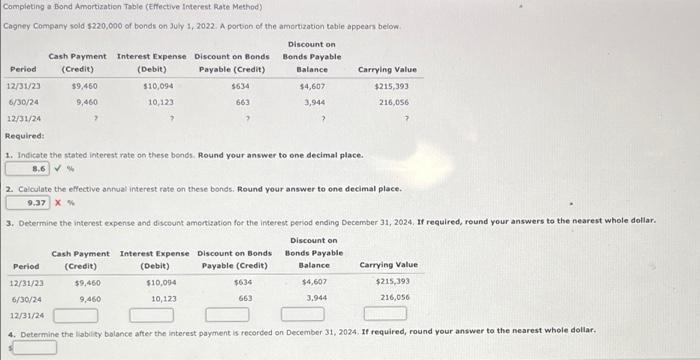

Question: Completing a Bond Amortization Table (Effective Interest Rate Method) Cagney Company sold $220,000 of bonds on July 1, 2022. A portion of the amortization table

Completing a Bond Amortization Table (Effective Interest Rate Method) Cagney Company sold $220,000 of bonds on July 1, 2022. A portion of the amortization table appears below. Discount on Bonds Payable Balance $4,607 3,944 ? Period 12/31/23 6/30/24 12/31/24 Required: Cash Payment Interest Expense Discount on Bonds (Credit) Payable (Credit) $634 $9,460 9,460 Period 12/31/23 6/30/24 12/31/24 (Debit) $10,094 10,123 1. Indicate the stated interest rate on these bonds. Round your answer to one decimal place. 8.6 % 2. Calculate the effective annual interest rate on these bonds. Round your answer to one decimal place. 9.37 X % $9,460 9,460 663 3. Determine the interest expense and discount amortization for the interest period ending December 31, 2024. If required, round your answers to the nearest whole dollar. Discount on Bonds Payable Balance Cash Payment Interest Expense Discount on Bonds (Credit) Payable (Credit) (Debit) $10,094 10,123 Carrying Value $215,393 216,056 $634 663 $4,607 3,944 Carrying Value $215,393 216,056 4. Determine the liability balance after the interest payment is recorded on December 31, 2024. If required, round your answer to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts