Question: COMPREHENSIVE PROBLEM #2 Saved Help Save & Exit Submit Check my work Christian Everland (SS# 412-34-5670) is single and resides at 3554 Arrival Road, Apartment

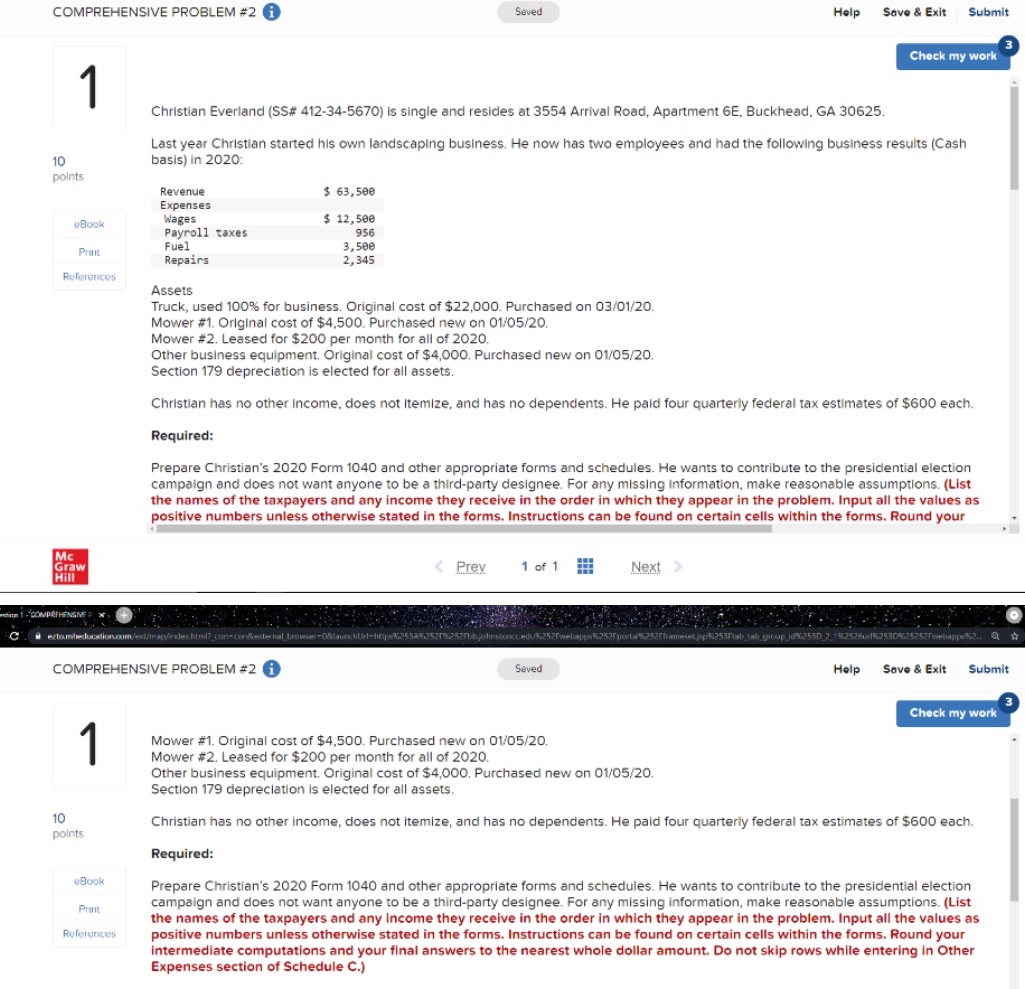

COMPREHENSIVE PROBLEM #2 Saved Help Save & Exit Submit Check my work Christian Everland (SS# 412-34-5670) is single and resides at 3554 Arrival Road, Apartment 6E, Buckhead, GA 30625. Last year Christian started his own landscaping business. He now has two employees and had the following business results (Cash 10 basis) in 2020: points Revenue $ 63, 500 Expenses Book Wages $ 12, 50e Payroll taxes 956 Print Fuel 3,50e Repairs 2,345 References Assets Truck, used 100% for business. Original cost of $22,000. Purchased on 03/01/20. Mower #1. Original cost of $4.500. Purchased new on 01/05/20. Mower #2. Leased for $200 per month for all of 2020. Other business equipment. Original cost of $4,000. Purchased new on 01/05/20. Section 179 depreciation is elected for all assets. Christian has no other Income, does not Itemize, and has no dependents. He paid four quarterly federal tax estimates of $600 each. Required: Prepare Christian's 2020 Form 1040 and other appropriate forms and schedules. He wants to contribute to the presidential election campaign and does not want anyone to be a third-party designee. For any missing information, make reasonable assumptions. (List the names of the taxpayers and any income they receive in the order in which they appear in the problem. Input all the values as positive numbers unless otherwise stated in the forms. Instructions can be found on certain cells within the forms. Round your Graw " 1-"COMPREHENSME F COMPREHENSIVE PROBLEM #2 Seved Help Save & Exit Submit Check my work Mower #1. Original cost of $4,500. Purchased new on 01/05/20. Mower #2. Leased for $200 per month for all of 2020. Other business equipment. Original cost of $4,000. Purchased new on 01/05/20. Section 179 depreciation is elected for all assets. 10 Christian has no other income, does not itemize, and has no dependents. He paid four quarterly federal tax estimates of $600 each. points Required: eBook Prepare Christian's 2020 Form 1040 and other appropriate forms and schedules. He wants to contribute to the presidential election Print campaign and does not want anyone to be a third-party designee. For any missing information, make reasonable assumptions. (List the names of the taxpayers and any income they receive in the order in which they appear in the problem. Input all the values as References positive numbers unless otherwise stated in the forms. Instructions can be found on certain cells within the forms. Round your intermediate computations and your final answers to the nearest whole dollar amount. Do not skip rows while entering in Other Expenses section of Schedule C.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts