Question: compounding monthly on today need help with number 1 and 2 1. Sammy anticipates that he will need approximately $250,000 in 17 years to cover

compounding monthly on today

need help with number 1 and 2

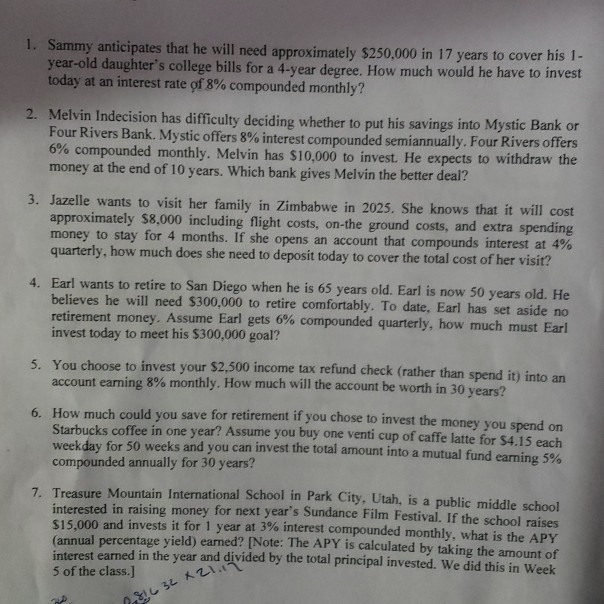

1. Sammy anticipates that he will need approximately $250,000 in 17 years to cover his 1- year-old daughter's college bills for a 4-year degree. How much would he have to invest today at an interest rate of 8% compounded monthly? 2. Melvin Indecision has difficulty deciding whether to put his savings into Mystic Bank or Four Rivers Bank. Mystic offers 8% interest compounded semiannually. Four Rivers offers 6% compounded monthly. Melvin has $10,000 to invest. He expects to withdraw the money at the end of 10 years. Which bank gives Melvin the better deal? 3. Jazelle wants to visit her family in Zimbabwe in 2025. She knows that it will cost approximately $8,000 including flight costs, on-the ground costs, and extra spending money to stay for 4 months. If she opens an account that compounds interest at 4% quarterly, how much does she need to deposit today to cover the total cost of her visit? 4. Earl wants to retire to San Diego when he is 65 years old. Earl is now 50 years old. He believes he will need $300,000 to retire comfortably. To date. Earl has set aside no retirement money. Assume Earl gets 6% compounded quarterly, how much must Earl invest today to meet his $300,000 goal? 5. You choose to invest your $2,500 income tax refund check (rather than spend it into an account earning 8% monthly. How much will the account be worth in 30 years? 6. How much could you save for retirement if you chose to invest the money you spend on Starbucks coffee in one year? Assume you buy one venti cup of caffe latte for $4.15 each weekday for 50 weeks and you can invest the total amount into a mutual fund earning 5% compounded annually for 30 years? 7. Treasure Mountain International School in Park City, Utah, is a public middle school interested in raising money for next year's Sundance Film Festival. If the school raises $15.000 and invests it for 1 year at 3% interest compounded monthly, what is the APY (annual percentage yield) earned? (Note: The APY is calculated by taking the amount of interest earned in the year and divided by the total principal invested. We did this in Week 5 of the class.) A81632 X 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts