Question: Comprehensive Problem 07-63 (LO 07-1, LO 07-2, LO 07-3, LO 07-4) (Algo) During 2022, your clients, Mr. and Mrs. Howell, owned the following investment assets:

Comprehensive Problem 07-63 (LO 07-1, LO 07-2, LO 07-3, LO 07-4) (Algo)

During 2022, your clients, Mr. and Mrs. Howell, owned the following investment assets:

| Investment Assets | Date Acquired | Purchase Price | Broker's Commission Paid at Time of Purchase |

|---|---|---|---|

| 300 shares of IBM common | 11/22/2019 | $ 10,600 | $ 100 |

| 200 shares of IBM common | 4/3/2020 | 43,500 | 300 |

| 3,000 shares of Apple preferred | 12/12/2020 | 172,000 | 1,300 |

| 2,100 shares of Cisco common | 8/14/2021 | 55,000 | 550 |

| 420 shares of Vanguard mutual fund | 3/2/2022 | 17,200 | No-load fund* |

*No commissions are charged when no-load mutual funds are bought and sold.

Because of the downturn in the stock market, Mr. and Mrs. Howell decided to sell most of their stocks and the mutual fund in 2022 and to reinvest in municipal bonds. The following investment assets were sold in 2022:

| Investment Assets | Date Sold | Sale Price | Broker's Commission Paid at Time of Sale |

|---|---|---|---|

| 300 shares of IBM common | 5/6 | $ 16,200 | $ 100 |

| 3,000 shares of Apple preferred | 10/5 | 223,900 | 2,000 |

| 2,100 shares of Cisco common | 8/15 | 63,500 | 650 |

| 451 shares of Vanguard mutual fund | 12/21 | 18,200 | No-load fund* |

*No commissions are charged when no-load mutual funds are bought and sold.

The Howells' broker issued them a Form 1099-B showing the sales proceeds net of the commissions paid. For example, the IBM sales proceeds were reported as $16,100 on the Form 1099-B they received.

In addition to the sales reflected in the table above, the Howells provided you with the following additional information concerning 2022:

- The Howells received a Form 1099-B from the Vanguard mutual fund reporting a $900 long-term capital gain distribution. This distribution was reinvested in 31 additional Vanguard mutual fund shares on 6/30/2022.

- In 2016, Mrs. Howell loaned $8,500 to a friend who was starting a new multilevel marketing company called LD3. The friend declared bankruptcy in 2022, and Mrs. Howell has been notified she will not be receiving any repayment of the loan.

- The Howells have a $4,800 short-term capital loss carryover and a $7,300 long-term capital loss carryover from prior years.

- The Howells did not instruct their broker to sell any particular lot of IBM stock.

- The Howells earned $4,250 in municipal bond interest, $4,250 in interest from corporate bonds, and $6,500 in qualified dividends.

- Assume the Howells have $192,500 of wage income during the year.

Comprehensive Problem 07-63 Part a (Algo)

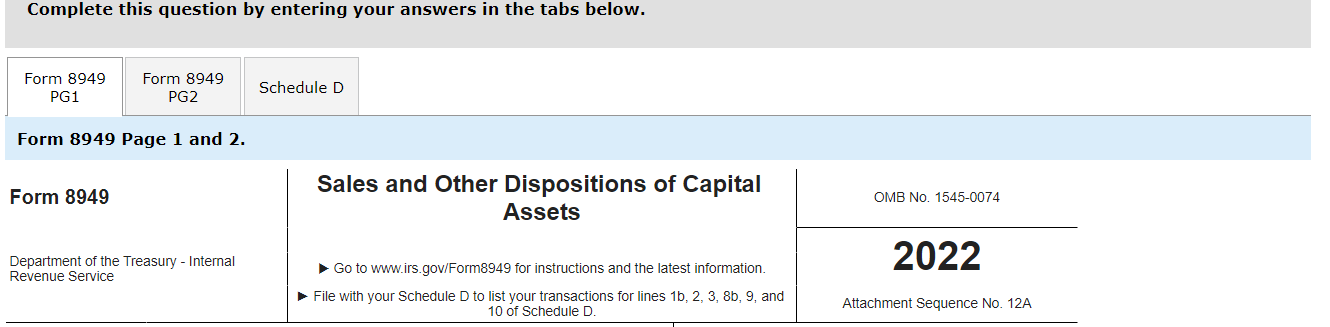

a. Use Form 8949 and page 1 of Schedule D to compute net long-term and short-term capital gains. Then, compute the Howells' tax liability for the year (ignoring the alternative minimum tax and any phase-out provisions) assuming they file a joint return, they have no dependents, they don't make any special tax elections, and their itemized deductions total $30,000. Assume that asset bases are reported to the IRS. (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.)

Mr. Howell social security number: 412-34-5670

Note: Negative amounts should be indicated by a minus sign. Use 2022 tax rules regardless of year on tax form.

Please help with this 3 Forms

Form 8949 Pade 1 and 2. Form 8949 Pade 1 and 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts