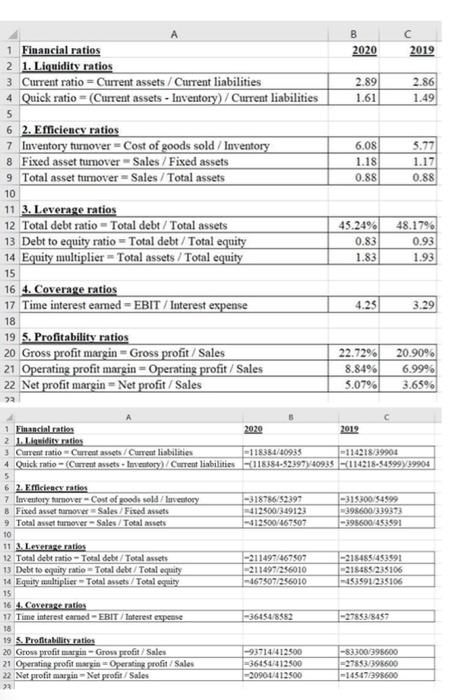

Question: complete two formulas data provided above B 2020 2019 1 Financial ratios 2 1. Liquidity ratios 3. Current ratio = Current assets/Current liabilities 4 Quick

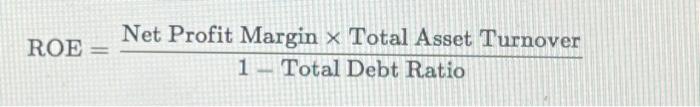

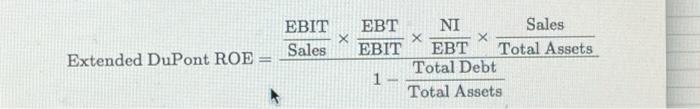

B 2020 2019 1 Financial ratios 2 1. Liquidity ratios 3. Current ratio = Current assets/Current liabilities 4 Quick ratio = (Current assets - Inventory)/Current liabilities 2.89 1.61 2.86 1.49 5 6.08 1.18 0.88 5.77 1.17 0.88 45.24% 0.83 1.83 48.1796 0.93 1.93 6 2. Efficiency ratios 7 Inventory turnover - Cost of goods sold / Inventory 8 Fixed asset tumover - Sales / Fixed assets 9 Total asset tumover = Sales / Total assets 10 11 3. Leverage ratios 12 Total debt ratio - Total debt / Total assets 13 Debt to equity ratio = Total debt / Total equity 14 Equity multiplier - Total assets / Total equity 15 16 4. Coverage ratios 17 Time interest eamed - EBIT / Interest expense 18 19 5. Profitability ratios 20 Gross profit margin = Gross profit / Sales 21 Operating profit margin - Operating profit / Sales 22 Net profit margin = Net profit /Sales 2 4.25 3.29 22.7296 8.8496 5.07% 20.90% 6.999 3.65% C 1. Einancial ratios 2020 2019 2 Liguidity ratios 3 Current ratio - Curreat assets Current liabilities -118354/40935 114218.39904 4 Quick ratio (Current assets - Inventory Current libilities (118384-5239740935 - 114218-34599X39908 -318786/52397 12.500/349123 12500/467507 -315300/54999 398600/339373 -395600/453991 6.2. Efficacy ratios 7 Inventory furnover Cost of goods sold / lavestory B Fixed asset hamower Sales / Fixed assets 9 Total asset tummover -Sales/ Total assets 10 11 Leverage raties 12 Total debt ratio - Total debt/Total assets 13 Debt to equity ratio Total debt/Total equity 14 Equity multiplier - Total assets/Total equity 15 16 4. Coverage rates 17 Time interest earned FBIT/terest expense 18 19 5. Profitability ratios 20 Grows profit margin- Grow profit/ Sales 21 Operating profit marin Operating profit/Sales 22 Net profit maguin-Net profit/Sales -211497/467507 -211497/256010 467507/256010 -218485/453991 -218485/235106 53991235106 -364548552 27853/8457 -93714/412500 -36154/412500 -20904/413500 -83300/398600 -27553/398600 -14567/398600 ROE Net Profit Margin x Total Asset Turnover 1 Total Debt Ratio Extended DuPont ROE = EBIT EBT NI Sales X X Sales EBIT EBT Total Assets Total Debt 1 - Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts