Question: Comprehensive Financial Planning Case Study The Hurton's Scenario: It has been about six months since you last met with James and Kay Hurton. Early on

Comprehensive Financial Planning Case Study

The Hurton's

Scenario:

It has been about six months since you last met with James and Kay Hurton. Early on a Monday morning in March of 2021, as you're settling into your office, you receive the following email from James:

From: James Hurton Sent: Monday, March 2, 2021 10:59 AM To: Joe Planner &..r@plansRus.ca> Subject: Meeting

Hey, hope you are well. Kay and I want to come in and see you about our retirement plan - just to have you look things over and make sure we're 'on track'. I've attached our statements and my pension information (Exhibit(s) 5 - 13).

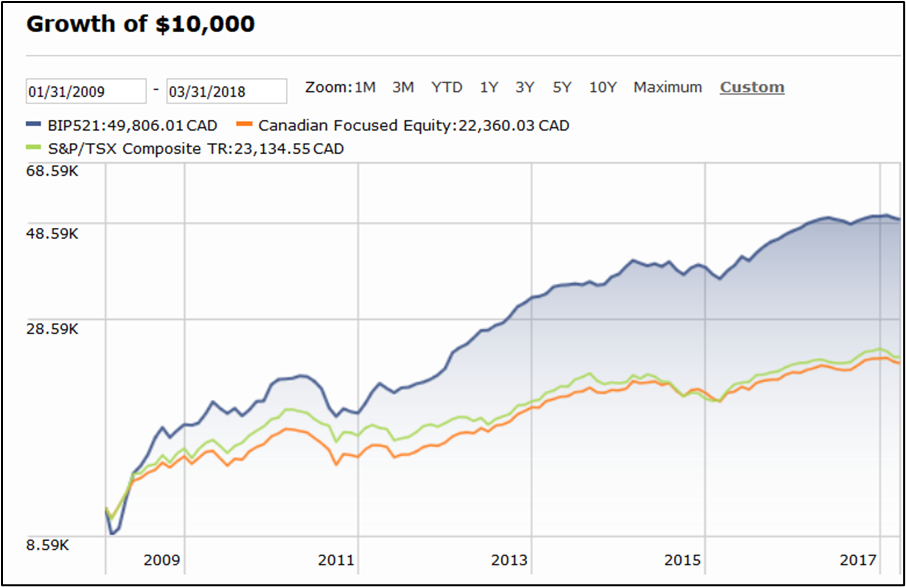

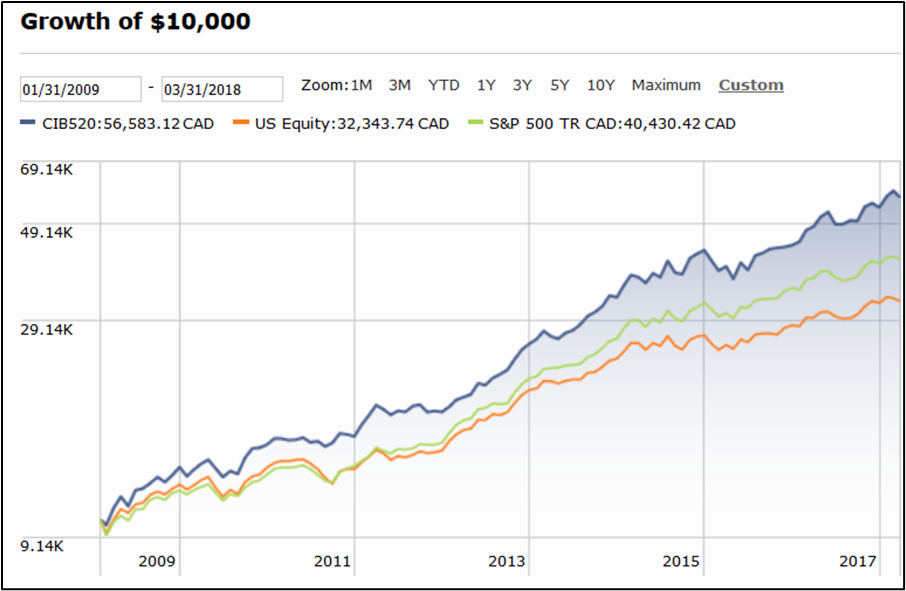

We also would like your opinion on an investment account that we've had at the Royal Bank for quite some time. We invested $38,000 a few years ago - it was sometime towards the end of January in 2009 ($27,500 into the CIBC Nasdaq Index Fund and $10,500 into the Brandes Canadian Equity Fund). It has really done well... last time I looked, we were up BIG TIME, but we'd still like your thoughts on what we should do and whether or not we should change it up? I've attached a copy of our most recent (December, 2019) statements (Exhibit(s) 16 and 17).

Also, I was talking to my brother about a couple of dividend paying stocks that he's all hyped-up about and thinks I should look into. I've attached the details (Exhibit(s) 14 and 15), but they look expensive compared to the dividends that they are paying! I think I'd be further ahead with a large cap Canadian mutual fund, don't you think? The dividends look pretty small for stocks that are priced over $100 each - sure doesn't seem like it's a good idea to me! I'd be interested in your opinion.

Kay and I have been thinking about when we want to retire and we'd like to chat with you about creating a formal written financial plan. We've been talking about what we think we'll need in retirement for income and we feel as though if we had roughly 75% of our current after-tax income on a monthly basis, that we'd be fine. We would like to know if you think we can accomplish that. When can we meet?

Take care,

James

The Hurton's Current Situation

James Hurton, age 49 is married to Kay Hurton age 50. They have 1 child, Kat, who was born in May of 2006.

Mr. Hurton started a job with the Alberta government as a budget officer 2 years ago.He was previously an accountant with a private firm for almost 18 years. He joined the government's defined benefit pension plan as soon as he started working there. In 2021, James earned $98,350. (Exhibit 13).

