Question: Comprehensive Problem 1 Part 4 and Part 6 : The following is a comprehensive problem which encompasses all of the elements learned in previous chapters.

Comprehensive Problem

Part and Part :

The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete parts and before completing parts and Please note that part is optional.

Part : At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts and

a Insurance expired during May is $

b Supplies on hand on May are $

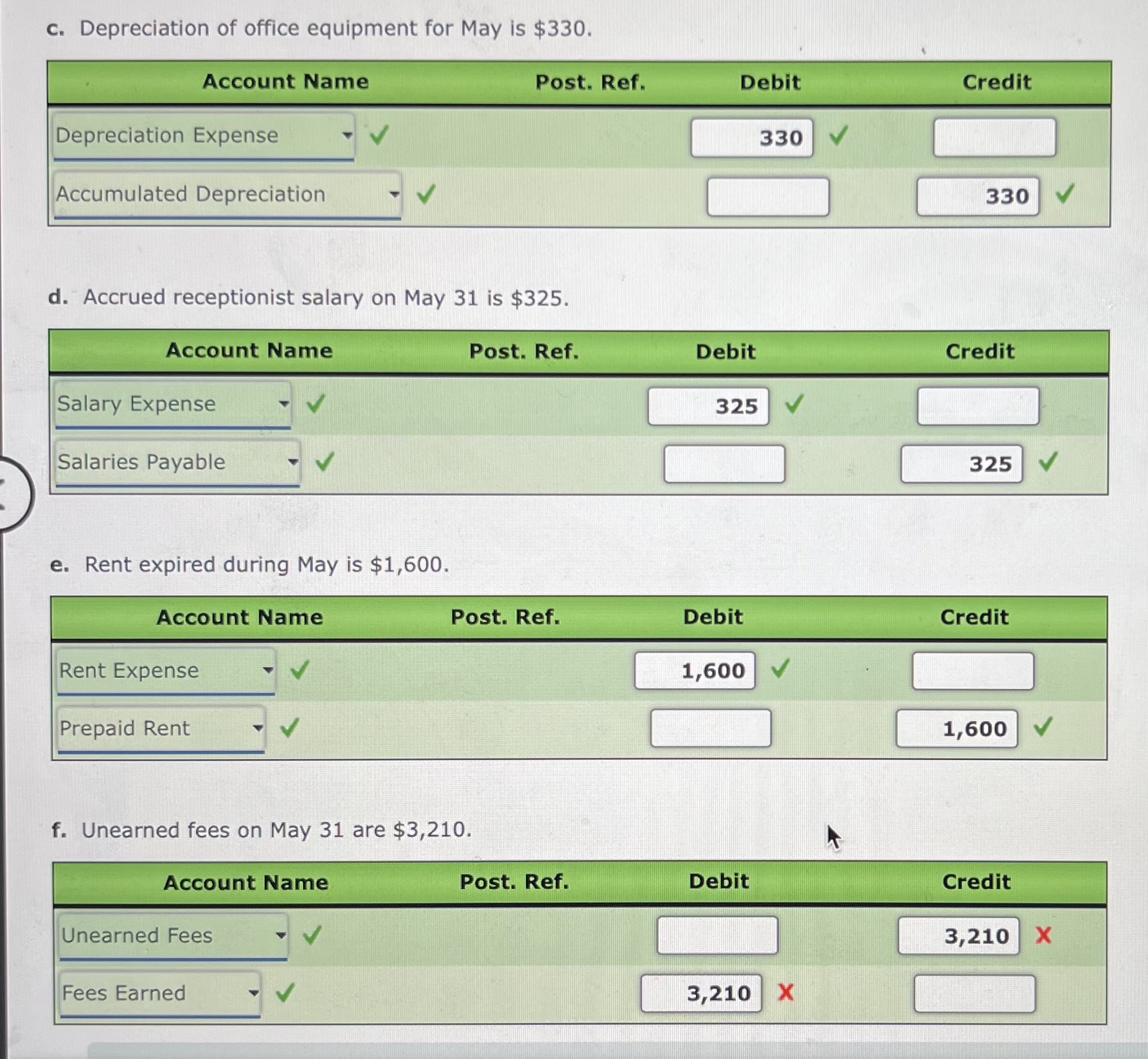

c Depreciation of office equipment for May is $

d Accrued receptionist salary on May is $

e Rent expired during May is $

f Unearned fees on May are $

Part : Journalize the adjusting entries. Then, post the entries to the attached spreadsheet from part If an amount box does not require an entry, leave it blank.

a Insurance expired during May is $

tableAccount Name,Post. Ref.,Debit,CreditInsurance Expense,Prepaid Insurance,

b Supplies on hand on May are $

tableAccount Name,Post. Ref.,Debit,CreditSupplies Expense,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock