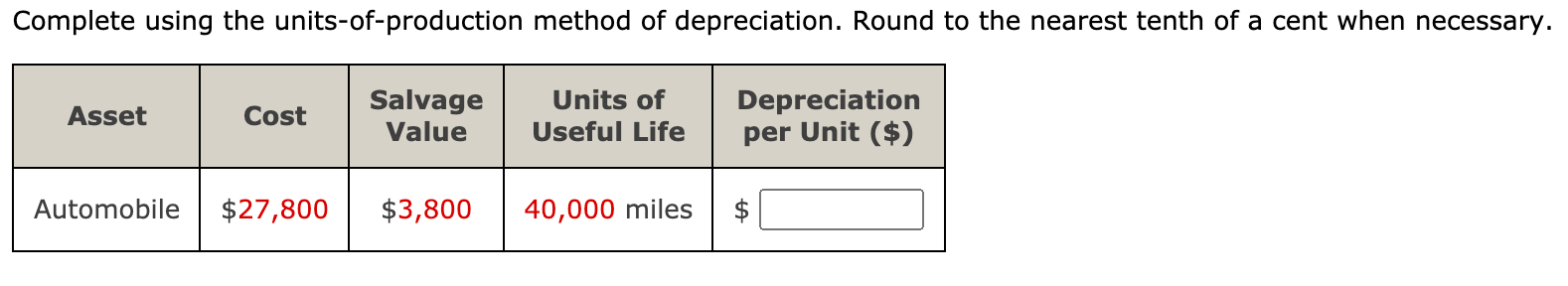

Question: Complete using the units-of-production method of depreciation. Round to the nearest tenth of a cent when necessary. Asset Cost Salvage Value Units of Useful Life

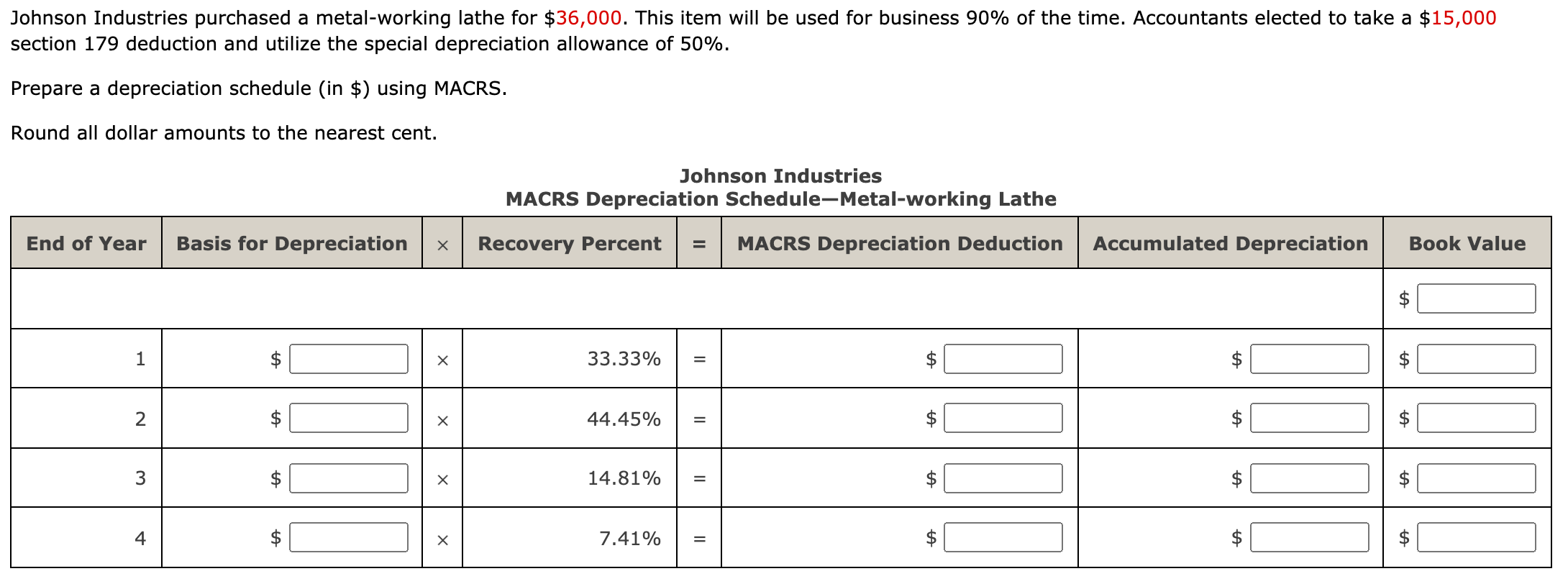

Complete using the units-of-production method of depreciation. Round to the nearest tenth of a cent when necessary. Asset Cost Salvage Value Units of Useful Life Depreciation per Unit ($) Automobile $27,800 $3,800 40,000 miles $ Johnson Industries purchased a metal-working lathe for $36,000. This item will be used for business 90% of the time. Accountants elected to take a $15,000 section 179 deduction and utilize the special depreciation allowance of 50%. Prepare a depreciation schedule (in $) using MACRS. Round all dollar amounts to the nearest cent. Johnson Industries MACRS Depreciation Schedule-Metal-working Lathe End of Year Basis for Depreciation Recovery Percent MACRS Depreciation Deduction Accumulated Depreciation Book Value $ A A 1 33.33% X A = $ $ A 2 44.45% = $ $ 3 $ x 14.81% $ II $ $ $ $ 4 $ 7.41% $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts