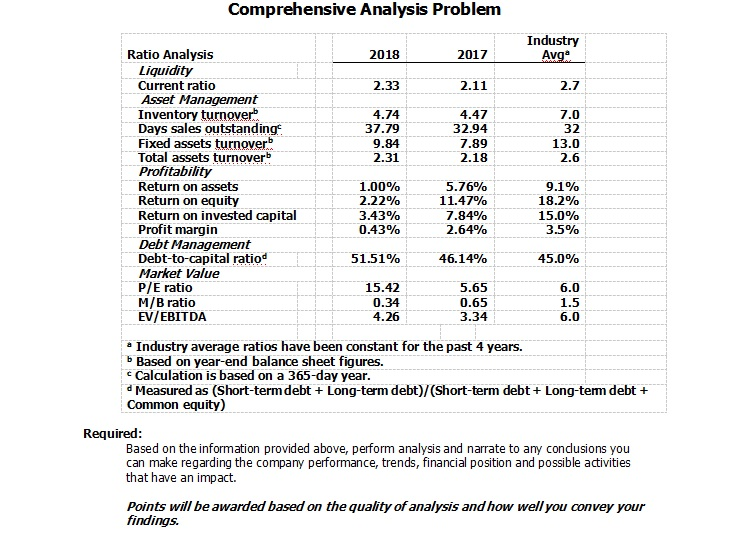

Question: Comprehensive Analysis Problem Industry Ratio Analysis 2018 2017 Liquidity Current ratio Asset Management Inventory turnoverb Days sales outstanding Fixed assets turnover Total assets turnoverb Profitability

Comprehensive Analysis Problem Industry Ratio Analysis 2018 2017 Liquidity Current ratio Asset Management Inventory turnoverb Days sales outstanding Fixed assets turnover Total assets turnoverb Profitability Return on assets Return on equity Return on invested capital Profit margin Debt Managemenit Debt-to-capital ratiod Market Value P/E ratio M/B ratio EV/EBITDA 2.33 2.11 2.7 4.74 37.79 9.84 2.31 4.47 32.94 7.89 2.18 7.0 32 13.0 2.6 1.00% 222% 3.43% 0.4390 5.76% 11.47% 7.8490 2.6490 9.1% 18.2% 15.0% 35% 51.51% 46.14% 45.0% 15.42 0.34 4.26 5.65 0.65 3.34 6.0 1.5 6.0 Industry average ratios have been constant for the past 4 years. bBased on year-end balance sheet figures. Calculation is based on a 365-day year dMeasured as (Short-term debt +Long-term debt)/(Short-term debt+ Long-tem debt + Common equity) Required Based on the information provided above, perform analysis and narrate to any condusions you can make regarding the company performance, trends, financial position and possible activities that have an impact. Points will be awarded based on the quality of analysis and how wellyou convey your findings. Comprehensive Analysis Problem Industry Ratio Analysis 2018 2017 Liquidity Current ratio Asset Management Inventory turnoverb Days sales outstanding Fixed assets turnover Total assets turnoverb Profitability Return on assets Return on equity Return on invested capital Profit margin Debt Managemenit Debt-to-capital ratiod Market Value P/E ratio M/B ratio EV/EBITDA 2.33 2.11 2.7 4.74 37.79 9.84 2.31 4.47 32.94 7.89 2.18 7.0 32 13.0 2.6 1.00% 222% 3.43% 0.4390 5.76% 11.47% 7.8490 2.6490 9.1% 18.2% 15.0% 35% 51.51% 46.14% 45.0% 15.42 0.34 4.26 5.65 0.65 3.34 6.0 1.5 6.0 Industry average ratios have been constant for the past 4 years. bBased on year-end balance sheet figures. Calculation is based on a 365-day year dMeasured as (Short-term debt +Long-term debt)/(Short-term debt+ Long-tem debt + Common equity) Required Based on the information provided above, perform analysis and narrate to any condusions you can make regarding the company performance, trends, financial position and possible activities that have an impact. Points will be awarded based on the quality of analysis and how wellyou convey your findings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts