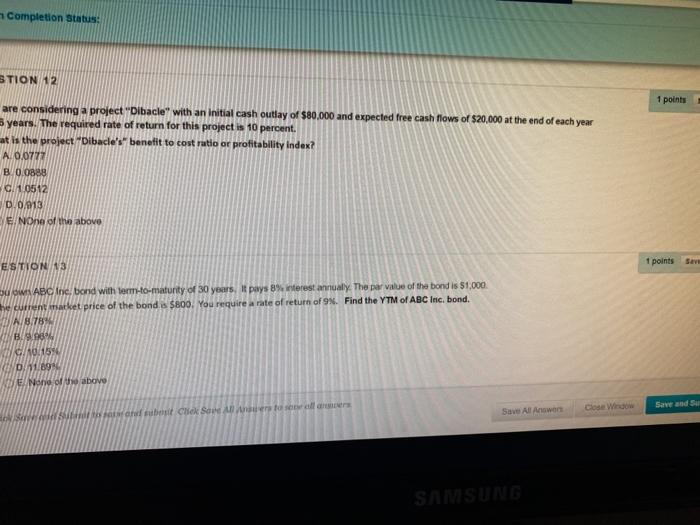

Question: Completion Status: STION 12 1 points are considering a project Dibacle with an initial cash outlay of $80,000 and expected free cash flows of $20,000

Completion Status: STION 12 1 points are considering a project "Dibacle with an initial cash outlay of $80,000 and expected free cash flows of $20,000 at the end of each year years. The required rate of return for this project is 10 percent. at is the project Dibacle's" benefit to cost ratio or profitability index? A. 0.0777 B 0.0888 C10512 D.0/013 ENOne of the above 1 points ESTIONS ABC Inc. bond with term-to-maturity of 30 years. It pays 8% interest annually. The par value of the bond is $1,000 he current market price of the bond is $800. You require a rate of return of 98. Find the YTM of ABC Inc, bond. A 8.78% BU NING 15 1.0994 WWE None of above Save All Answers Close Window Save and Sun Sobot Cek Sadher for alle SAMSUNG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts