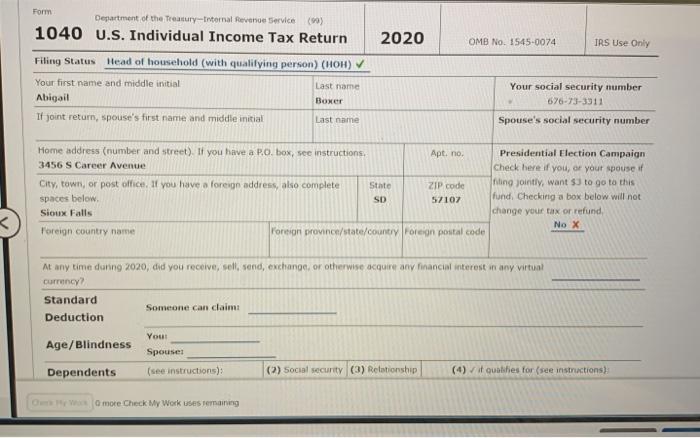

Question: Comprehensive Problem 1-2B Abigail (Abby) Boxer, age 38, is a single mother (birthdate April 28, 1982) working as a civilian accountant for the U.S. Army.

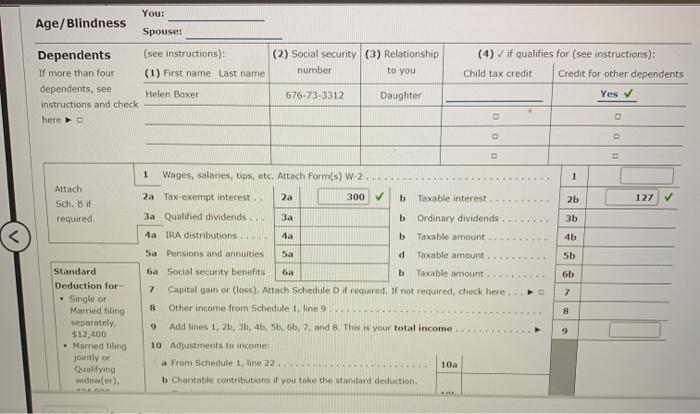

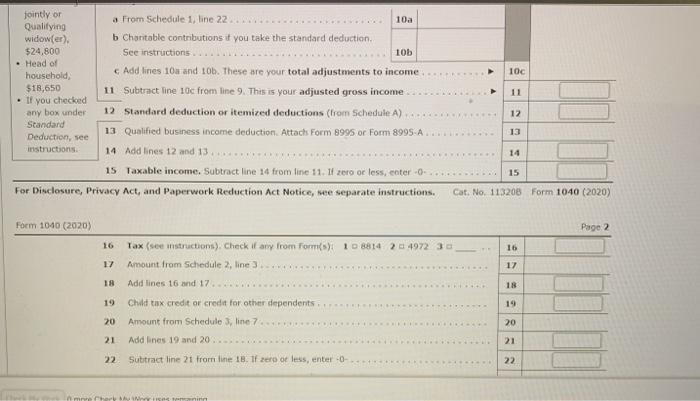

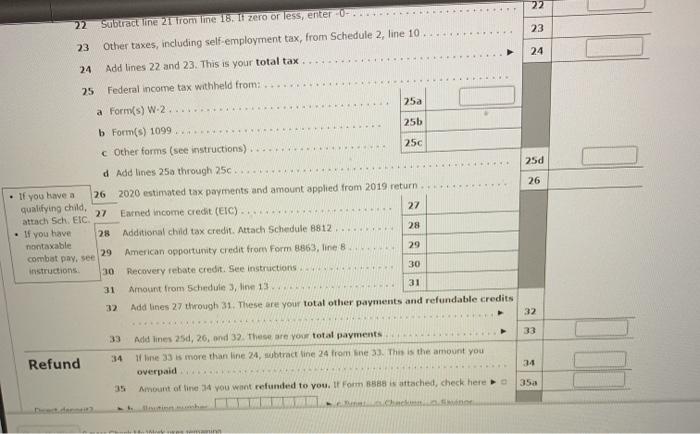

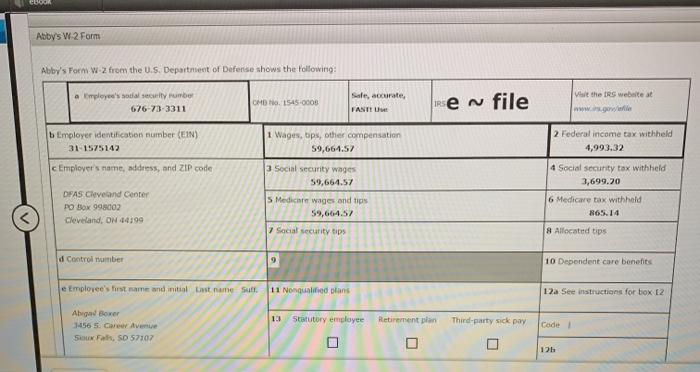

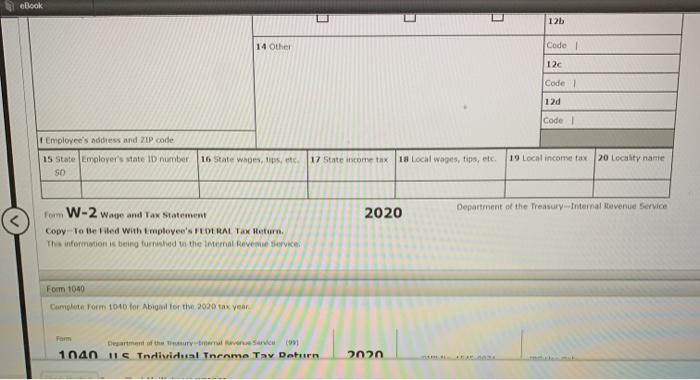

Form Department of the Treasury-internal Revenue Service (90) 1040 U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only Filing Status Head of household (with qualifying person) (HOH) Your first name and middle initial Last name Abigail Boxer If joint return, spouse's first name and middle initial Last name Your social security number 676-73-3311 Spouse's social security number Home address (number and street). If you have a PO box, see instructions, Apt. no. Presidential Election Campaign 3456 S Career Avenue Check here if you, or your spouse of City, town, or post office. If you have a foreign address, also complete State ZIP code ning jointly, want to go to this spaces below. SD 57107 fund. Checking a box below will not Sioux Falls change your tax or refund, No X Foreign country name Foreion province/state/country Foreign postal code At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual Currency? Standard Someone can claimi Deduction Age/Blindness Yout Spouse (see instructions): Dependents (2) Social security (3) Relationship (4) /it qualities for (see instructions): more Check My Works remaining Age/Blindness You: Spouse: (see instructions): (2) Social security (3) Relationship number to you (1) First name Last name Dependents If more than four dependents, see instructions and check here (4) Vif qualifies for (see instructions): Child tax credit Credit for other dependents Yes Helen Boxer 676-73-3312 Daughter 0 1 Wages, salaries, tips, etc. Attach Form(s) W 2 1 2b 127 Attach Sch. Bu required 3b 45 5b 6 2a Tax-exempt interest .. 2a 300 b Taxable interest 3a Qualified dividends. 3a b Ordinary dividends. 4a TRA distributions 4a b Taxable amount Sa Pensions and annuities 5a d Taxable amount 6a Social security benefits b Taxable amount 7 Capital gain or loss). Attach Schedule D if required, if not required, check here 8 Other income from Schedule 1, line 9 Add lines 1, 2, 3, 4, 5, 6, 7, and 8 This is your total income 10 Adjustments to income: a From Schedule 1, line 22. 10a b Charitable contributions if you take the standard deduction 7 Standard Deduction for Single or Married filing separately $12,400 Married filing jointly of Qualifying widower), 8 9 100 jointly or a From Schedule 1, line 22 10a Qualifying widower), b Charitable contributions if you take the standard deduction $24,800 See instructions 10b Head of household, Add lines 10 and tob. These are your total adjustments to income $18,650 11 Subtract line 10c from line 9. This is your adjusted gross income . If you checked any box under 12 Standard deduction or itemized deductions (from Schedule A) Standard Deduction, see 13 Qualified business income deduction. Attach Form 8995 or Form 8995 A... instructions 14 Add lines 12 and 13 15 Taxable income. Subtract line 14 from line 11. If zero or less, coter.0- For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. 12 13 14 15 Cat. No. 113208 Form 1040 (2020) Form 1040 (2020) Page 2 16 16 17 12 18 18 Tax (see instructions). Check it any from form(s) 1 0 8814 2 4972 36 Amount from Schedule 2, line 3 Add lines 16 and 17.. Child tax credit or credit for other dependents Amount from Schedule 3, line 7 Add lines 19 and 20. 19 19 20 20 21 21 22 Suttract line 21 from line 18. If zero or less, enter -- 22 min 22 22 23 23 24 Subtract line 21 from line 18. I zero or less enter - Other taxes, including self-employment tax, from Schedule 2, line 10 Add lines 22 and 23. This is your total tax Federal income tax withheld from: 24 25 25a a Form(s) W-2 250 26 b Form(s) 1099 25b c Other forms (see instructions) 250 d Add lines 25a through 25c If you have a 26 2020 estimated tax payments and amount applied from 2019 return qualifying child, 27 Earned Income credit (EIC)... 27 attach Sch. EIC If you have 28 Additional child tax credit. Attach Schedule 8812 28 nontaxable 29 29 combat pay, see American opportunity credit fron Form 8863, line 8 instructions 30 Recovery rebate credit. See instructions 30 31 Amount from schedule, line 13 31 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 33 34 Refund Add lines 25d, 26, and 32. These are your total payments 1 line 33 is more than line 24, subtract line 24 from ine3J. This is the amount you overpaid Amount of line 4 you want refunded to you. It Form is attached, check here 34 350 Chic CBOOK Abby's W2 Form Abby's Form W-2 from the U.S. Department of Defense shows the following: Employee's social security rumber 676-73-3311 CMD No. 1545.0006 Sale, accurate, FANTTU en file Visit the IRS website at www.gr b Employer identification number (EIN) 31-1575142 c Employer's name, address, and ZIP code 1 Wages, bps, other compensation 59,664.57 3 Social security wages 59,664.57 Medicine wages and tips 59,664.57 7 Social security tips 2 Federal income tax withheld 4,993.32 4 Social security tax withheld 3,699.20 6 Medicare tax withheld DEAS Cleveland Center PO Box 999002 Cleveland, OH 44199 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial ist name su 11 Nonqualified plans 12a See instructions for box 12 13 Statutory employee Retirement plan Abgasd Bower 1456 5. Can Avenue Sioux Falls, SD 57107 Third-party sick pay Code 1 U 12 eBook 5 12b 14 Other Code 12 Code 1 120 Code Employee's address and ZIP code 15 State Employer's state ID number SO 16 state who, lips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Department of the Treasury Internal Revenue Service 2020 Form W-2 wage and Tax Statement Copy-To Be Filed with Em 's FEDERAL TAX Return The information is being tomated the mernal Revenue Service Form 1040 Complete Form 1040 for Abigail for the 2020 sax year 09 Dartment of the war 104 S. Individual Tnrame Tax Return 2020 Form Department of the Treasury-internal Revenue Service (90) 1040 U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only Filing Status Head of household (with qualifying person) (HOH) Your first name and middle initial Last name Abigail Boxer If joint return, spouse's first name and middle initial Last name Your social security number 676-73-3311 Spouse's social security number Home address (number and street). If you have a PO box, see instructions, Apt. no. Presidential Election Campaign 3456 S Career Avenue Check here if you, or your spouse of City, town, or post office. If you have a foreign address, also complete State ZIP code ning jointly, want to go to this spaces below. SD 57107 fund. Checking a box below will not Sioux Falls change your tax or refund, No X Foreign country name Foreion province/state/country Foreign postal code At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual Currency? Standard Someone can claimi Deduction Age/Blindness Yout Spouse (see instructions): Dependents (2) Social security (3) Relationship (4) /it qualities for (see instructions): more Check My Works remaining Age/Blindness You: Spouse: (see instructions): (2) Social security (3) Relationship number to you (1) First name Last name Dependents If more than four dependents, see instructions and check here (4) Vif qualifies for (see instructions): Child tax credit Credit for other dependents Yes Helen Boxer 676-73-3312 Daughter 0 1 Wages, salaries, tips, etc. Attach Form(s) W 2 1 2b 127 Attach Sch. Bu required 3b 45 5b 6 2a Tax-exempt interest .. 2a 300 b Taxable interest 3a Qualified dividends. 3a b Ordinary dividends. 4a TRA distributions 4a b Taxable amount Sa Pensions and annuities 5a d Taxable amount 6a Social security benefits b Taxable amount 7 Capital gain or loss). Attach Schedule D if required, if not required, check here 8 Other income from Schedule 1, line 9 Add lines 1, 2, 3, 4, 5, 6, 7, and 8 This is your total income 10 Adjustments to income: a From Schedule 1, line 22. 10a b Charitable contributions if you take the standard deduction 7 Standard Deduction for Single or Married filing separately $12,400 Married filing jointly of Qualifying widower), 8 9 100 jointly or a From Schedule 1, line 22 10a Qualifying widower), b Charitable contributions if you take the standard deduction $24,800 See instructions 10b Head of household, Add lines 10 and tob. These are your total adjustments to income $18,650 11 Subtract line 10c from line 9. This is your adjusted gross income . If you checked any box under 12 Standard deduction or itemized deductions (from Schedule A) Standard Deduction, see 13 Qualified business income deduction. Attach Form 8995 or Form 8995 A... instructions 14 Add lines 12 and 13 15 Taxable income. Subtract line 14 from line 11. If zero or less, coter.0- For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. 12 13 14 15 Cat. No. 113208 Form 1040 (2020) Form 1040 (2020) Page 2 16 16 17 12 18 18 Tax (see instructions). Check it any from form(s) 1 0 8814 2 4972 36 Amount from Schedule 2, line 3 Add lines 16 and 17.. Child tax credit or credit for other dependents Amount from Schedule 3, line 7 Add lines 19 and 20. 19 19 20 20 21 21 22 Suttract line 21 from line 18. If zero or less, enter -- 22 min 22 22 23 23 24 Subtract line 21 from line 18. I zero or less enter - Other taxes, including self-employment tax, from Schedule 2, line 10 Add lines 22 and 23. This is your total tax Federal income tax withheld from: 24 25 25a a Form(s) W-2 250 26 b Form(s) 1099 25b c Other forms (see instructions) 250 d Add lines 25a through 25c If you have a 26 2020 estimated tax payments and amount applied from 2019 return qualifying child, 27 Earned Income credit (EIC)... 27 attach Sch. EIC If you have 28 Additional child tax credit. Attach Schedule 8812 28 nontaxable 29 29 combat pay, see American opportunity credit fron Form 8863, line 8 instructions 30 Recovery rebate credit. See instructions 30 31 Amount from schedule, line 13 31 Add lines 27 through 31. These are your total other payments and refundable credits 32 33 33 34 Refund Add lines 25d, 26, and 32. These are your total payments 1 line 33 is more than line 24, subtract line 24 from ine3J. This is the amount you overpaid Amount of line 4 you want refunded to you. It Form is attached, check here 34 350 Chic CBOOK Abby's W2 Form Abby's Form W-2 from the U.S. Department of Defense shows the following: Employee's social security rumber 676-73-3311 CMD No. 1545.0006 Sale, accurate, FANTTU en file Visit the IRS website at www.gr b Employer identification number (EIN) 31-1575142 c Employer's name, address, and ZIP code 1 Wages, bps, other compensation 59,664.57 3 Social security wages 59,664.57 Medicine wages and tips 59,664.57 7 Social security tips 2 Federal income tax withheld 4,993.32 4 Social security tax withheld 3,699.20 6 Medicare tax withheld DEAS Cleveland Center PO Box 999002 Cleveland, OH 44199 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial ist name su 11 Nonqualified plans 12a See instructions for box 12 13 Statutory employee Retirement plan Abgasd Bower 1456 5. Can Avenue Sioux Falls, SD 57107 Third-party sick pay Code 1 U 12 eBook 5 12b 14 Other Code 12 Code 1 120 Code Employee's address and ZIP code 15 State Employer's state ID number SO 16 state who, lips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Department of the Treasury Internal Revenue Service 2020 Form W-2 wage and Tax Statement Copy-To Be Filed with Em 's FEDERAL TAX Return The information is being tomated the mernal Revenue Service Form 1040 Complete Form 1040 for Abigail for the 2020 sax year 09 Dartment of the war 104 S. Individual Tnrame Tax Return 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts