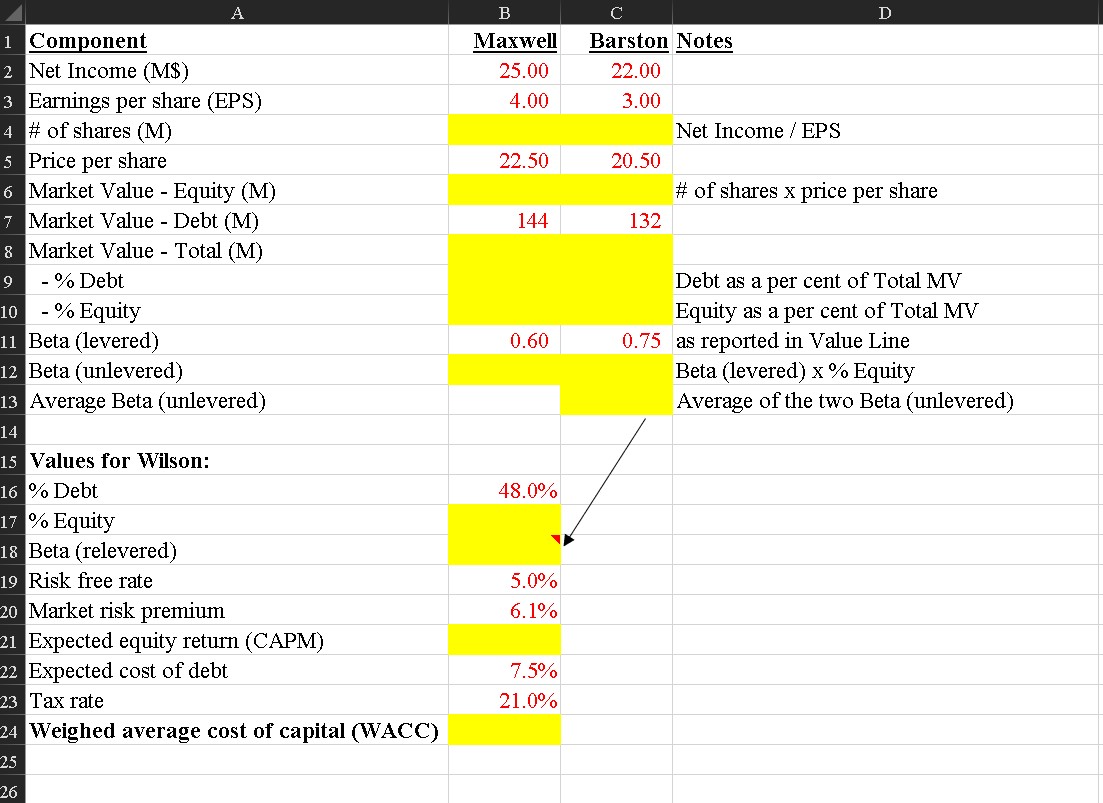

Question: Component Maxwell Barston Notes Net Income ( M$ ) 2 5 . 0 0 2 2 . 0 0 Earnings per share ( EPS )

Component Maxwell Barston Notes Net Income M$ Earnings per share EPS # of shares M Net Income EPS Price per share Market Value Equity M # of shares x price per share Market Value Debt M Market Value Total M Debt Debt as a per cent of Total MV Equity Equity as a per cent of Total MV Beta levered as reported in Value Line Beta unlevered Beta levered x Equity Average Beta unlevered

Average of the two Beta unlevered Values for Wilson: Debt Equity Beta relevered Risk free rate Market risk premium Expected equity return CAPM Expected cost of debt Tax rate Weighed average cost of capital WACC

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock