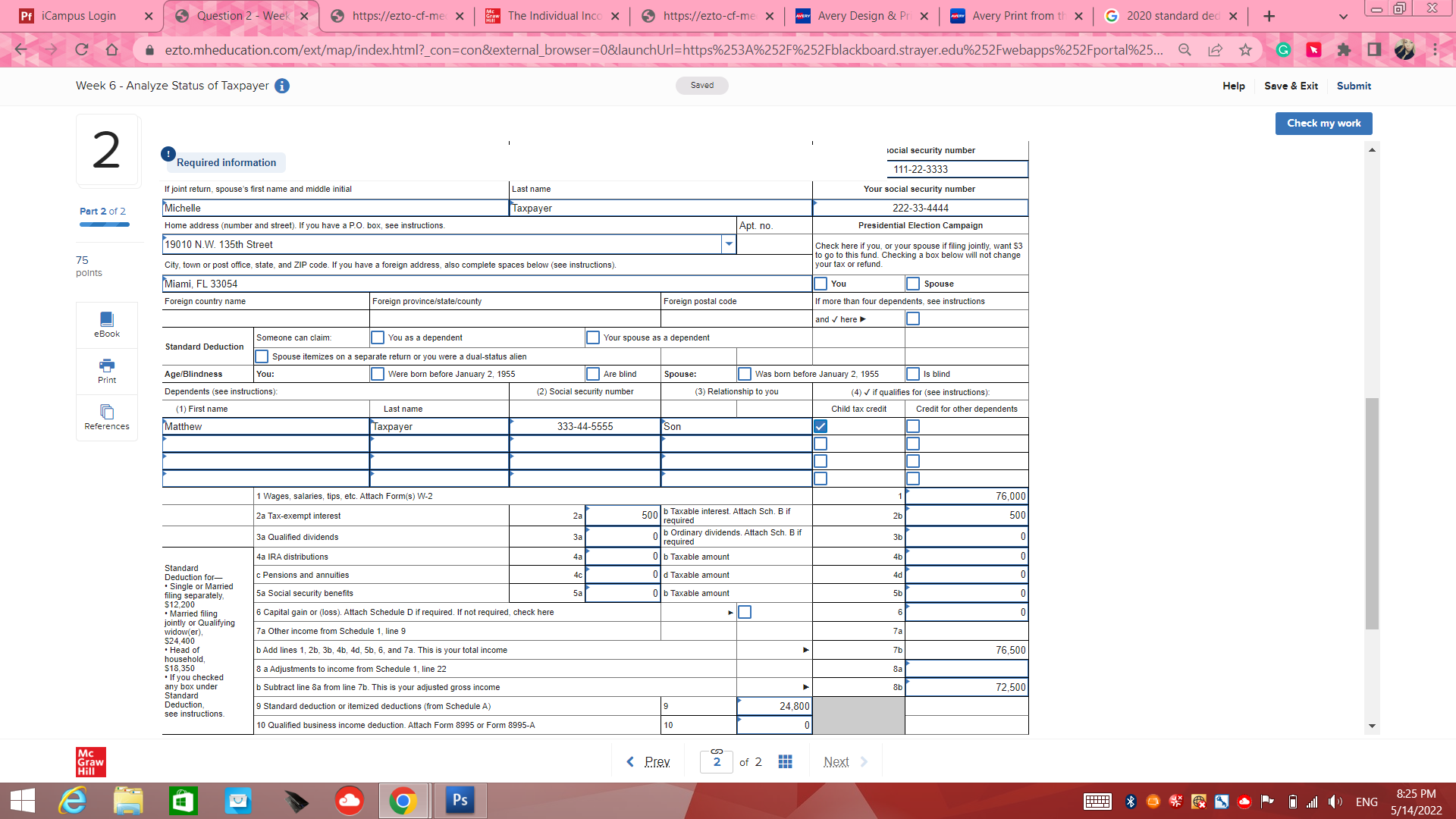

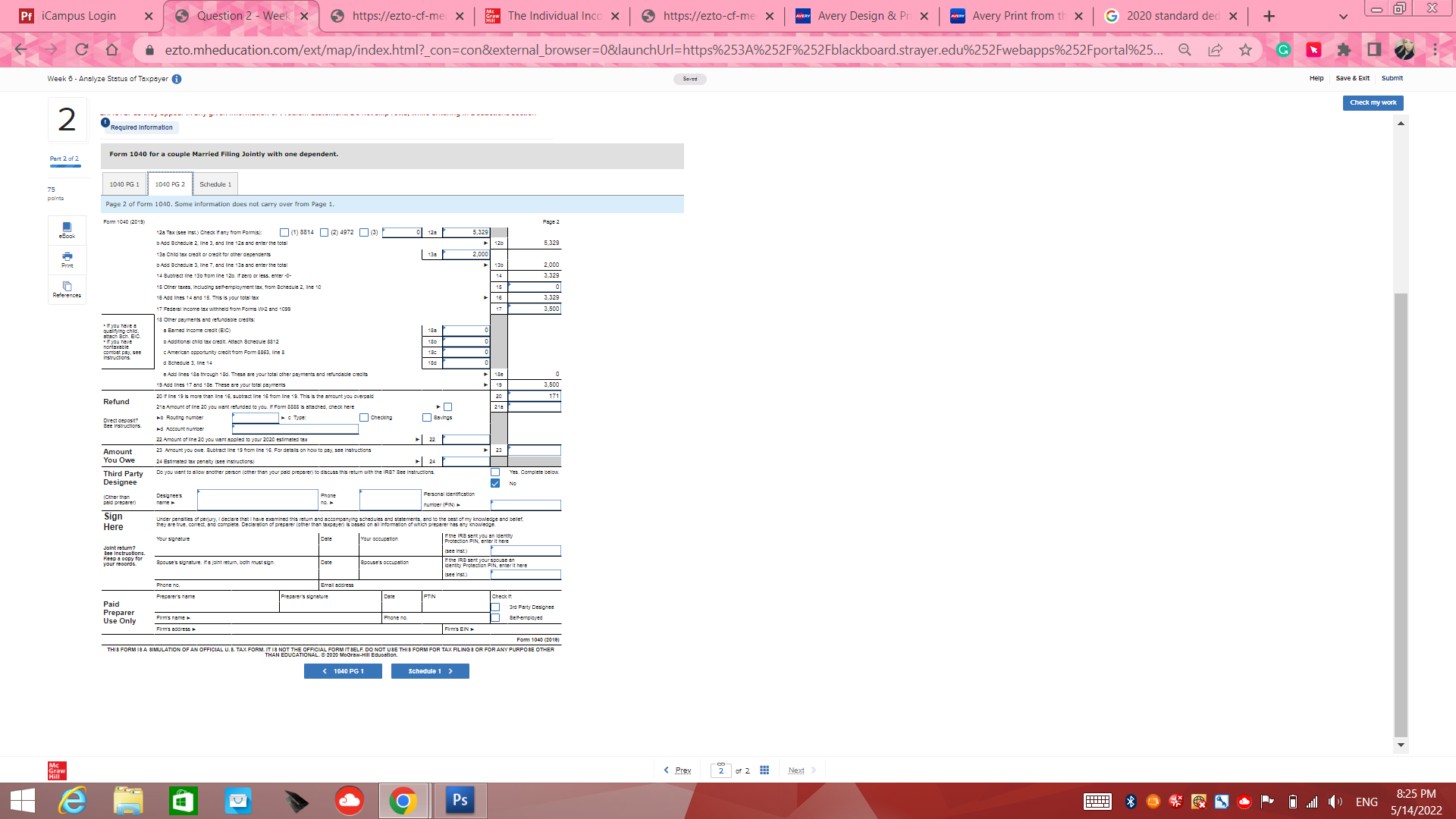

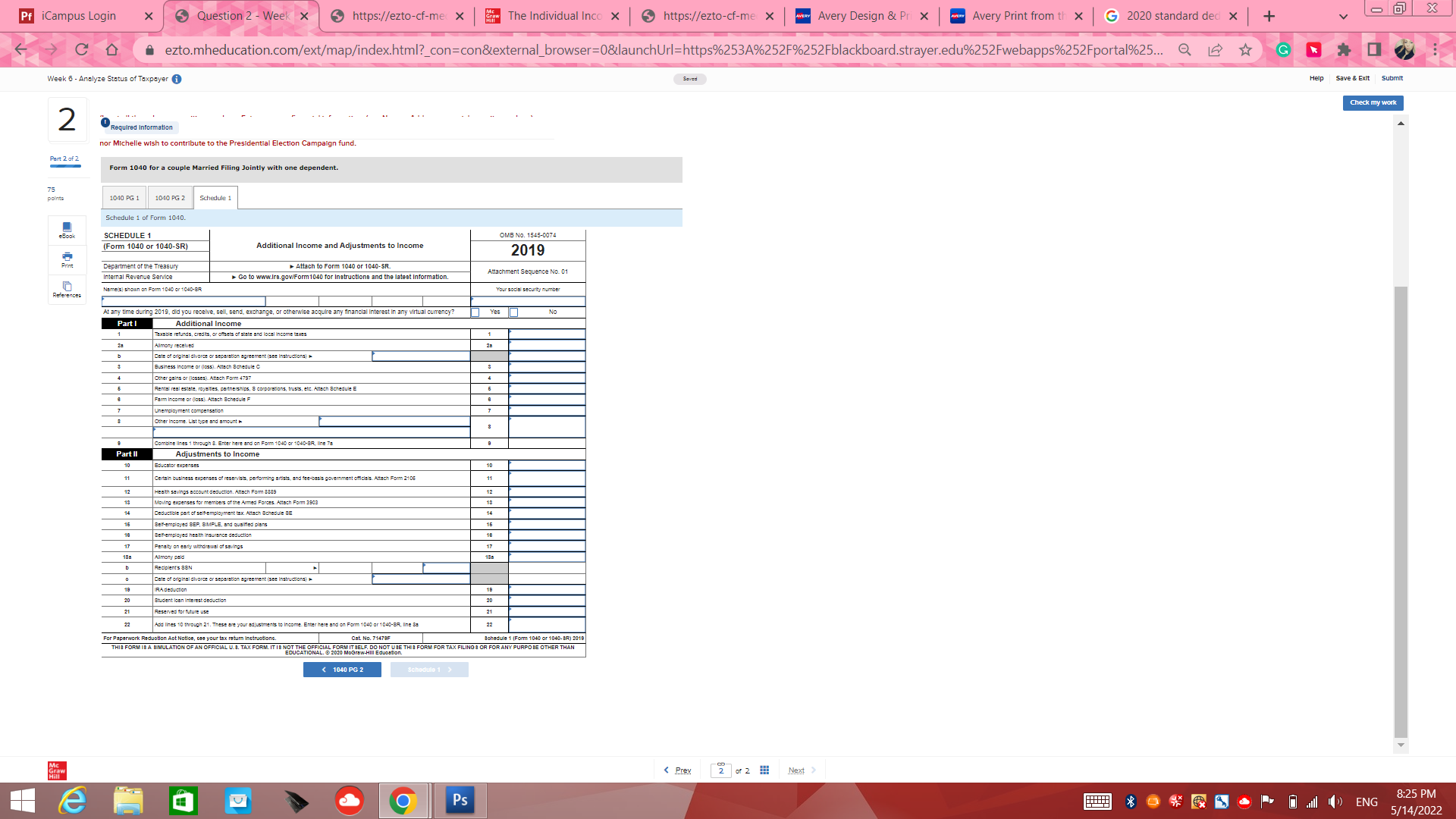

Question: CompleteMarc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available). Marc and Michelle's address is 19010 N.W.

CompleteMarc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available).

Marc and Michelle's address is 19010 N.W. 135th Street, Miami, FL 33054.

Social security numbers:

Marc Taxpayer: 111-22-3333 Michelle Taxpayer: 222-33-4444

Matthew Taxpayer: 333-44-5555 Prior Spouse 111-11-1111

Pf iCampus Login X Question 2 - Week x > https://ezto-cf-mec X The Individual Inco X > https://ezto-cf-mexx AVERY Avery Design & Pri Avery Print from th G 2020 standard ded X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fblackboard.strayer.edu%252Fwebapps%252Fportal%25... Q G Week 6 - Analyze Status of Taxpayer i Saved Help Save & Exit Submit 2 Part 2 of 2 75 points Required information If joint return, spouse's first name and middle initial Michelle Home address (number and street). If you have a P.O. box, see instructions. 