Kay Hurton is a Human Resources Specialist, and has worked for Northwest & Ethical Investments L.P. (NEI) for the past 24 years. She currently earns $80,390 annually and contributes to a group RRSP plan (Exhibit 5). Her employer matches their employee's contributions into the group RSP up to 7.0% of their earnings and Kay is currently contributing at that level. The plan has grown at an annual rate of roughly 6.0% since it was first established in 2001 (four years after she first began working).

James and Kay expect to work for another 18 - 20 years, retiring in their mid-sixties - both of their salaries have an annual indexing component that keeps pace with inflation.

Not unlike many other Canadian families the Hurton's primary goal is to pay off the mortgage on both their home, and a vacation property before they retire. In addition, they would like to pay for their child's post-secondary education but have not started a RESP yet and are unsure whether or not they should start one.

Kat, isn't sure what she wants to do when she grows-up, but she is really interested in the sciences and she is pretty confident that she wants to go to university.The Hurton's want a plan that saves enough money for a fulltime 4-year Bachelor degree program (tuition, books & expenses) and feel confident that Kat will attend the U of C and live with them while doing so - thereby enabling her to manage the 5 course per term load.

While the Hurton's have not begun saving for their child's education, Kay's mother, who passed away last year, did set aside $15,000 in a testamentary trust for Kat's education (Exhibit 12).

Based on the most recent bank account and investment account statements provided by the Hurton's during your initial meeting you were able to create a Net Worth Statement for the Hurton household - as of December 31, 2021 (Exhibit 1).

At the time of your last meeting (December 2020) with the Hurton's you also made the following notes:

- The Hurton's appear to have a sound personal net worth statement.

- Both James & Kay have a "Growth" oriented investor profile with a target asset allocation of 20% cash/cash-equivalent/fixed-income and 80% equity.

- They want to retire in their mid-60's (64-66) ....is this feasible?

- $15,000 in a 1-year GIC matures June 2020

- Testamentary trust for Kat.

- Was invested at 2.25% per annum.

- How will they pay for Kat's education?

- Mortgage on principal residence is due for renewal in 6 months.

- Currently valued at roughly $625,000.

- Housing prices are expected to remain stable over the next 1-2 years

- The Hurton's are concerned about impact of rising mortgages rates.

- Should they renew mortgage for 7- or 10-year term or go short-term?

- Will this affect their ability to retire in their mid-60s?

- Mortgage on vacation property locked into a variable 3-year mortgage in August 2019 at P-0.00%.

- Both Kay & James have just opened up TFSA's and will be depositing $13,000 into each over the next few months.

- These are their only TFSA's and no previous contributions have ever been made

- They will be seeking advice on how to invest inside the TFSA's.

- James's most recent NOA states unused RRSP room of $104,000.

- Kay's most recent NOA states unused RRSP room of $64,000.

- James has a DB pension plan that is based on his last 3 year's average earnings with a 2% pay-out per year of pensionable service.

- James's 2021 PA = $10,819.

- James recently transferred-in a small balance Locked-in Retirement Account (LIRA) from a previous employer's pension plan. (Exhibit 7).

- Kay contributes 7% to her employer's group RSP plan

James and Kay enjoy life and take great pleasure from watching their young daughter grow into young adulthood. However, of late, and perhaps given the poor state of the economy, they have begun harboring doubts about whether they can retire in the comfort they once hoped while, at the same time, be able to assist their daughter with the cost of a university education.

As Kay put it to you recently: "we both work very hard but it seems we're always just a couple of steps behind where we should be! We enjoy life, and hope to retire in our mid-60s', but I'm just not sure if we can? The bills, paying off mortgages and saving for Kat's education are just some of thing things that always seem to get kicked to the back burner!"

James agreed stating: "yeah, the bills just seem to keep getting bigger every month!"

James and Kay Hurton Net Worth Statement December 31,2021 Exhibit 1 | ||||

| Liquid Assets | Short-Term Liabilities | |||

| Chequing Account | $9,000 | Credit Card(3) | $3,500 | |

| Emergency Savings | 21,830 | Line of Credit(2) | 0 | |

| Total Liquid Assets | $30,830 | Total Current Liabilities | $3,500 | |

| Long Term Assets | Long-Term Liabilities | |||

| RRSP - James | $83,927 | BMW loan (4.9%) | $15,061 | |

| LIRA - James | 46,475 | Mortgage - Principal Residence | 449,847 | |

| TFSA - James | 13,000 | Mortgage - Vacation | 261,658 | |

| Spousal RRSP - Kay | 38,108 | |||

| TFSA - Kay | 13,000 | |||

| Group RRSP - Kay | 206,616 | |||

| Investment Account - Joint | 56,879 | |||

| 2016 BMW 328xi | 40,000 | |||

| 2015 Ford Escape | 24,000 | |||

| Household Goods | 30,000 | |||

| Principal Residence | 625,000 | |||

| Vacation Home | 400,000 | |||

| Total Long-Term Assets(1) | $1,577,005 | Total Long-Term Liabilities | $726,566 | |

| Total Assets(1) | $1,607,835 | Total Liabilities | $730,066 | |

| Household Net Worth | $877,769 | |||

Note(s): 1. Excludes trust account (BV = $15,000) for Kat, maturing in June / 2022. 2. Credit limit on unsecured line of credit $60,000, 8.5% annual interest rate). 3. Credit card is used for daily expenses, but is paid in full each month. | ||||

REQUIRED:

- Identify the implicit and explicit problems and issues that the Hurtons are facing?

- Assess a minimum of 2 potential solutions to each of the problems/issues they face (both a qualitative and quantitative analysis should be completed for each potential solution).

- Create a financial plan (Recommendations and Implementation) that in your best judgement, given the case facts, and any research you complete, will best help the Hurtons effectively deal with the problems and challenges they face in achieving their retirement goals.

Projected Financial Benchmarks

- Long-run inflation rate 2.0% per year.

Exhibit 2

Long-Run (10 year) Historic Returns on Investment by Asset Class | |

| Canadian Large Cap. Funds | 7.00% |

| Canadian Balanced Funds | 5.40% |

| Canadian Fixed Income (Bond) Funds | 4.76% |

| 3 month Canadian T-Bill | 1.06% |

| International Fixed Income (Bond) Funds | 4.89% |

| Canadian Dividend Funds | 7.50% |

| U.S. Large Cap. Funds | 2.96% |

| U.S. Mid Cap. Funds | 3.53% |

| U.S. Small Cap. Funds | 4.27% |

| International Equity Funds | 3.95% |

| Global Equity Funds | 4.64% |

Exhibit 3

| Current Canadian Bank Mortgage Rates | ||||||||

| Term | Variable | 1 | 2 | 3 | 4 | 5 | 7 | 10 |

| Rate | P - 0.00% | 3.24% | 3.34% | 3.49% | 3.59% | 3.29% | 3.59% | 4.14% |

| Prime = 3.45% |

Exhibit 4

James and Kay Hurton Monthly Household Cash Flow Statement | |||

| Income | $14,895 | ||

| Monthly Listed Expenses: | |||

| Income Tax - James | $1,918 | ||

| Income Tax - Kay | 1,438 | ||

| Group Health Benefits Deduction | 237 | ||

| EI / CPP Premiums | 575 | ||

| DB Pension Plan Contribution - James | 890 | ||

| Mortgage - Principal Residence | 2,455 | ||

| Mortgage - Vacation Property | 1,452 | ||

| Property Taxes - Principal Residence | 335 | ||

| Property Taxes - Vacation Property | 218 | ||

| Cable, Cellphones, & Internet | 350 | ||

| Vacation Property Utilities | 275 | ||

| Vacation Property Insurance | 150 | ||

| Principal Residence Insurance | 150 | ||

| Principal Residence Utilities | 400 | ||

| Principal Residence Maintenance / Repairs | 375 | ||

| Vehicle expenses (gas, insurance, registration) | 431 | ||

| BWM loan | 450 | ||

| Groceries | 550 | ||

| Clothing | 250 | ||

| Vacations * | 1,000 | ||

| Entertainment and Dining Out | 325 | ||

| Kat - Dance | 175 | ||

| Life Insurance ** | 100 | ||

| Miscellaneous ($50/week - coffee, lunches, etc.) | 217 | ||

| Total Listed Expenses | ($14,716) | ||

| Net available for savings | $179 | ||

Notes:

* One family trip per year.

**Life insured is on James (Benefit $200,000).

James's current MTR = 36%, Average Tax Rate = 26.91%

Kay's current MTR = 30.5%, Average Tax Rate = 25.75%

Projected average tax rate in retirement: 22.87%

Exhibit 5

Credential Asset Management

Kay Hurton

Group RRSP Plan

December 31, 2021

| Current Unit | Market | % of Plan's | ||||

Investment | Price $ x | # of Units | = | Value $ | Book Cost $ | Market Value |

NEI Canadian Bond Fund Series A FEL | 10.2629 | 3,686.040 | 37,829.36 | 31,020.16 | 18.31 | |

NEI Ethical Canadian Equity Fund Series A FEL | 22.1768 | 1,931.678 | 42,838.34 | 18,094.10 | 20.73 | |

NEI Ethical Special Equity Fund Series A FEL | 27.1892 | 664.029 | 18,054.32 | 8,459.63 | 8.74 | |

NEI Ethical International Equity Fund Series A FEL | 17.1239 | 2,392.385 | 40,966.46 | 21,630.57 | 19.83 | |

NEI Ethical Global Equity Fund Series A NL | 10.7847 | 1,476.548 | 15,924.13 | 8,934.51 | 7.70 | |

NEI Ethical U.S. Equity Fund A FEL | 35.4298 | 1,439.562 | 51,003.39 | 20,602.03 | 24.69 |

Total of all Investments in this plan $206,616.00 $108,741.00 100.00%

Exhibit 6

BMO Investorline

James Hurton

RRSP

December 31, 2021

Market | % of Plan's | |

Investment | Value $ | Market Value |

CIBC Global Technology FD | 4,100 | 4.89 |

CIBC International Small Co FD | 8,466 | 10.09 |

TD Canadian Index FD | 12,093 | 14.41 |

TD Canadian Small Cap FD | 7,426 | 8.85 |

TD Entertainment & Comm FD | 4,679 | 5.58 |

TD US Index FD | 17,389 | 20.72 |

TD US Mid-Cap Growth FD | 8,335 | 9.93 |

TD US Small-Cap Growth FD | 4,159 | 4.96 |

BMO Money Market Fund | 17,280 | 20.59 |

Total of all Investments in this plan $83,927 100%

Exhibit 7

BMO Investorline

James Hurton

LIRA

December 31, 2021

Market | % of Plan's | |

Investment | Value $ | Market Value |

CIBC Global Technology FD | 2,772 | 5.96 |

CIBC International Small Co FD | 5,024 | 10.81 |

TD Canadian Index FD | 6,834 | 14.70 |

TD Canadian Small Cap FD | 4,114 | 8.85 |

TD Entertainment & Comm FD | 2,798 | 6.02 |

TD US Index FD | 10,078 | 21.68 |

TD US Mid-Cap Growth FD | 5,000 | 10.76 |

TD US Small-Cap Growth FD | 2,437 | 5.24 |

BMO Money Market Fund | 7,418 | 15.96 |

Total of all Investments in this plan $46,475 100%

Exhibit 8

BMO Investorline

Kay Hurton

Spousal RRSP

December 31, 2021

Market | % of Plan's | |

Investment | Value $ | Market Value |

CIBC Global Technology FD | 1,906 | 5.00 |

TD Canadian Index FD | 9,527 | 25.00 |

TD Entertainment & Comm FD | 2,668 | 7.00 |

TD US Index FD | 9,908 | 26.00 |

TD US Mid-Cap Growth FD | 2,667 | 7.00 |

BMO Money Market Fund | 11,432 | 30.00 |

Total of all Investments in this plan $38,108 100%

Exhibit 9

TD Waterhouse Investment Trading Account December 31,2021 Client: James Hurton and Kay Hurton | ||||

| Fund | No. of Units / Shares | Book Value per Unit / Share | Market Value per Unit / Share | Total Market Value |

| PH&N MMF | 21,83 | $10.00 | $10.00 | $21,830 |

| CIBC International Equity | 1,500.075 | $10.30 | $13.42 | $20,131 |

| BMO Dividend | 201.105 | $60.66 | $70.23 | $14,124 |

| BMO Mid Corporate Bond Index ETF (ZCM) | 1,400 | $15.96 | $16.16 | $22,624 |

| Market Value | $78,709 |

Exhibit 10

TD Waterhouse TFSA December 31,2021 Client: James Hurton | ||||

| Fund | No. of Units / Shares | Book Value per Unit / Share | Market Value per Unit / Share | Total Market Value |

| Cash Balance | $13,000 | |||

| Market Value | $13,000 |

Exhibit 11

TD Waterhouse TFSA December 31,2021 Client: Kay Hurton | ||||

| Fund | No. of Units / Shares | Book Value per Unit / Share | Market Value per Unit / Share | Total Market Value |

| Cash Balance | $13,000 | |||

| Market Value | $13,000 |

Exhibit 12

Bank of Montreal Trust Account December 31,2021 Client: In Trust for Kat Hurton | ||||

| Fund | Book Value | Market Value | Total Market Value | |

1 Year non-redeemable GIC (2.25%) Matures June 19, 2022 | $15,000 | $15,000 | $15,000 |

Exhibit 13

Defined Benefit Pension Statement

Mr. James Hurton

Alberta Government Employee No.: 999444888

Statement of Pension Benefits

Plan Type: Defined Benefit - Average Final 3 years earnings

Current Salary: $98,350 annual

Expected Service at Retirement: 20 years

Pension Factor: 2%

Qualifying Factor: 85

Exhibit 14

Projected Dividend Stream | Current MV | ||||

Stock | 2019 | 2020 | 2021 | Thereafter | |

XLM Canadian Large Cap | $ 3.15 | $ 3.35 | $ 3.45 | +5.0% p.a. | $ 140.89 |

Exhibit 15

Projected Dividend Stream | Current MV | ||||

Stock | 2019 | 2020 | 2021 | Thereafter | |

QXY Canadian Large Cap | $ 2.79 | $ 2.95 | $ 3.18 | +4.5% p.a. | $ 119.36 |

Exhibit 16

Brandes Canadian Equity (BIP521) Jan., 2009 - March 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts