Question: COMPOUND INTEREST Learning Objective for question 1 09-01 Calculate the future value and present value in compound interest applications, by both the algebraic method and

COMPOUND INTEREST

-

Learning Objective for question 1

09-01 Calculate the future value and present value in compound interest applications, by both the algebraic method and the preprogrammed financial calculator method

-

Learning Objective for question 2

09-01 Calculate the future value and present value in compound interest applications, by both the algebraic method and the preprogrammed financial calculator method

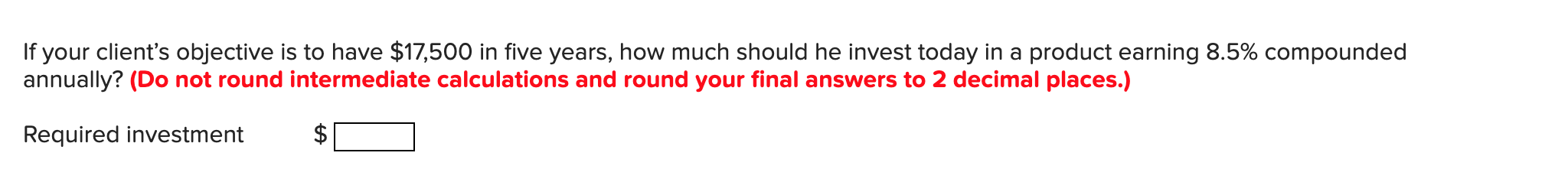

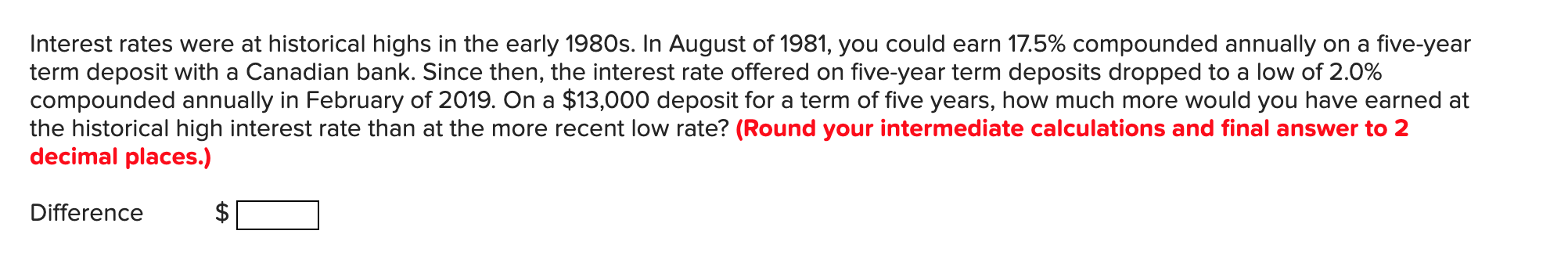

If your client's objective is to have $17,500 in five years, how much should he invest today in a product earning 8.5% compounded annually? (Do not round intermediate calculations and round your final answers to 2 decimal places.) Required investment Interest rates were at historical highs in the early 1980s. In August of 1981, you could earn 17.5% compounded annually on a five-year term deposit with a Canadian bank. Since then, the interest rate offered on five-year term deposits dropped to a low of 2.0% compounded annually in February of 2019. On a $13,000 deposit for a term of five years, how much more would you have earned at the historical high interest rate than at the more recent low rate? (Round your intermediate calculations and final answer to 2 decimal places.) Difference A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts