Question: completing their own response to the problems. 1. State the present worth of the future payment of $9,450 five years from now at 7% compounded

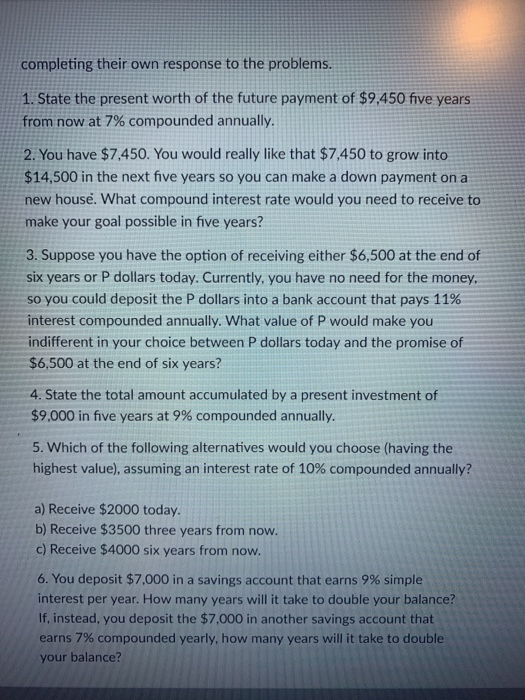

completing their own response to the problems. 1. State the present worth of the future payment of $9,450 five years from now at 7% compounded annually. 2. You have $7,450. You would really like that $7,450 to grow into $14,500 in the next five years so you can make a down payment on a new hous. What compound interest rate would you need to receive to make your goal possible in five years? 3. Suppose you have the option of receiving either $6,500 at the end of six years or P dollars today. Currently, you have no need for the money so you could deposit the P dollars into a bank account that pays 11% interest compounded annually. What value of P would make you indifferent in your choice between P dollars today and the promise of $6,500 at the end of six years? 4. State the total amount accumulated by a present investment of $9,000 in five years at 9% compounded annually. 5. Which of the following alternatives would you choose (having the highest value), assuming an interest rate of 10% compounded annually? a) Receive $2000 today. b) Receive $3500 three years from now. c) Receive $4000 six years from now. 6. You deposit $7,000 in a savings account that earns 9% simple interest per year. How many years will it take to double your balance? If, instead, you deposit the $7,000 in another savings account that earns 7% compounded yearly, how many years will it take to double your balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts