Question: Compounding and Discounting over multiple period You are offered a choice between 1. 4,809 today or 2. 5,000 four years from now. Assuming an

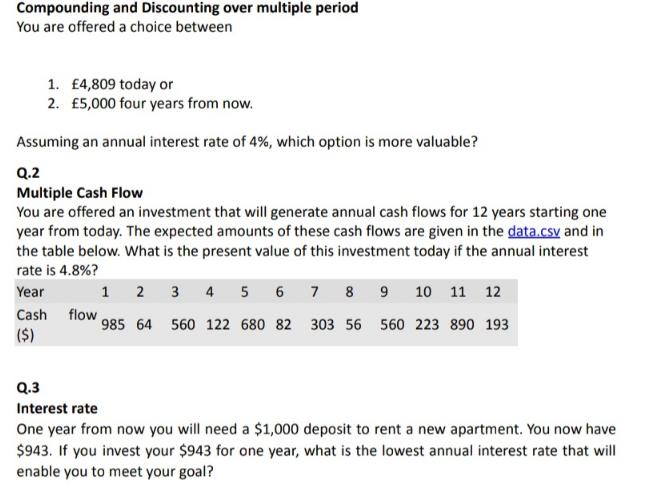

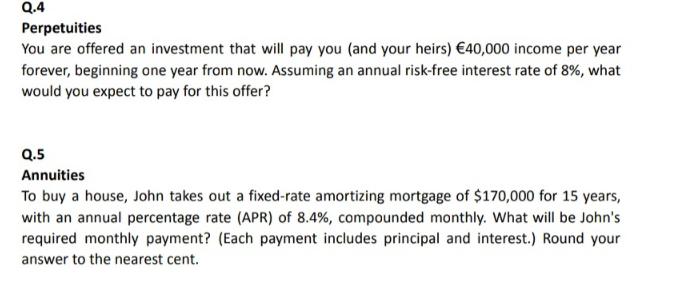

Compounding and Discounting over multiple period You are offered a choice between 1. 4,809 today or 2. 5,000 four years from now. Assuming an annual interest rate of 4%, which option is more valuable? Q.2 Multiple Cash Flow You are offered an investment that will generate annual cash flows for 12 years starting one year from today. The expected amounts of these cash flows are given in the data.csv and in the table below. What is the present value of this investment today if the annual interest rate is 4.8%? Year Cash flow ($) 1 2 3 4 5 6 7 8 9 10 11 12 985 64 560 122 680 82 303 56 560 223 890 193 Q.3 Interest rate One year from now you will need a $1,000 deposit to rent a new apartment. You now have $943. If you invest your $943 for one year, what is the lowest annual interest rate that will enable you to meet your goal? Q.4 Perpetuities You are offered an investment that will pay you (and your heirs) 40,000 income per year forever, beginning one year from now. Assuming an annual risk-free interest rate of 8%, what would you expect to pay for this offer? Q.5 Annuities To buy a house, John takes out a fixed-rate amortizing mortgage of $170,000 for 15 years, with an annual percentage rate (APR) of 8.4%, compounded monthly. What will be John's required monthly payment? (Each payment includes principal and interest.) Round your answer to the nearest cent.

Step by Step Solution

3.54 Rating (147 Votes )

There are 3 Steps involved in it

SOLUTION Q1 To compare the two options we need to calculate the present value of the second option Option 2 using the formula PV FV 1 rn where PV pres... View full answer

Get step-by-step solutions from verified subject matter experts