19010 N.W. 135th Street Last name Taxpayer City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). Miami, FL 33054 Foreign country name Foreign province/state/county Foreign postal code Apt. no. social security number 111-22-3333 Your social security number 222-33-4444 Presidential Election Campaign Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change your tax or refund. You Spouse If more than four dependents, see instructions and here eBook Someone can claim: Standard Deduction Age/Blindness You: You as a dependent Spouse itemizes on a separate return or you were dual-status alien Were born before January 2, 1955 Your spouse as a dependent Are blind Spouse: Print Dependents (see instructions): (2) Social security number Was born before January 2, 1955 (3) Relationship to you Is blind (1) First name References Matthew Last name Taxpayer (4) if qualifies for (see instructions) Child tax credit Credit for other dependents 333-44-5555 Son Mc Graw Hill P 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 2a Tax-exempt interest 2a 500 b Taxable interest. Attach Sch. B if 2b 76,000 500 required 3a Qualified dividends b Ordinary dividends. Attach Sch. B if required 3b 0 4a IRA distributions 4a 0b Taxable amount 4b 0 Standard Deduction for- Single or Married filing separately, $12,200 c Pensions and annuities 4c Old Taxable amount 4d 0 5a Social security benefits 5a 0b Taxable amount 5b 0 Married filing 6 Capital gain or (loss). Attach Schedule D if required. If not required, check here 6 0 jointly or Qualifying 7a Other income from Schedule 1, line 9 widow(er), $24,400 Head of household $18,350 If you checked any box under Standard Deduction, see instructions. 8 a Adjustments to income from Schedule 1, line 22 b Subtract line 8a from line 7b. This is your adjusted gross income 9 Standard deduction or itemized deductions (from Schedule A) 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A 7a b Add lines 1, 2b, 3b, 4b, 4d, 5b, 6, and 7a. This is your total income 7b 76,500 8a 8b 72,500 24,800 10 5 Ps < Prev NG 2 of 2 Next > Check my work X ENG 8:25 PM 5/14/2022

Step by Step Solution

There are 3 Steps involved in it

Lets go through the process of completing Marc and Michelles Form 1040 and Schedule 1 stepbystep using hypothetical data as the specific income amounts werent provided in your previous messages Ill il... View full answer

Get step-by-step solutions from verified subject matter experts