are considering the following bonds to include in your portfolio: Bond 1 Bond 2 Bond 3 Price $200,000.00 Face Value Coupon Rate $200,000.00 5.00% $200,000.00 10.00% 9.00% Interest payments paid, per year 2x 1x 2x Maturity (Years) 15 20 30 Effective rate 7.00% 8.00% 9.00% a) Determine the price you would be willing to pay for each of these bonds using the PV function. (12 pts) **Important: All work needs to be completed through Excel. Restate the information on Excel and complete by linking all calculations, where applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts