Question: Comprehensive problem 2. Part 5 and 7 Please help! For a compound transaction, if an amount box does not require an entry, leave it blank

Comprehensive problem 2. Part 5 and 7 Please help!

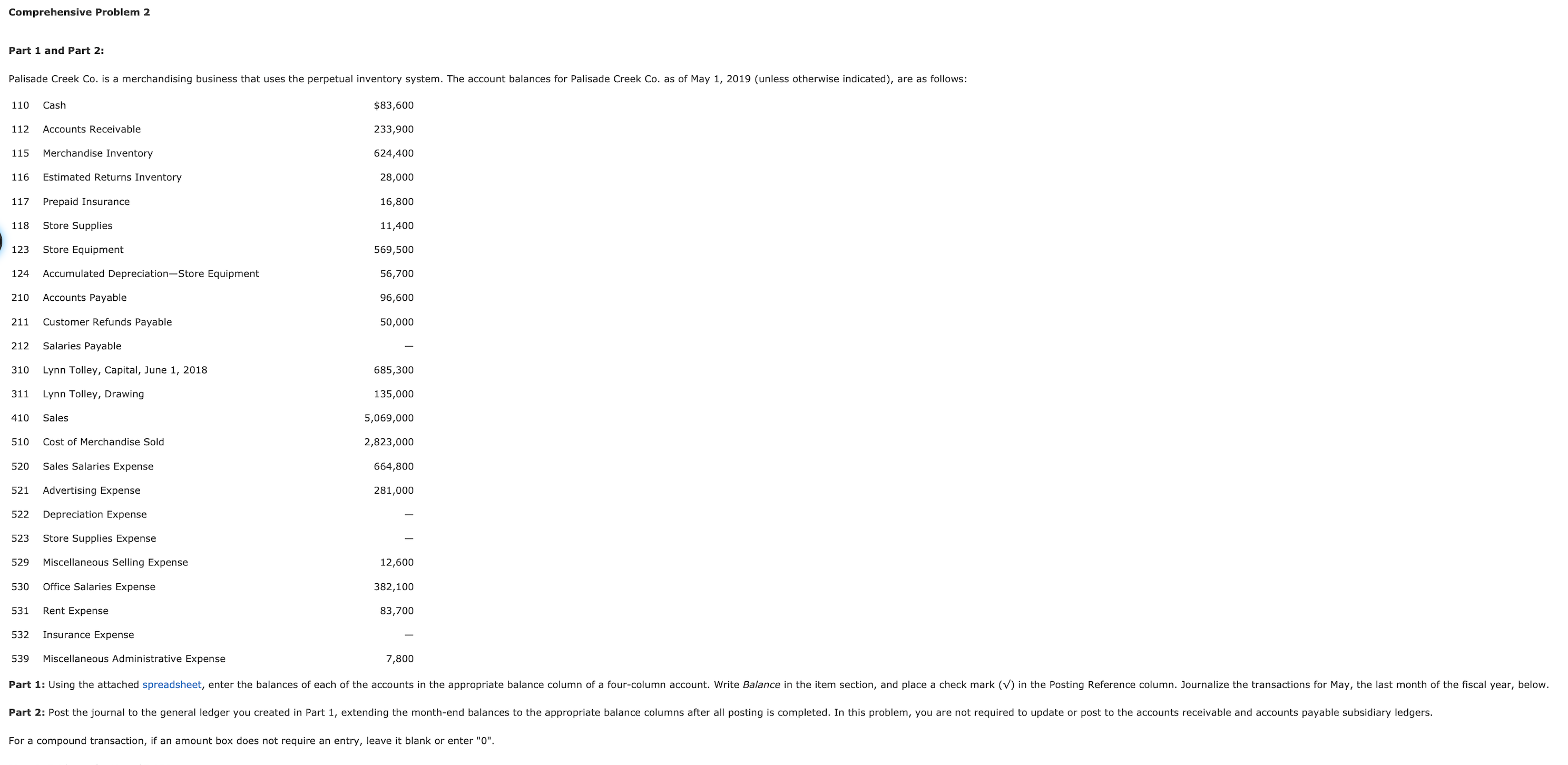

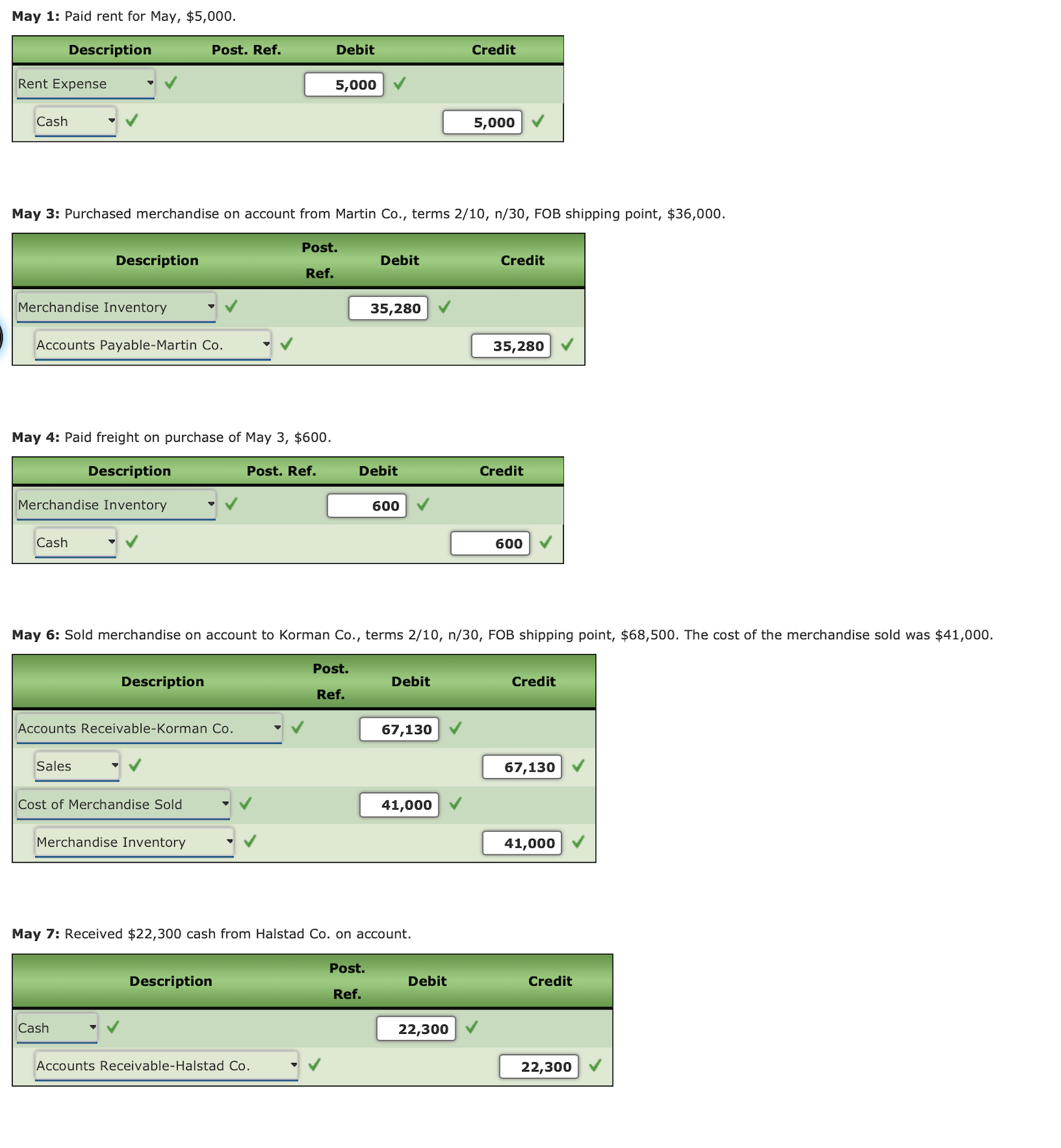

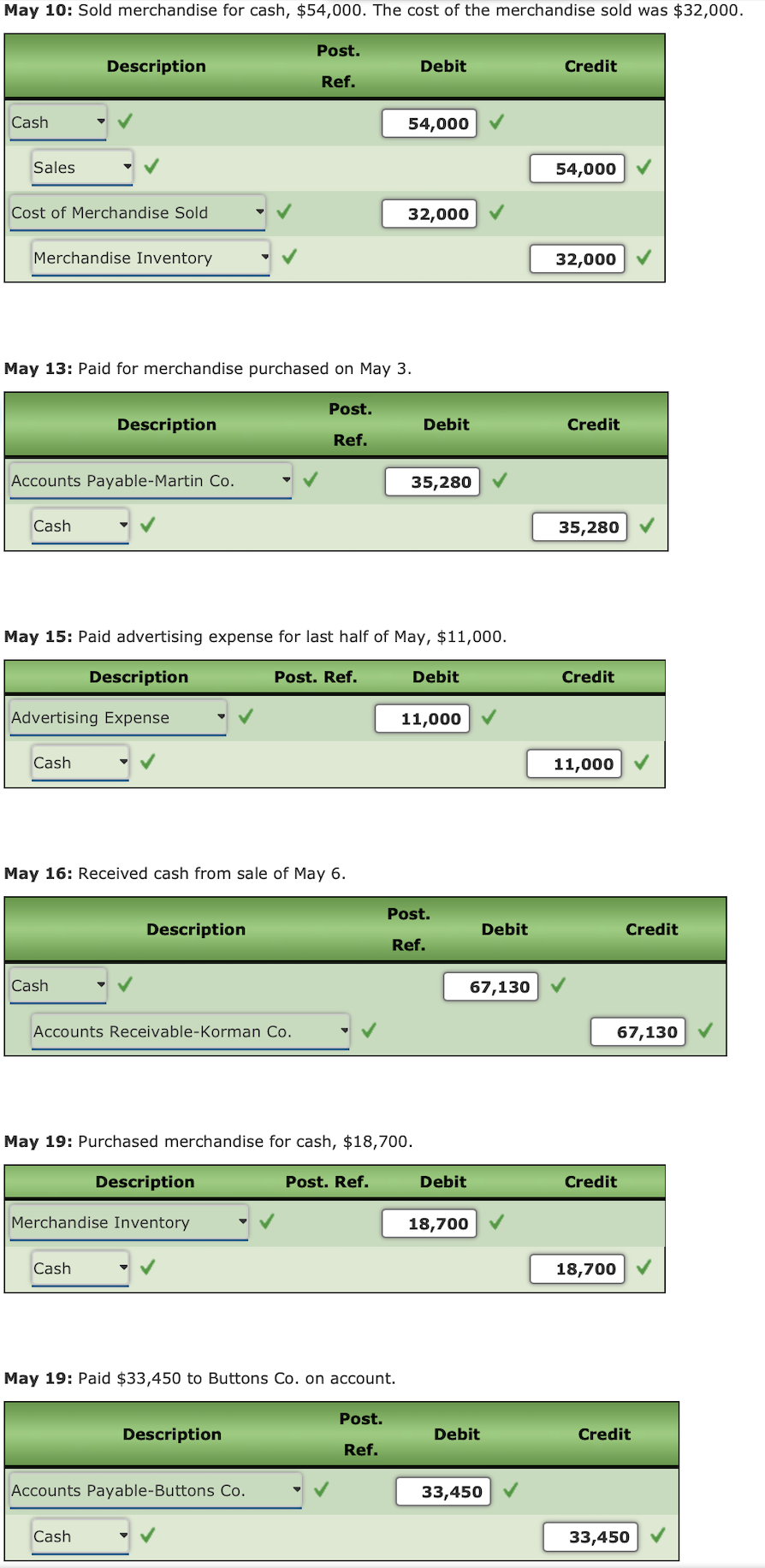

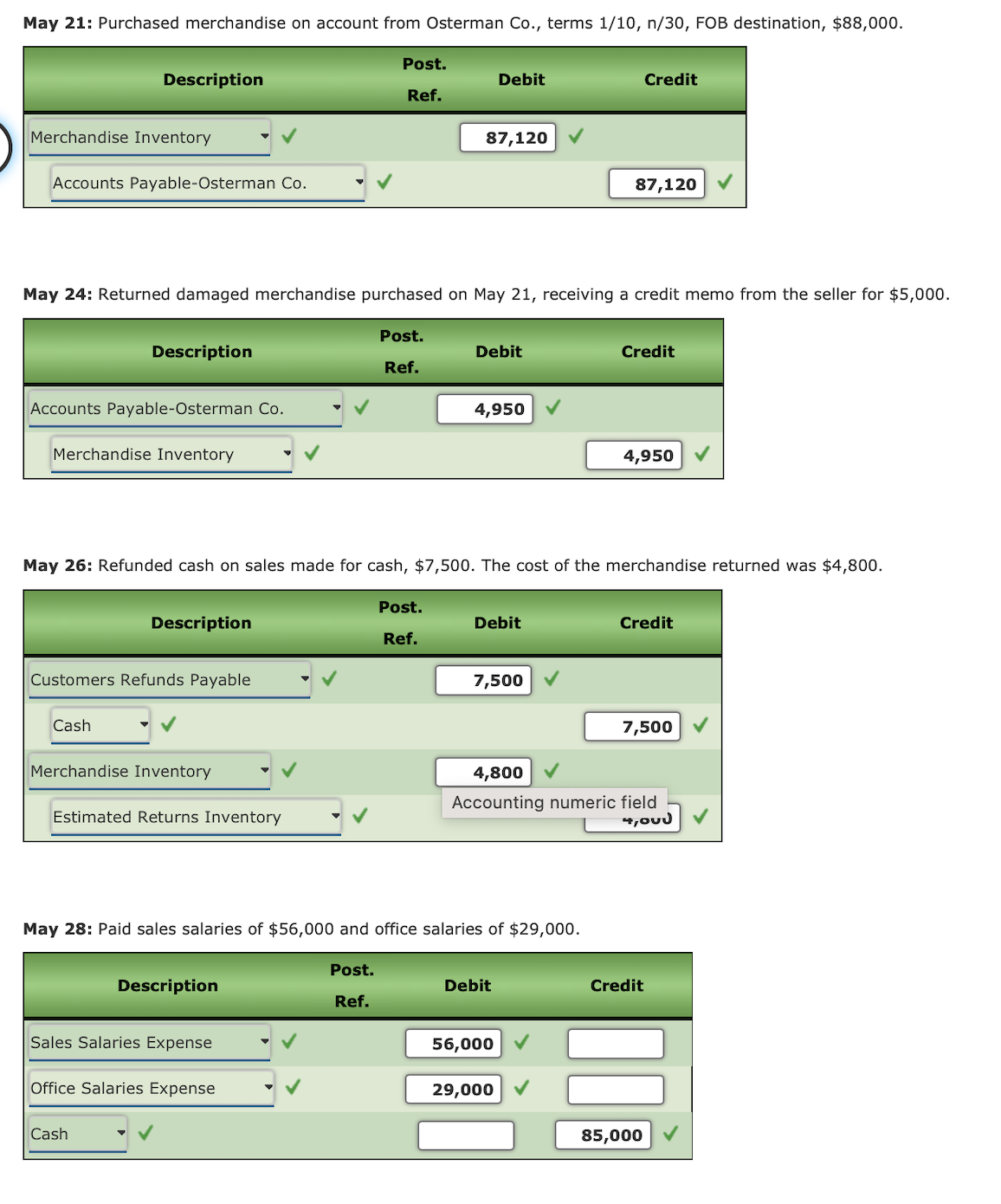

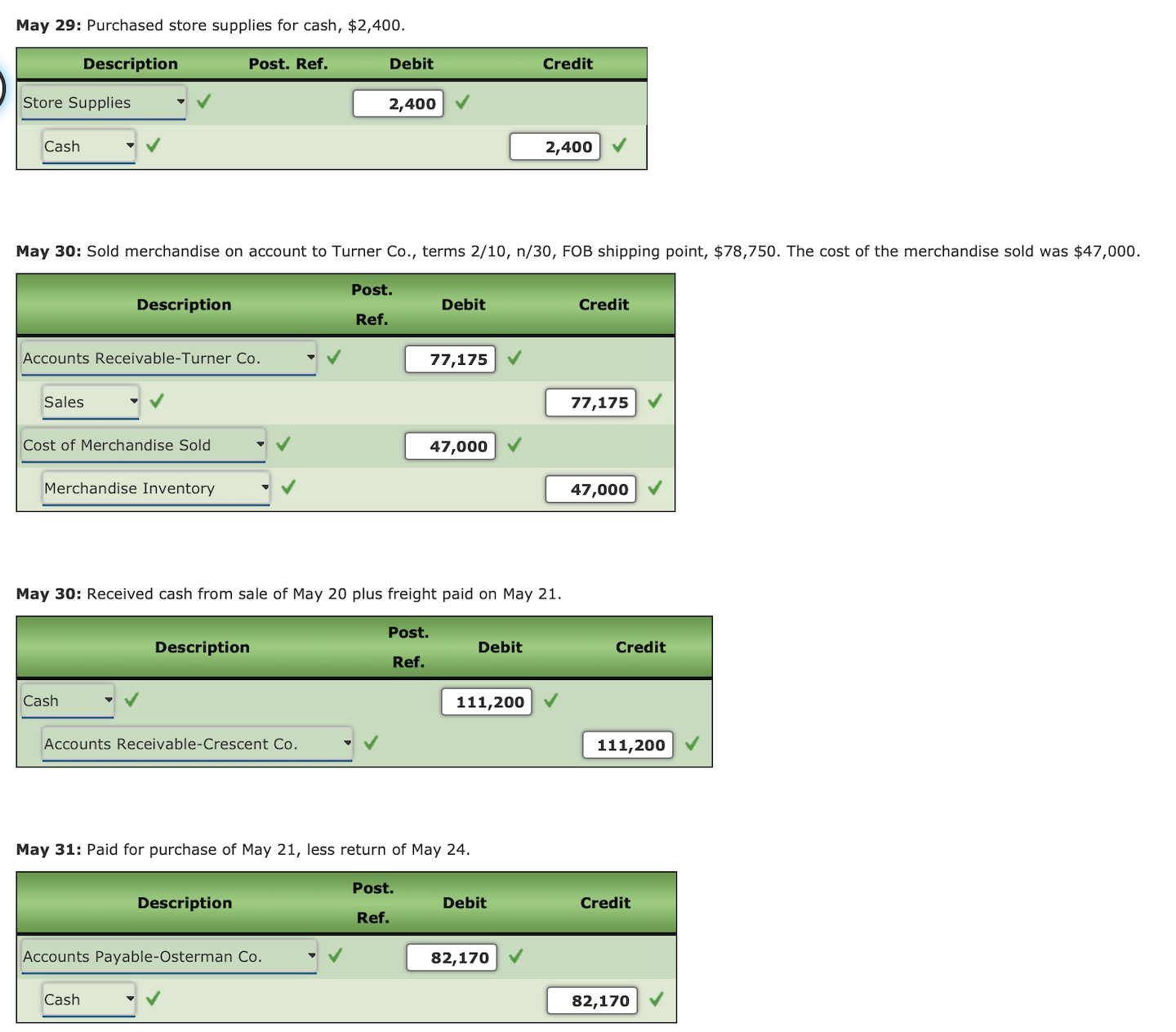

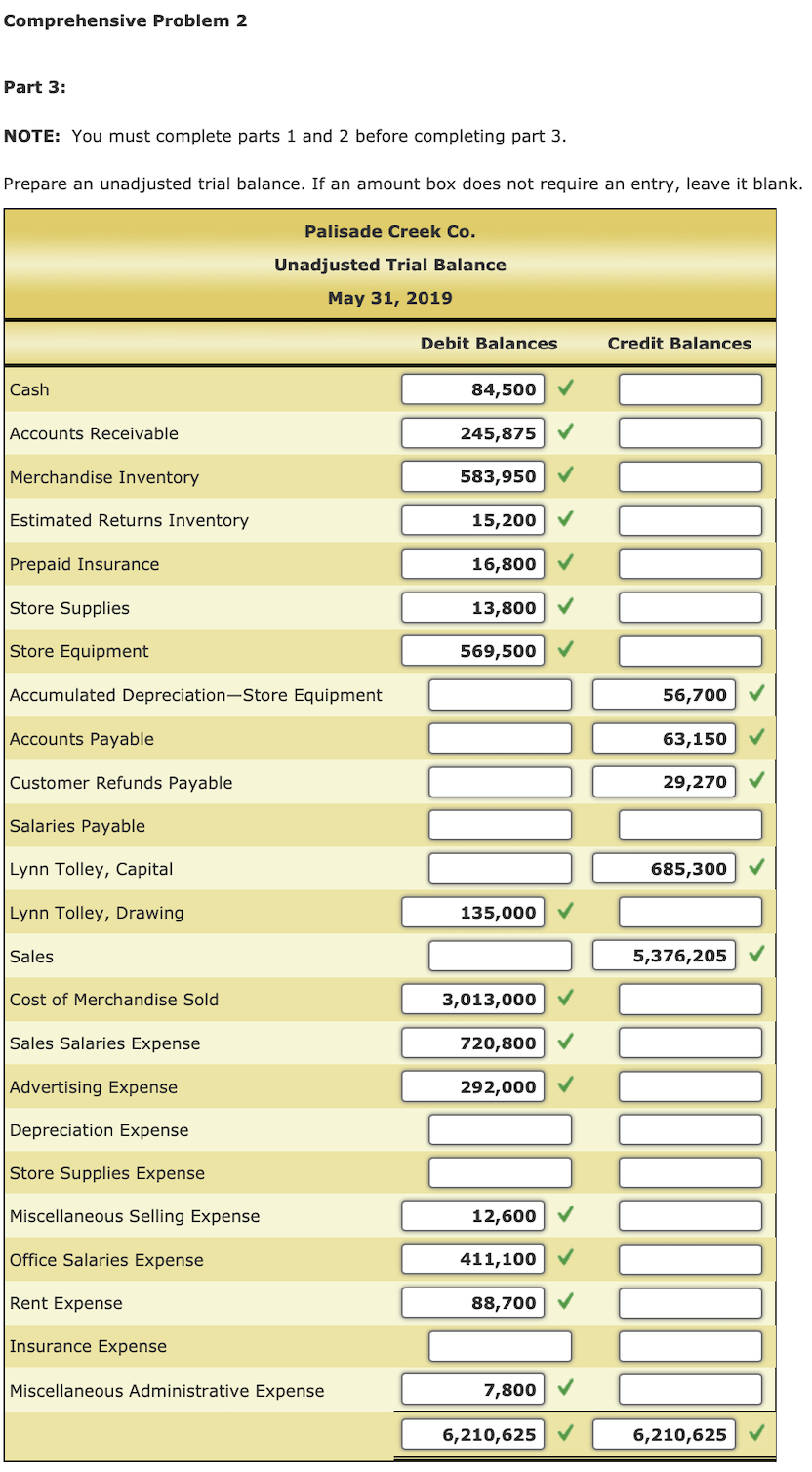

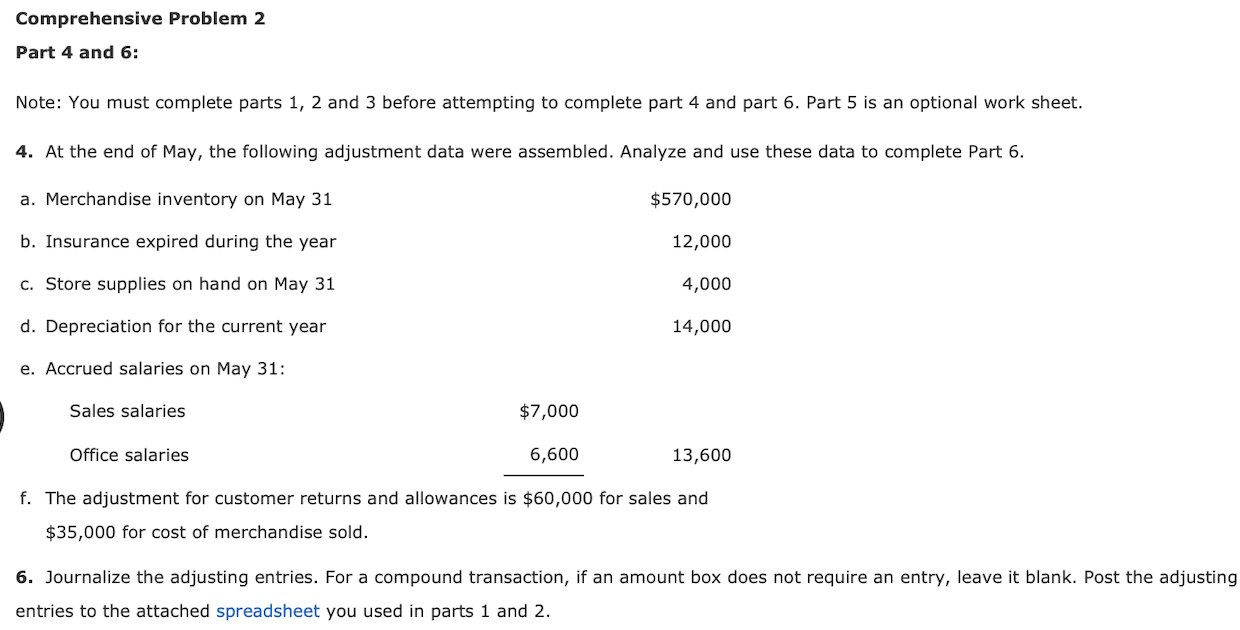

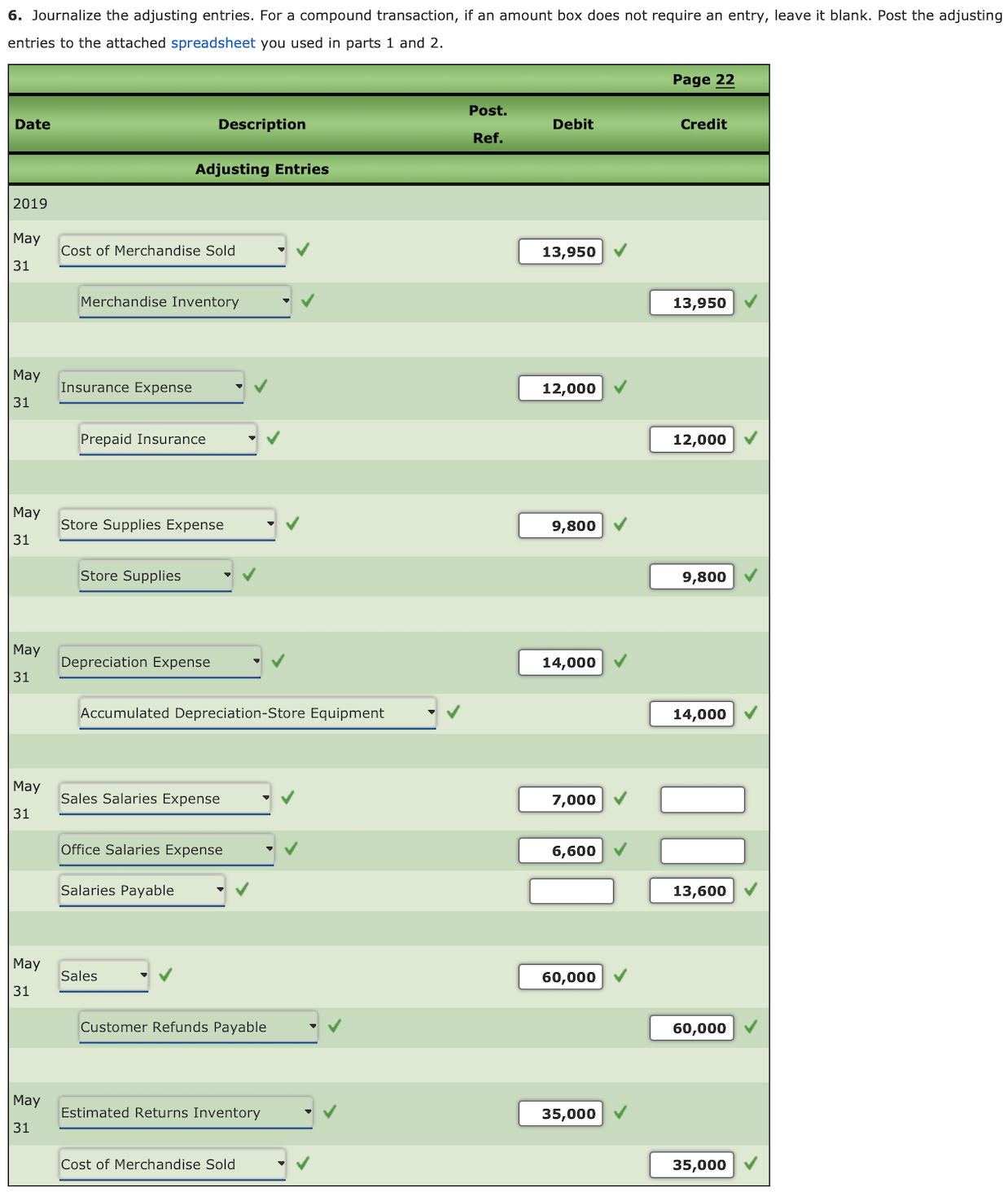

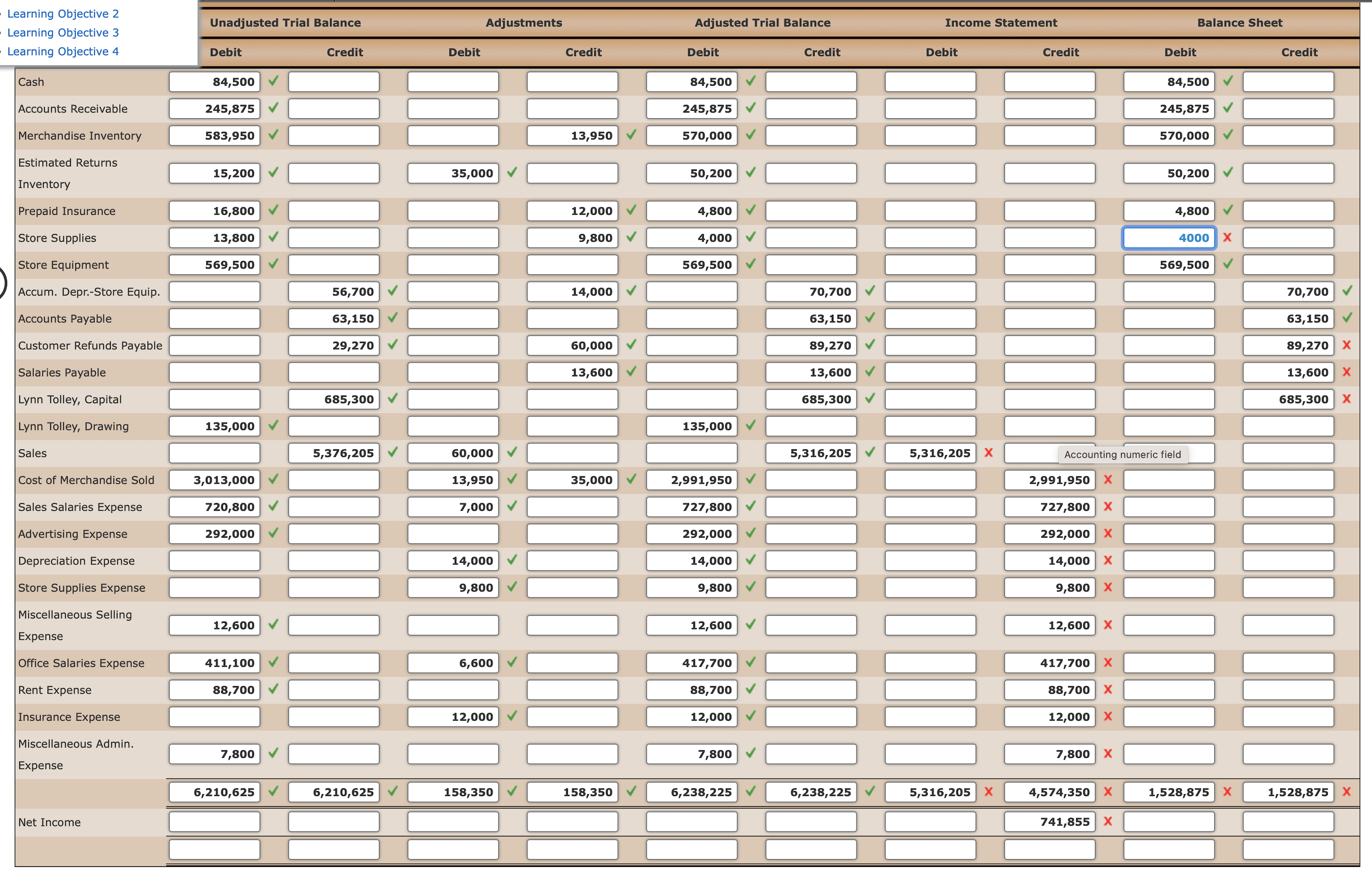

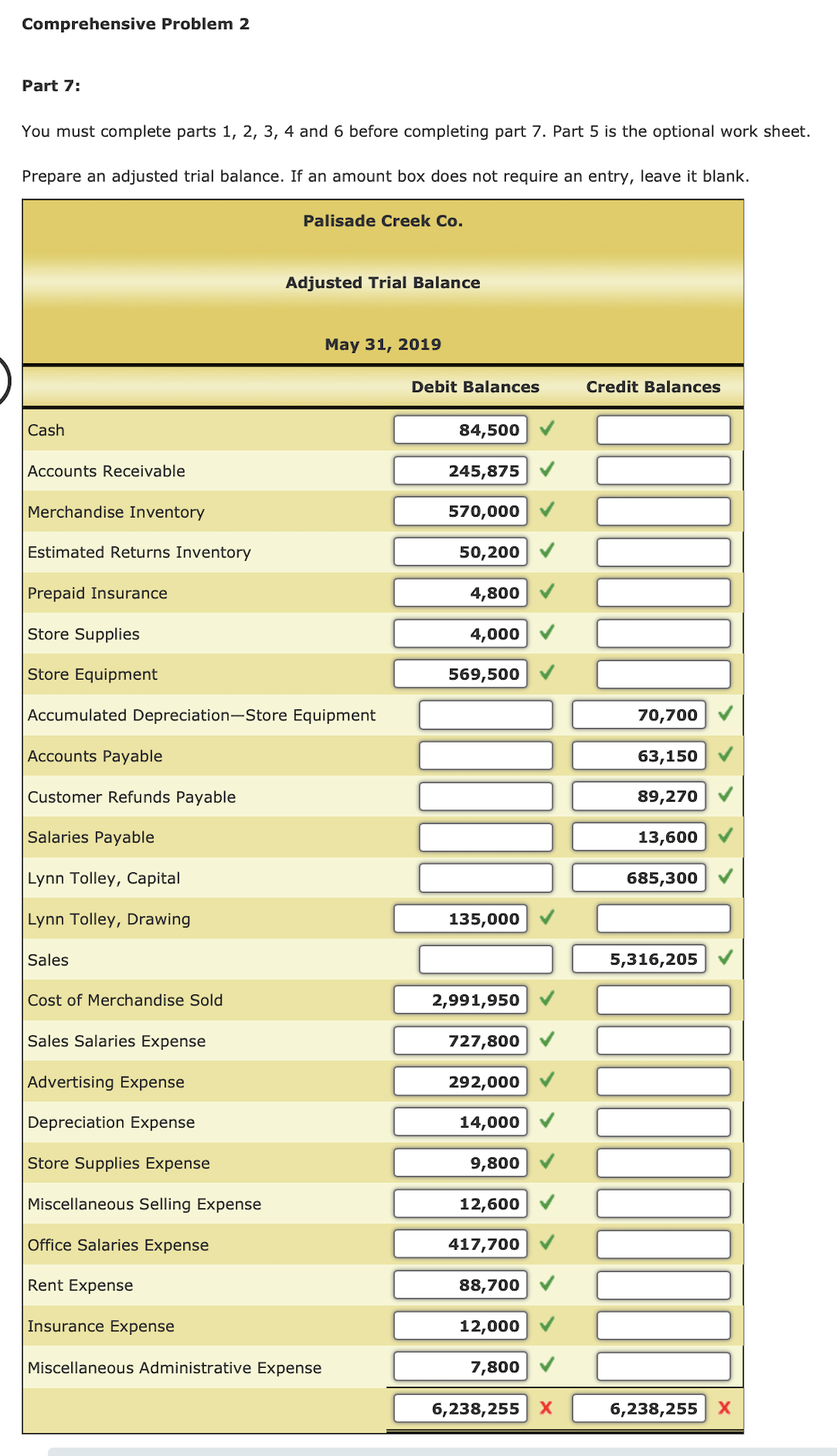

For a compound transaction, if an amount box does not require an entry, leave it blank or enter "0". May 1: Paid rent for May, $5,000. May 3: Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, \$36,000. May 4: Paid freight on purchase of May 3, $600. May 6: Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, \$68,500. The cost May 7: Received $22,300 cash from Halstad Co. on account. May 13: Paid for merchandise purchased on May 3. May 15: Paid advertising expense for last half of May, $11,000. May 16: Received cash from sale of May 6. May 19: Purchased merchandise for cash, $18,700. May 19: Paid $33,450 to Buttons Co. on account. May 24: Returned damaged merchandise purchased on May 21 , receiving a credit memo from the seller for $5,000. May 26: Refunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800. May 28: Paid sales salaries of $56,000 and office salaries of $29,000. May 29: Purchased store supplies for cash, $2,400. May 30: Sold merchandise on account to Turner Co., terms 2/10, n/30, FC May 30: Received cash from sale of May 20 plus freight paid on May 21. May 31: Paid for purchase of May 21, less return of May 24. Comprehensive Problem 2 Part 3: NOTE: You must complete parts 1 and 2 before completing part 3. Note: You must complete parts 1, 2 and 3 before attempting to complete part 4 and part 6 . Part 5 is an optional work sheet. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6 . f. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of merchandise sold. 6. Journalize the adjusting entries. For a compound transaction, if an amount box does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2 . save it blank. Post the adjusting Part 7: You must complete parts 1, 2, 3,4 and 6 before completing part 7. Part 5 is the optional work sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts