Question: Completing the Accounting Cycle 229 Learning Objectives 1, 2, 3. 4. 5.6 P4-31A Completing the accounting cycle from adjusting entries to post-closing trial balance with

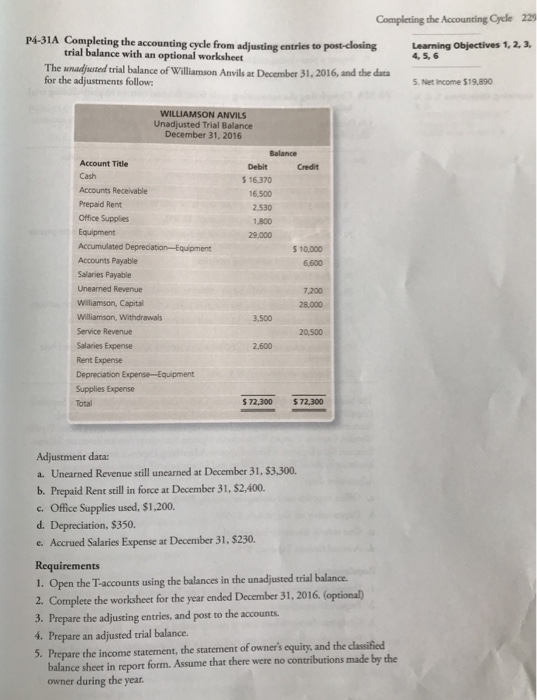

Completing the Accounting Cycle 229 Learning Objectives 1, 2, 3. 4. 5.6 P4-31A Completing the accounting cycle from adjusting entries to post-closing trial balance with an optional worksheet The uradjusted trial balance of Williamson Anvils at December 31, 2016, and the data for the adjustments follow: 5. Net Income 519,890 WILLIAMSON ANVILS Unadjusted Trial Balance December 31, 2016 Account Title Cash Balance Debit Credit $ 16,370 16,500 2.530 1,800 29,000 $ 10,000 6.600 Accounts Receivable Prepaid Rent Office Supplies Equipment Accumulated Depreciation Equipment Accounts Payable Salaries Payable Unearned Revenue Wiliamson, Capital Williamson, Withdrawals Service Revenue Salaries Expense Rent Expense Depreciation Expense-Equipment Supplies Expense Total 7,200 28.000 3.500 20,500 2,600 $ 72,300 $72.300 Adjustment data: a. Unearned Revenue still uncarned at December 31, $3,300. b. Prepaid Rent still in force at December 31, $2,400. c. Office Supplies used, $1,200. d. Depreciation, $350. c. Accrued Salaries Expense at December 31, $230. Requirements 1. Open the T-accounts using the balances in the unadjusted trial balance. 2. Complete the worksheet for the year ended December 31, 2016. (optional) 3. Prepare the adjusting entries, and post to the accounts. 4. Prepare an adjusted trial balance. 5. Prepare the income statement, the statement of owner's equity, and the classified balance sheer in report form. Assume that there were no contributions made by the owner during the year. 6. Prepare the closing entries, and post to the accounts. 7. Prepare a post-closing trial balance. 8. Calculate the current ratio for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts