Question: Comprehensive Problem 22-86 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) Skip to question While James Craig and his former

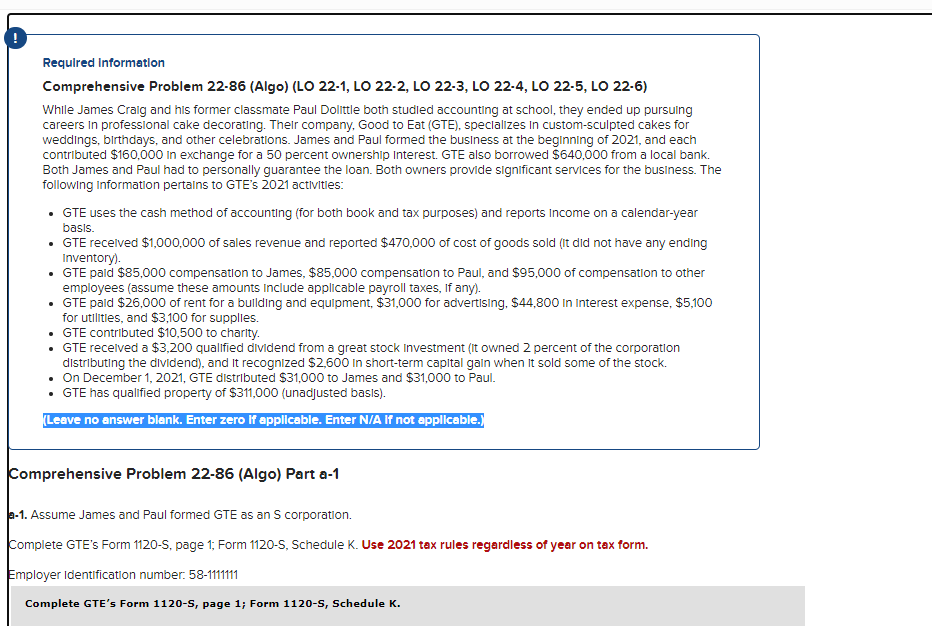

Comprehensive Problem 22-86 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) Skip to question While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company, Good to Eat (GTE), specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contribcuted $160,000 in exchange for a 50 percent ownComprehensive Problem 22-86 (Algo) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6)

Skip to question

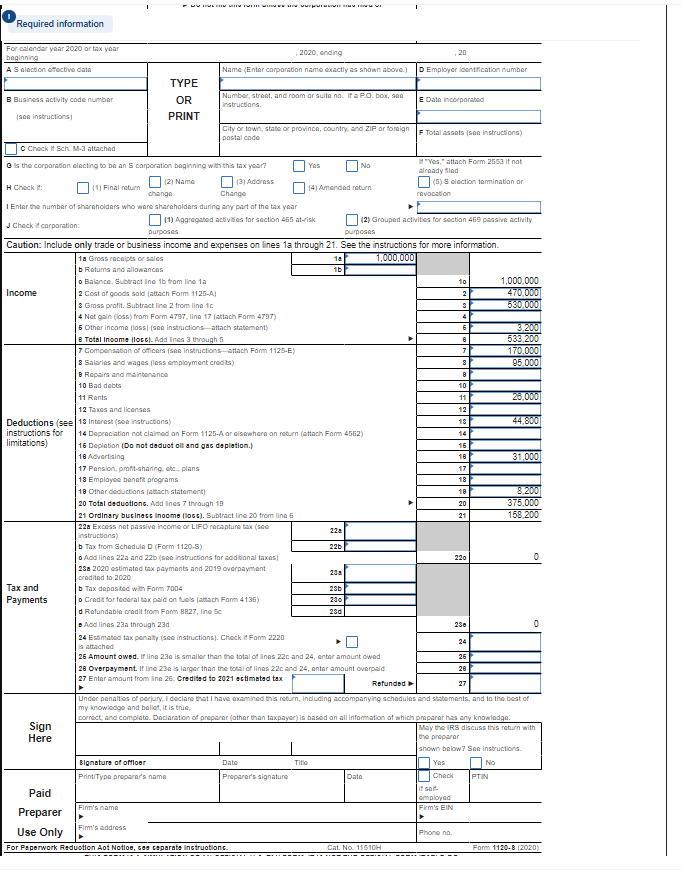

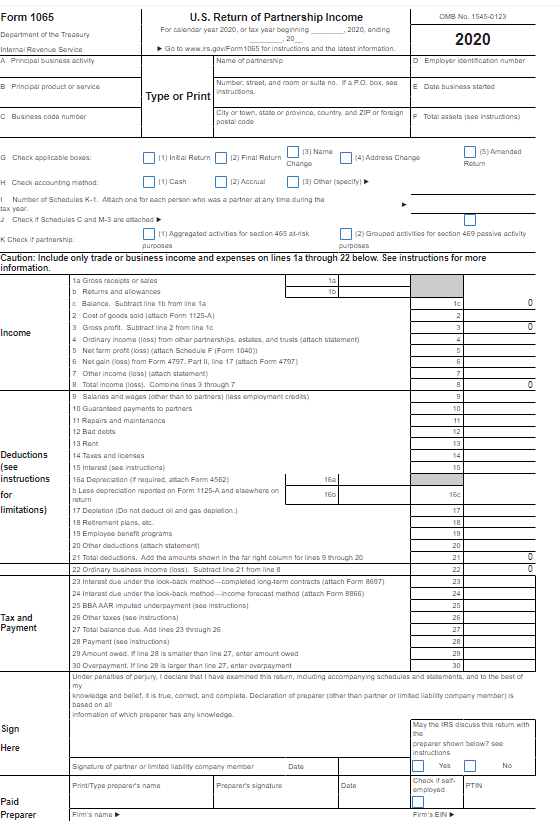

While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Their company, Good to Eat (GTE), specializes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contributed $160,000 in exchange for a 50 percent ownership interest. GTE also borrowed $640,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following information pertains to GTEs 2021 activities:

- GTE uses the cash method of accounting (for both book and tax purposes) and reports income on a calendar-year basis.

- GTE received $1,000,000 of sales revenue and reported $470,000 of cost of goods sold (it did not have any ending inventory).

- GTE paid $85,000 compensation to James, $85,000 compensation to Paul, and $95,000 of compensation to other employees (assume these amounts include applicable payroll taxes, if any).

- GTE paid $26,000 of rent for a building and equipment, $31,000 for advertising, $44,800 in interest expense, $5,100 for utilities, and $3,100 for supplies.

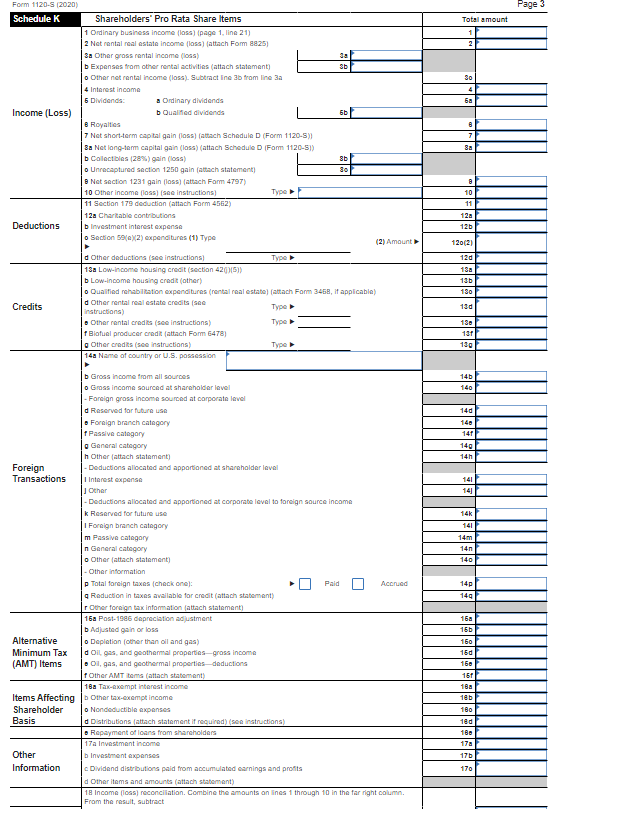

- GTE contributed $10,500 to charity.

- GTE received a $3,200 qualified dividend from a great stock investment (it owned 2 percent of the corporation distributing the dividend), and it recognized $2,600 in short-term capital gain when it sold some of the stock.

- On December 1, 2021, GTE distributed $31,000 to James and $31,000 to Paul.

- GTE has qualified property of $311,000 (unadjusted basis).

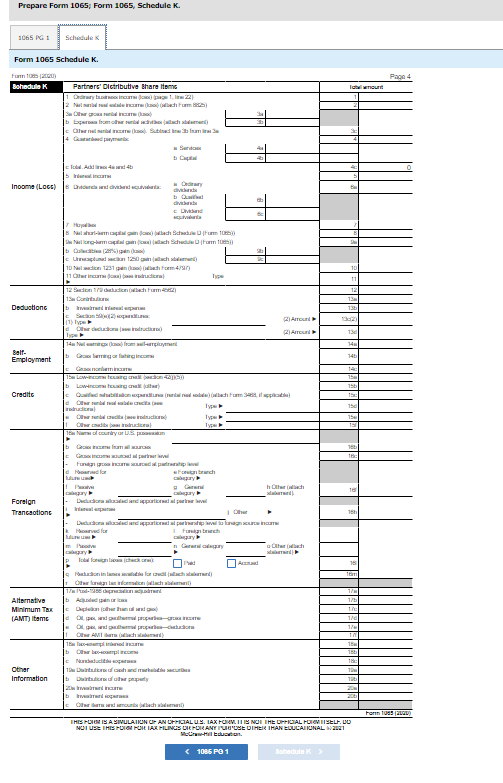

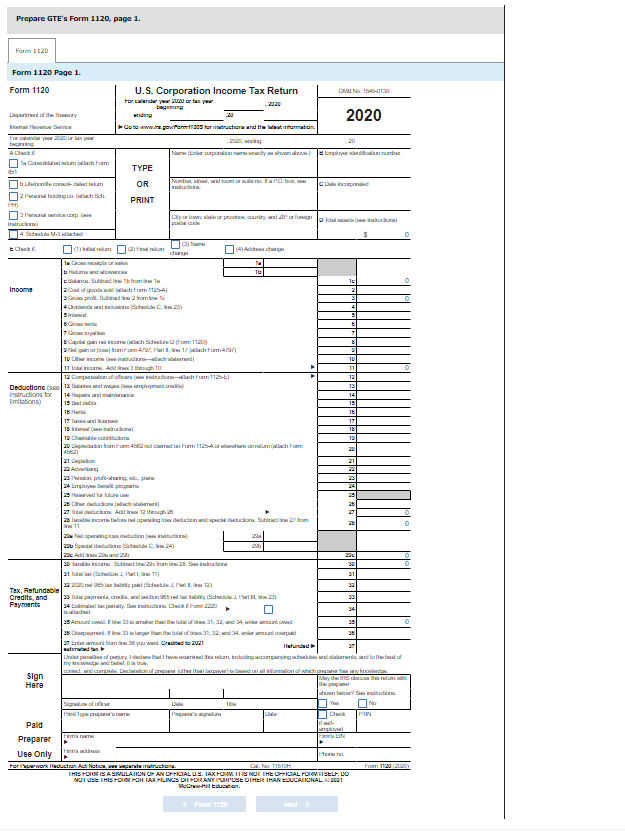

Requlred Information Comprehensive Problem 22-86 (AlgO) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Thelr company, Good to Eat (GTE), speclallzes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contrlbuted $160,000 in exchange for a 50 percent ownership interest. GTE also borrowed $640,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following Information pertains to GTE's 2021 actlvitles: - GTE uses the cash method of accounting (for both book and tax purposes) and reports Income on a calendar-year basis. - GTE recelved $1,000,000 of sales revenue and reported $470,000 of cost of goods sold (It did not have any ending Inventory). - GTE paid $85,000 compensation to James, $85,000 compensation to Paul, and $95,000 of compensation to other employees (assume these amounts Include applicable payroll taxes, If any). - GTE paid $26,000 of rent for a bullding and equilpment, $31,000 for advertising, $44,800 in Interest expense, $5,100 for utilities, and $3,100 for supplies. - GTE contributed $10,500 to charity. - GTE recelved a $3,200 quallfied dividend from a great stock Investment (it owned 2 percent of the corporation distributing the dividend), and It recognized $2,600 in short-term capltal gain when it sold some of the stock. - On December 1, 2021, GTE distributed $31,000 to James and $31,000 to Paul. - GTE has qualfied property of $311,000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A If not applicable.) Comprehensive Problem 22-86 (Algo) Part a-1 a-1. Assume James and Paul formed GTE as an S corporation. Complete GTE's Form 1120-S, page 1; Form 1120-S, Schedule K. Use 2021 tax rules regardless of year on tax form. Employer Identification number. 58-1111111 Complete GTE's Form 1120-S, page 1; Form 1120S, Schedule K. Required information Q ls tho corporation clacting to be an 5 corporation boginning with this tax vosr? Yas Na In "Yes, " attach Form 2553 if nat H Crwek in: [1] Final reburn 4 [2] Name (3) Addrass [4] Amandad neburn (5) S election tammination ar ravocetion I Entar the number of sharaholdars who ware sharaholdars during ary part af the twx yaar Caution: Include only trade or business income and expenses on [nes 1a through 21 . See the instructions for more information. Form 1120-S (2020) G Check applicsble bowes: (1) Inibal Reburn (2) Final Raturn (3) N (4) Address Chango (5) Amended H Chock acoounting mathod: (1) Cash [2] Accrual (3) Cthar (specify) I Number of Schadulas K-1. Atach ona far esch person who was a pertner at any time during the tix yowr. J. Check if Schadules C and M-3 ane attsched K. Chack if partnership: [1] Aggregated activities for saction 465 at-risk (2) Grouped activities for soction 459 passive activity Caution: Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information. Prepare Form 1065; Form 1065, Schedule K. Form 1065 schedule K. mocinwilil tusation. Mobraw til taveat. Requlred Information Comprehensive Problem 22-86 (AlgO) (LO 22-1, LO 22-2, LO 22-3, LO 22-4, LO 22-5, LO 22-6) While James Craig and his former classmate Paul Dolittle both studied accounting at school, they ended up pursuing careers in professional cake decorating. Thelr company, Good to Eat (GTE), speclallzes in custom-sculpted cakes for weddings, birthdays, and other celebrations. James and Paul formed the business at the beginning of 2021, and each contrlbuted $160,000 in exchange for a 50 percent ownership interest. GTE also borrowed $640,000 from a local bank. Both James and Paul had to personally guarantee the loan. Both owners provide significant services for the business. The following Information pertains to GTE's 2021 actlvitles: - GTE uses the cash method of accounting (for both book and tax purposes) and reports Income on a calendar-year basis. - GTE recelved $1,000,000 of sales revenue and reported $470,000 of cost of goods sold (It did not have any ending Inventory). - GTE paid $85,000 compensation to James, $85,000 compensation to Paul, and $95,000 of compensation to other employees (assume these amounts Include applicable payroll taxes, If any). - GTE paid $26,000 of rent for a bullding and equilpment, $31,000 for advertising, $44,800 in Interest expense, $5,100 for utilities, and $3,100 for supplies. - GTE contributed $10,500 to charity. - GTE recelved a $3,200 quallfied dividend from a great stock Investment (it owned 2 percent of the corporation distributing the dividend), and It recognized $2,600 in short-term capltal gain when it sold some of the stock. - On December 1, 2021, GTE distributed $31,000 to James and $31,000 to Paul. - GTE has qualfied property of $311,000 (unadjusted basis). (Leave no answer blank. Enter zero if applicable. Enter N/A If not applicable.) Comprehensive Problem 22-86 (Algo) Part a-1 a-1. Assume James and Paul formed GTE as an S corporation. Complete GTE's Form 1120-S, page 1; Form 1120-S, Schedule K. Use 2021 tax rules regardless of year on tax form. Employer Identification number. 58-1111111 Complete GTE's Form 1120-S, page 1; Form 1120S, Schedule K. Required information Q ls tho corporation clacting to be an 5 corporation boginning with this tax vosr? Yas Na In "Yes, " attach Form 2553 if nat H Crwek in: [1] Final reburn 4 [2] Name (3) Addrass [4] Amandad neburn (5) S election tammination ar ravocetion I Entar the number of sharaholdars who ware sharaholdars during ary part af the twx yaar Caution: Include only trade or business income and expenses on [nes 1a through 21 . See the instructions for more information. Form 1120-S (2020) G Check applicsble bowes: (1) Inibal Reburn (2) Final Raturn (3) N (4) Address Chango (5) Amended H Chock acoounting mathod: (1) Cash [2] Accrual (3) Cthar (specify) I Number of Schadulas K-1. Atach ona far esch person who was a pertner at any time during the tix yowr. J. Check if Schadules C and M-3 ane attsched K. Chack if partnership: [1] Aggregated activities for saction 465 at-risk (2) Grouped activities for soction 459 passive activity Caution: Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information. Prepare Form 1065; Form 1065, Schedule K. Form 1065 schedule K. mocinwilil tusation. Mobraw til taveat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts