Question: Compounding and Discount Factor (Natural Resource Extraction) 1. Explain present value of benefit and future value cost. 2. Assume you put 20,000 dollars (principal) in

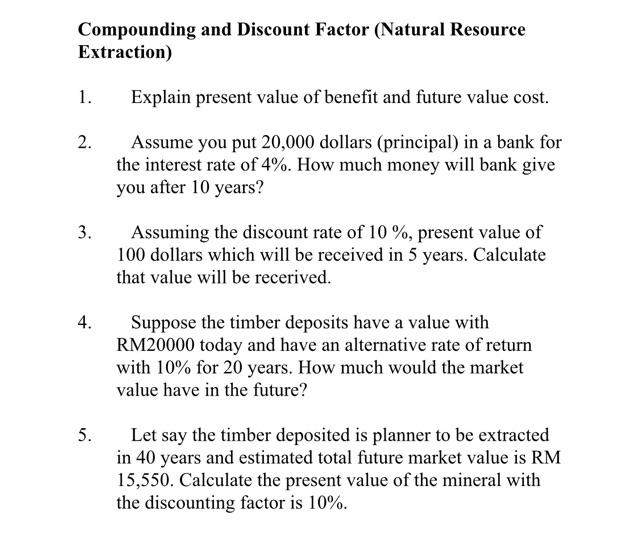

Compounding and Discount Factor (Natural Resource Extraction) 1. Explain present value of benefit and future value cost. 2. Assume you put 20,000 dollars (principal) in a bank for the interest rate of 4%. How much money will bank give you after 10 years? 3. Assuming the discount rate of 10%, present value of 100 dollars which will be received in 5 years. Calculate that value will be recerived. 4. Suppose the timber deposits have a value with RM20000 today and have an alternative rate of return with 10% for 20 years. How much would the market value have in the future? 5. Let say the timber deposited is planner to be extracted in 40 years and estimated total future market value is RM 15,550. Calculate the present value of the mineral with the discounting factor is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts