Question: COMPOUNDED INTEREST Question 1 Question 2 Question 3 If one compound interest rate is 12 percent per annum compounding monthly (J12 = 12%) and another

COMPOUNDED INTEREST

Question 1

Question 2

Question 3

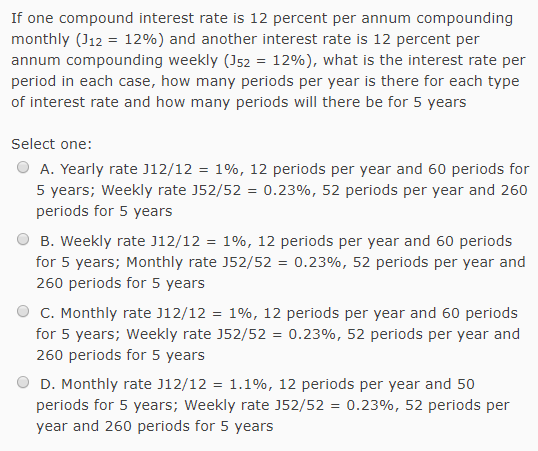

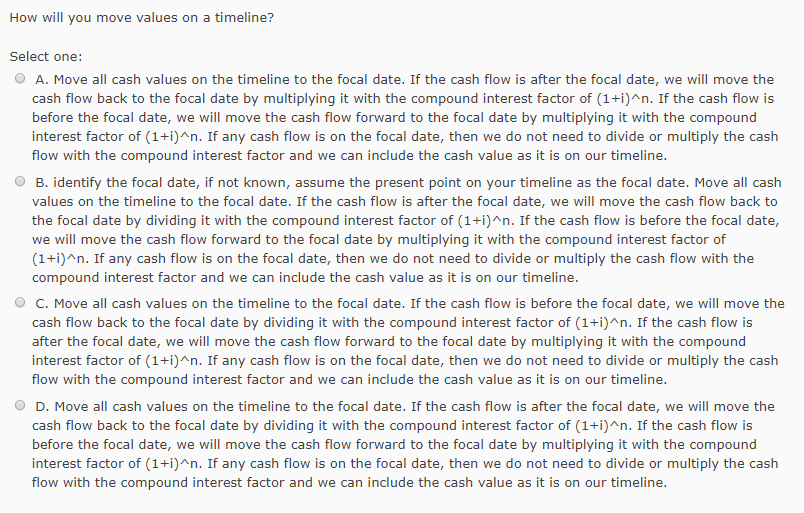

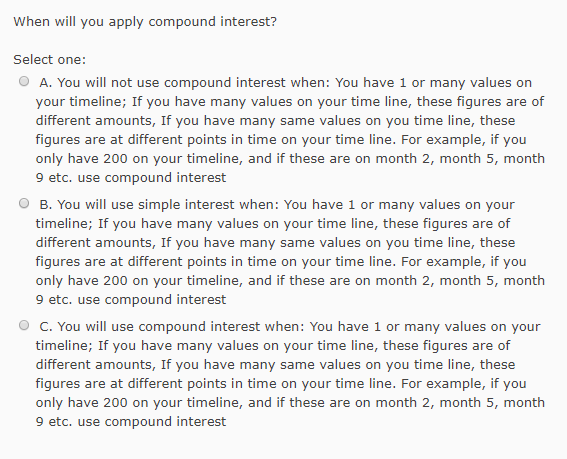

If one compound interest rate is 12 percent per annum compounding monthly (J12 = 12%) and another interest rate is 12 percent per annum compounding weekly (152 = 12%), what is the interest rate per period in each case, how many periods per year is there for each type of interest rate and how many periods will there be for 5 years Select one: O A. Yearly rate J12/12 = 1%, 12 periods per year and 60 periods for 5 years; Weekly rate 152/52 = 0.23%, 52 periods per year and 260 periods for 5 years OB. Weekly rate J12/12 = 1%, 12 periods per year and 60 periods for 5 years; Monthly rate 152/52 = 0.23%, 52 periods per year and 260 periods for 5 years O C. Monthly rate J12/12 = 1%, 12 periods per year and 60 periods for 5 years; Weekly rate 152/52 = 0.23%, 52 periods per year and 260 periods for 5 years O D. Monthly rate J12/12 = 1.1%, 12 periods per year and 50 periods for 5 years; Weekly rate 152/52 = 0.23%, 52 periods per year and 260 periods for 5 years How will you move values on a timeline? Select one: O A. Move all cash values on the timeline to the focal date. If the cash flow is after the focal date, we will move the cash flow back to the focal date by multiplying it with the compound interest factor of (1+i)^n. If the cash flow is before the focal date, we will move the cash flow forward to the focal date by multiplying it with the compound interest factor of (1+i)^n. If any cash flow is on the focal date, then we do not need to divide or multiply the cash flow with the compound interest factor and we can include the cash value as it is on our timeline. O B. identify the focal date, if not known, assume the present point on your timeline as the focal date. Move all cash values on the timeline to the focal date. If the cash flow is after the focal date, we will move the cash flow back to the focal date by dividing it with the compound interest factor of (1+i)^n. If the cash flow is before the focal date, we will move the cash flow forward to the focal date by multiplying it with the compound interest factor of (1+i)^n. If any cash flow is on the focal date, then we do not need to divide or multiply the cash flow with the compound interest factor and we can include the cash value as it is on our timeline. O C. Move all cash values on the timeline to the focal date. If the cash flow is before the focal date, we will move the cash flow back to the focal date by dividing it with the compound interest factor of (1+i)^n. If the cash flow is after the focal date, we will move the cash flow forward to the focal date by multiplying it with the compound interest factor of (1+i)^n. If any cash flow is on the focal date, then we do not need to divide or multiply the cash flow with the compound interest factor and we can include the cash value as it is on our timeline. O D. Move all cash values on the timeline to the focal date. If the cash flow is after the focal date, we will move the cash flow back to the focal date by dividing it with the compound interest factor of (1+i)^n. If the cash flow is before the focal date, we will move the cash flow forward to the focal date by multiplying it with the compound interest factor of (1+i)^n. If any cash flow is on the focal date, then we do not need to divide or multiply the cash flow with the compound interest factor and we can include the cash value as it is on our timeline. When will you apply compound interest? Select one: O A. You will not use compound interest when: You have 1 or many values on your timeline; If you have many values on your time line, these figures are of different amounts, If you have many same values on you time line, these figures are at different points in time on your time line. For example, if you only have 200 on your timeline, and if these are on month 2, month 5, month 9 etc. use compound interest O B. You will use simple interest when: You have 1 or many values on your timeline; If you have many values on your time line, these figures are of different amounts, If you have many same values on you time line, these figures are at different points in time on your time line. For example, if you only have 200 on your timeline, and if these are on month 2, month 5, month 9 etc. use compound interest O C. You will use compound interest when: You have 1 or many values on your timeline; If you have many values on your time line, these figures are of different amounts, If you have many same values on you time line, these figures are at different points in time on your time line. For example, if you only have 200 on your timeline, and if these are on month 2, month 5, month 9 etc. use compound interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts