Question: COMPREHENSIVE PROBLEM 2 With Emphasis on Schedule A eyes are husband and wife and file a joint return. They live at 5677 3722. Jamie's social

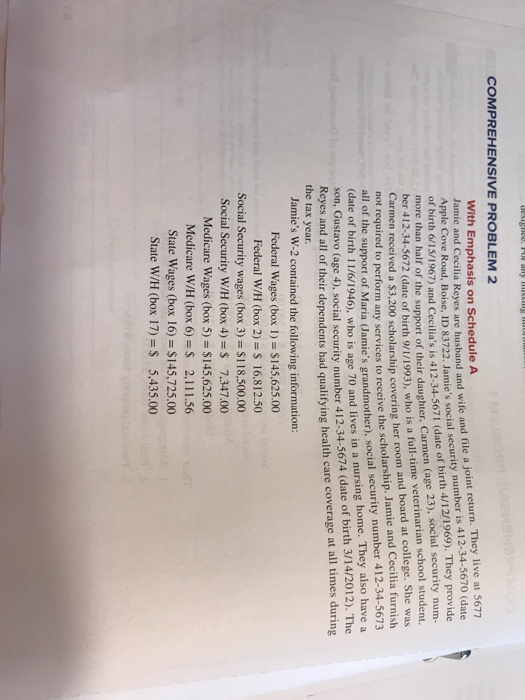

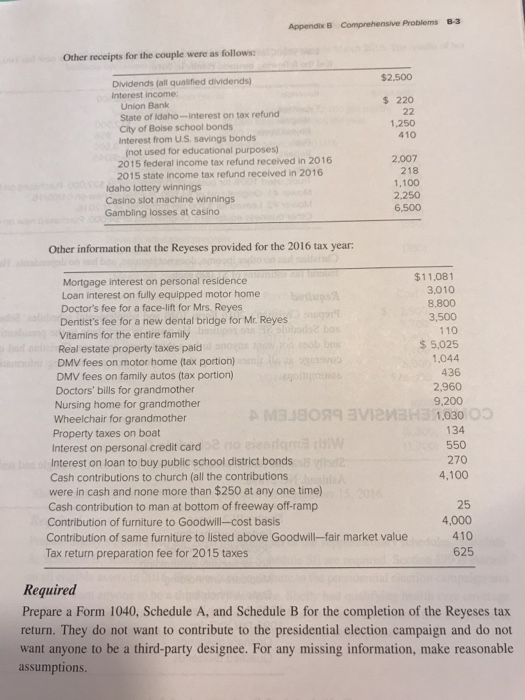

COMPREHENSIVE PROBLEM 2 With Emphasis on Schedule A eyes are husband and wife and file a joint return. They live at 5677 3722. Jamie's social security number is 412-34-5670 (date and Cecilia's is 412-34-5671 (date of birth 4/12/1969). They provide f their daughter, Carmen (age 23), social security num- Apple Cove Road, Boise, ID 8 more than half of the support o ber 412-34-5672 (date of birth 9/1/1993), who is a full-time veterinarian school student. Carmen received a $3,200 scholarship covering her room and board at college. She was not required to perform any services to receive the scholarship. Jamie and Cecilia furnish all of the support of Maria (Jamie's grandmother), social security number 412-34-5673 ate of birth 11/6/1946), who is age 70 and lives in a nursing home. They also have a n, Gustavo (age 4), social security number 412-34-5674 (date of birth 3/14/2012). The (da so Reyes and all of their dependents had qualifying health care coverage at all times during the tax year. Jamie's W-2 contained the following information: Federal Wages (box 1) $145,625.00 Federal W/H (box 2) = $ 16,812.50 Social Security wages (box 3) $118,500.00 Social Security W/H (box 4) = $ 7347.00 Medicare wages (box 5) = $145,625.00 Medicare w/H (box 6) = $ 2.11 1.56 State Wages (box 16) = $145,725.00 State W/H (box 17) = $ 5,435.00 COMPREHENSIVE PROBLEM 2 With Emphasis on Schedule A eyes are husband and wife and file a joint return. They live at 5677 3722. Jamie's social security number is 412-34-5670 (date and Cecilia's is 412-34-5671 (date of birth 4/12/1969). They provide f their daughter, Carmen (age 23), social security num- Apple Cove Road, Boise, ID 8 more than half of the support o ber 412-34-5672 (date of birth 9/1/1993), who is a full-time veterinarian school student. Carmen received a $3,200 scholarship covering her room and board at college. She was not required to perform any services to receive the scholarship. Jamie and Cecilia furnish all of the support of Maria (Jamie's grandmother), social security number 412-34-5673 ate of birth 11/6/1946), who is age 70 and lives in a nursing home. They also have a n, Gustavo (age 4), social security number 412-34-5674 (date of birth 3/14/2012). The (da so Reyes and all of their dependents had qualifying health care coverage at all times during the tax year. Jamie's W-2 contained the following information: Federal Wages (box 1) $145,625.00 Federal W/H (box 2) = $ 16,812.50 Social Security wages (box 3) $118,500.00 Social Security W/H (box 4) = $ 7347.00 Medicare wages (box 5) = $145,625.00 Medicare w/H (box 6) = $ 2.11 1.56 State Wages (box 16) = $145,725.00 State W/H (box 17) = $ 5,435.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts